Our CEO Adriel Tam speaks with Kiplinger Magazine about the various types of advisors and firms available to consumers to...

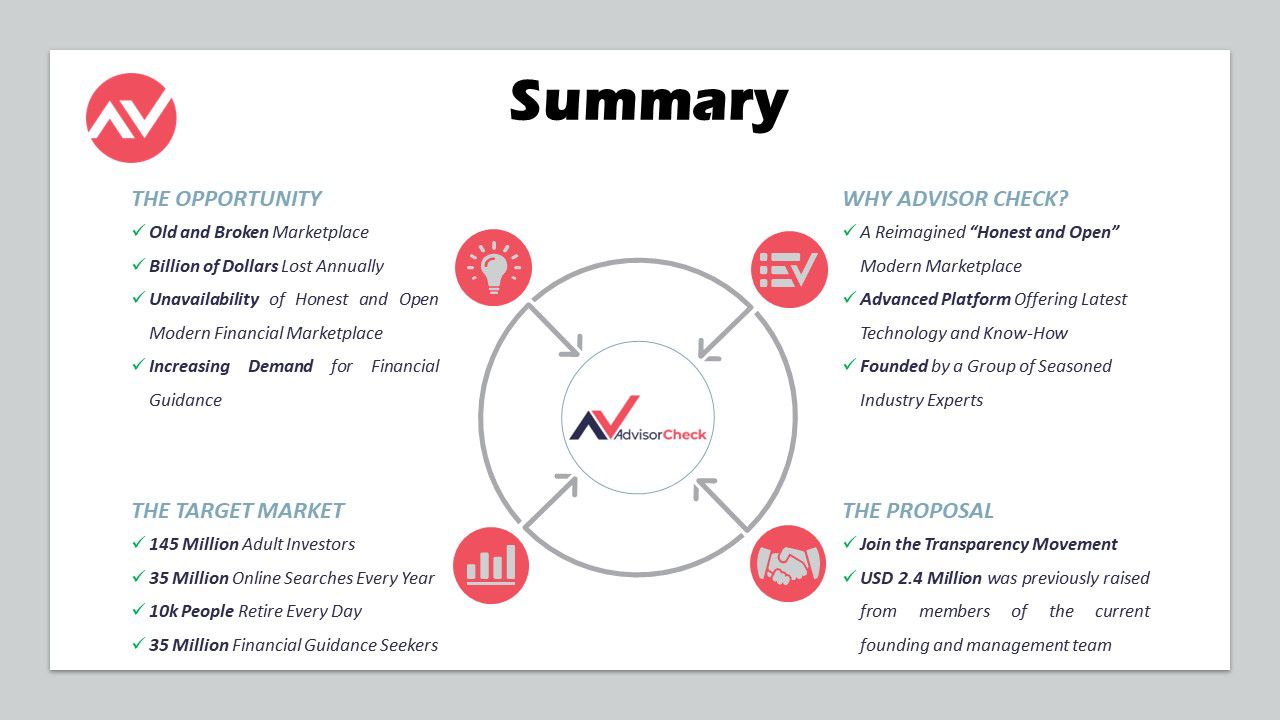

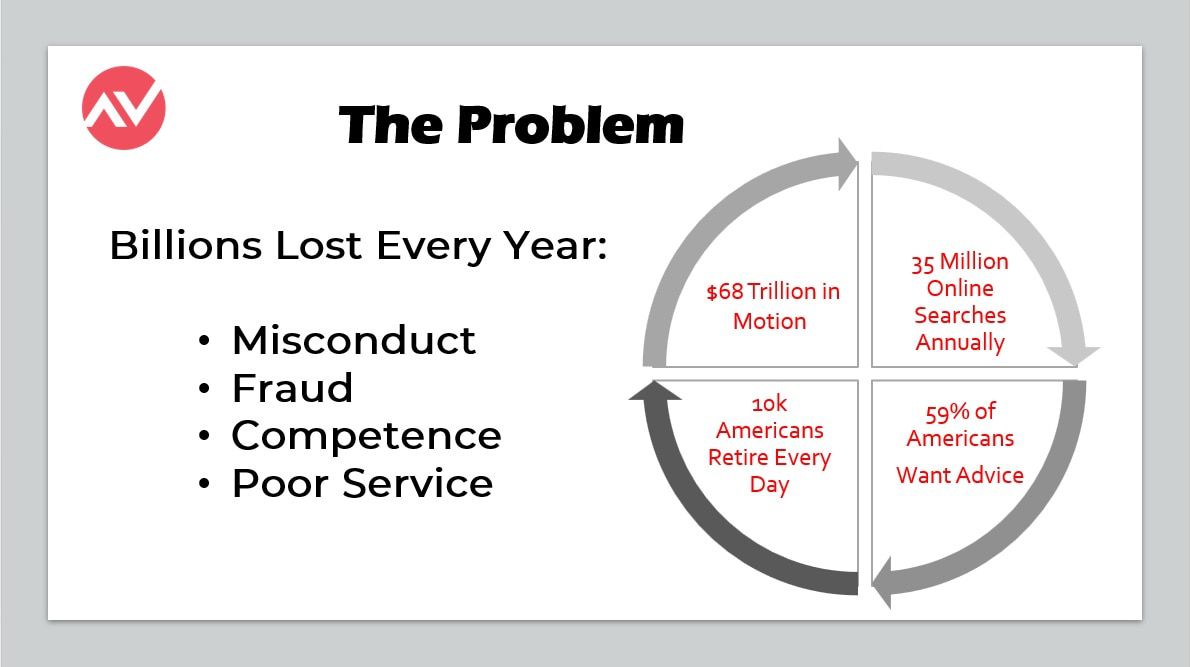

Opportunity

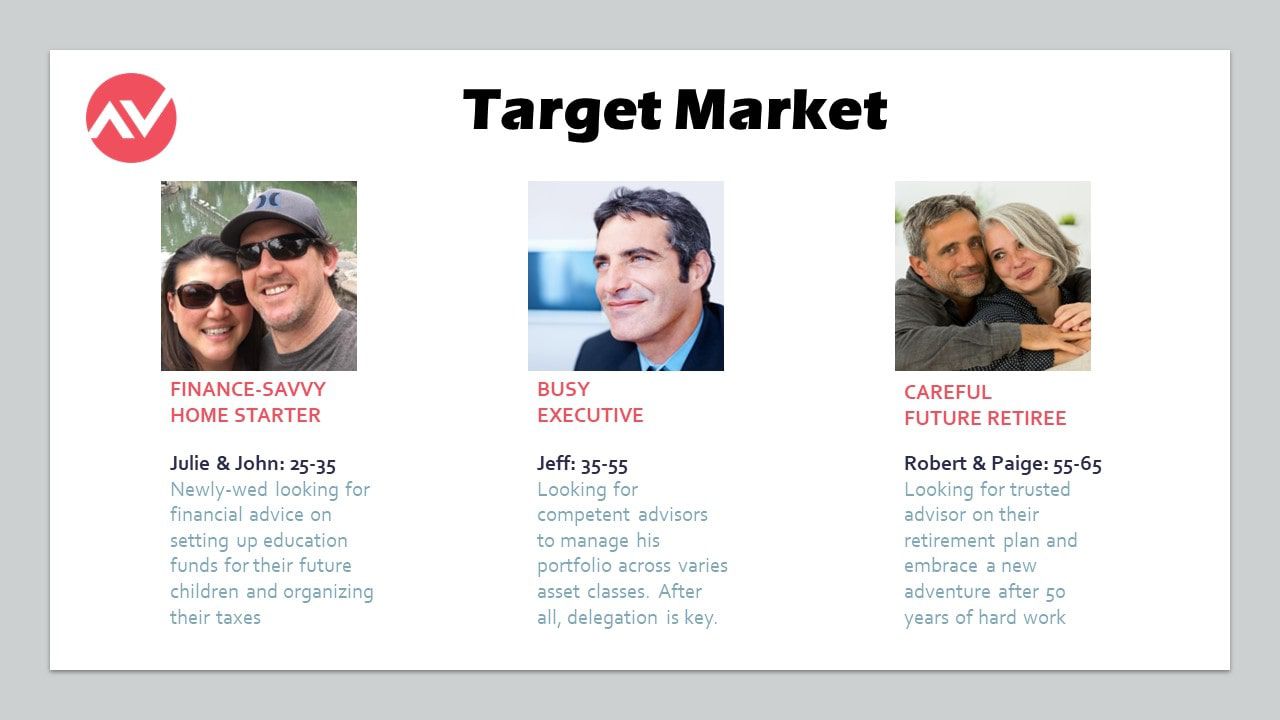

Reimagining a New Playing Field for Every Investor

What's the Big Deal?

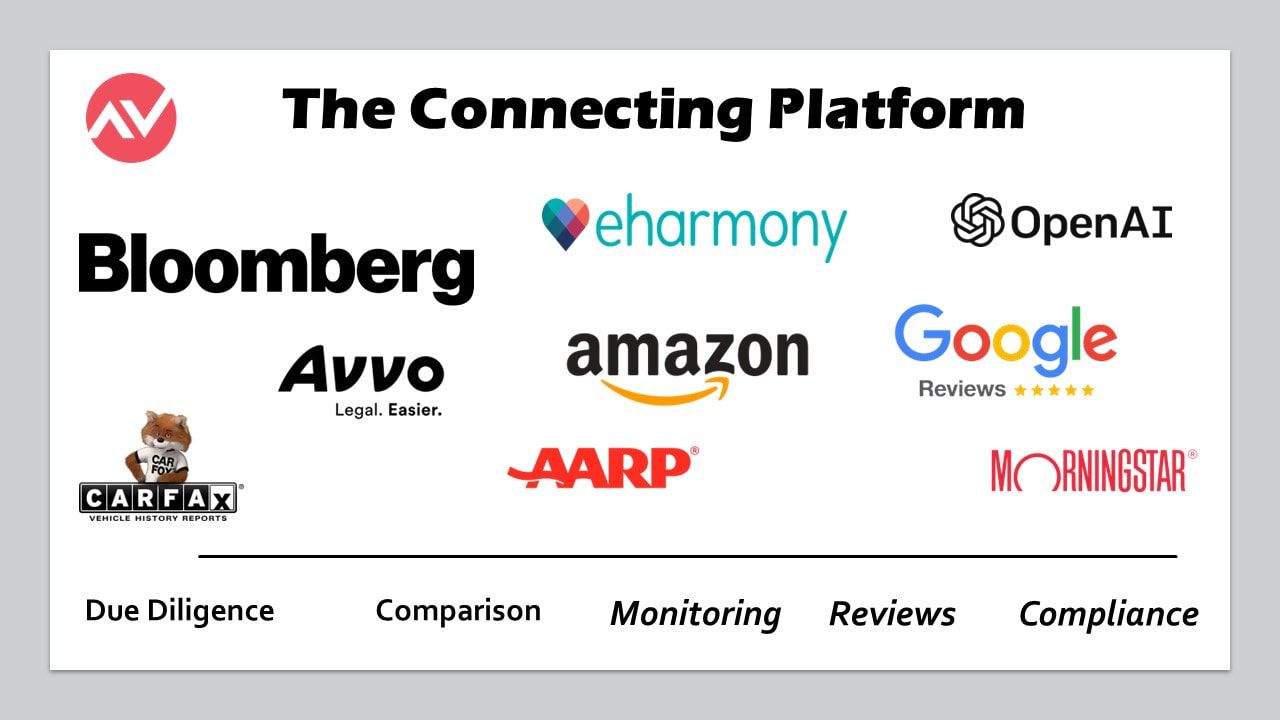

How We're Solving it.

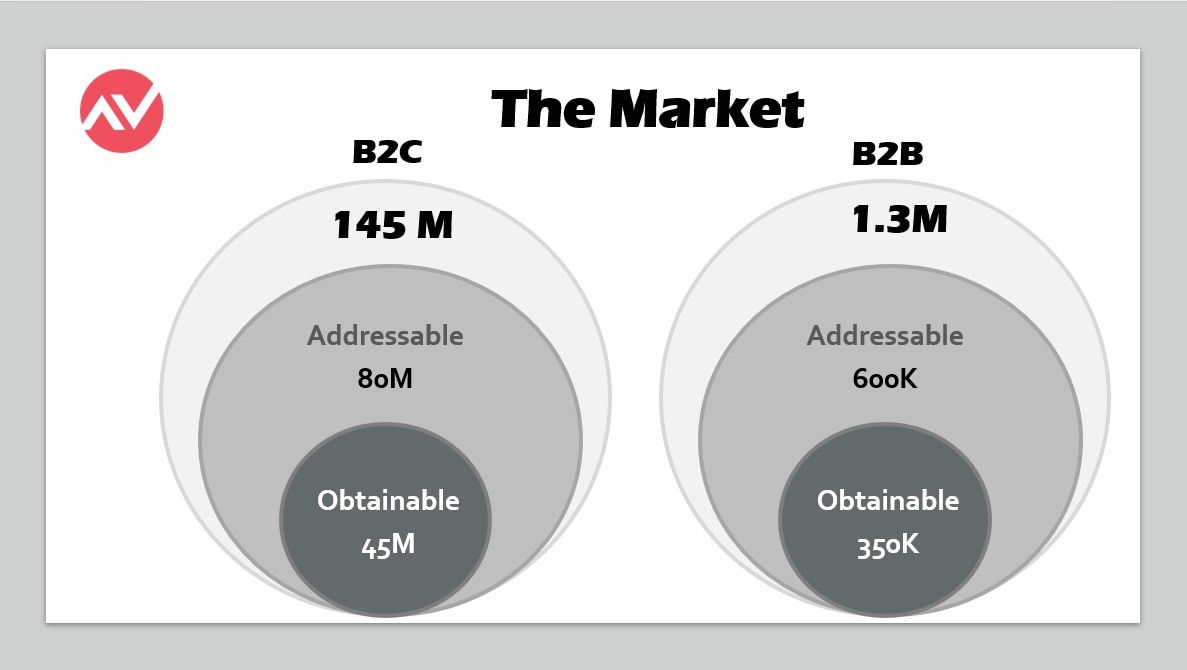

How Big is the Opportunity?

Hint: Trillions

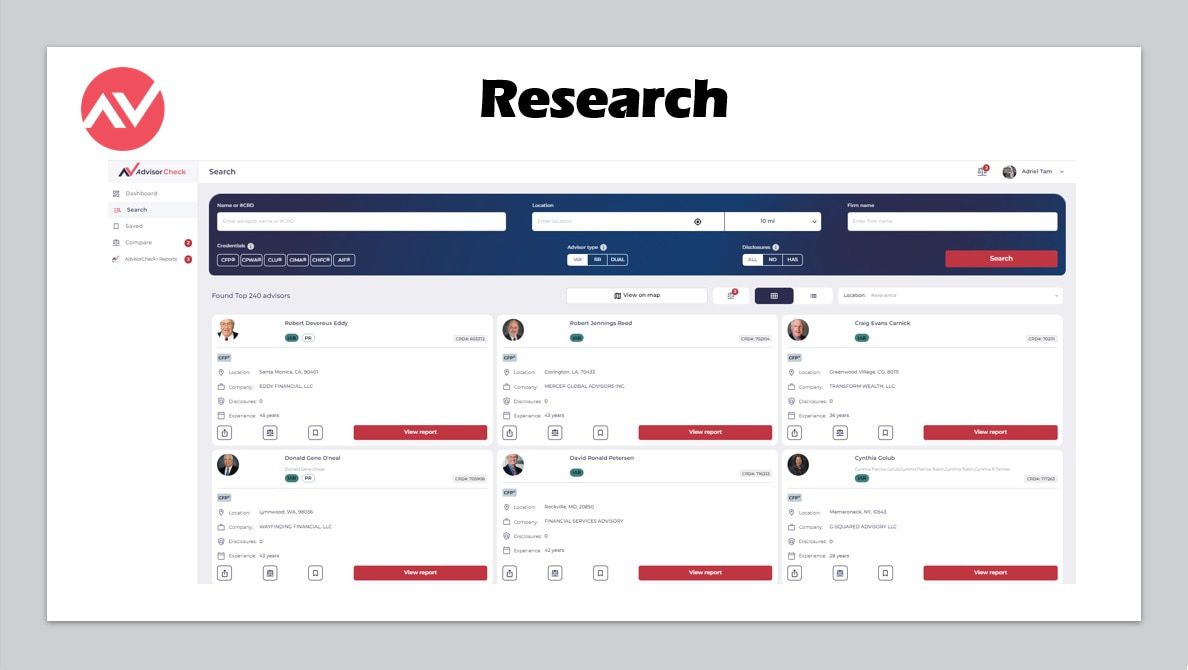

Product

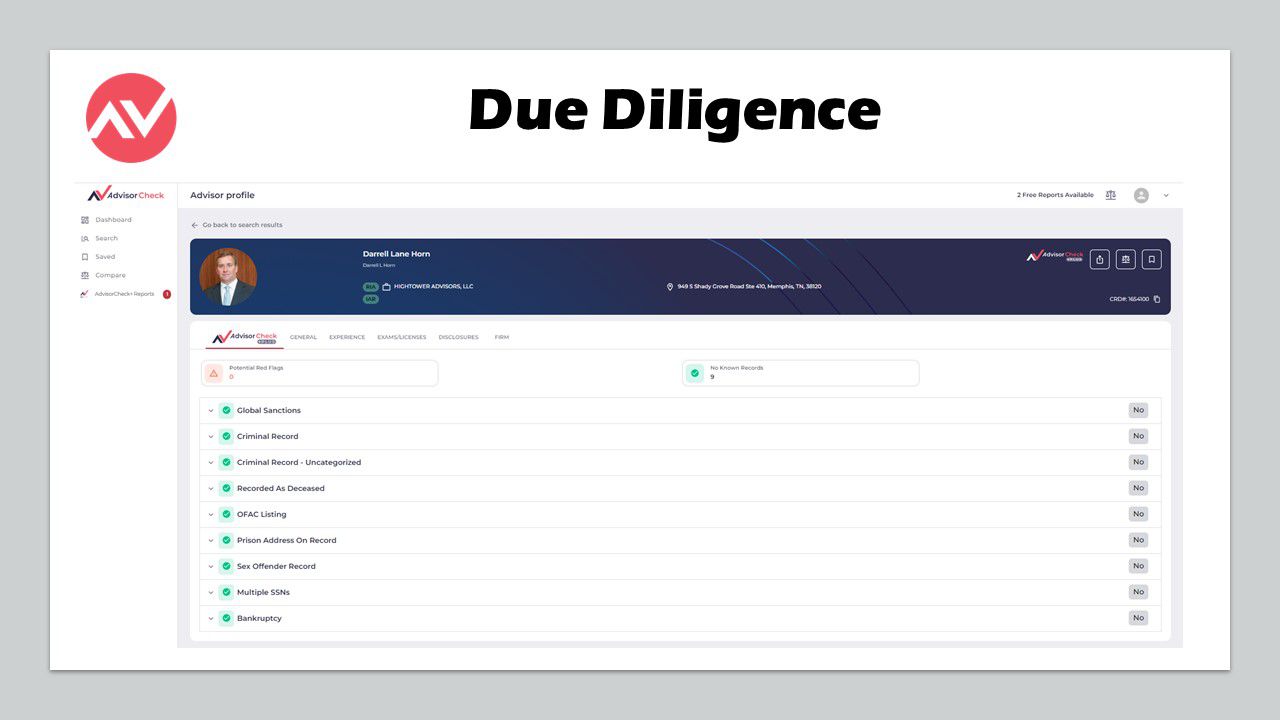

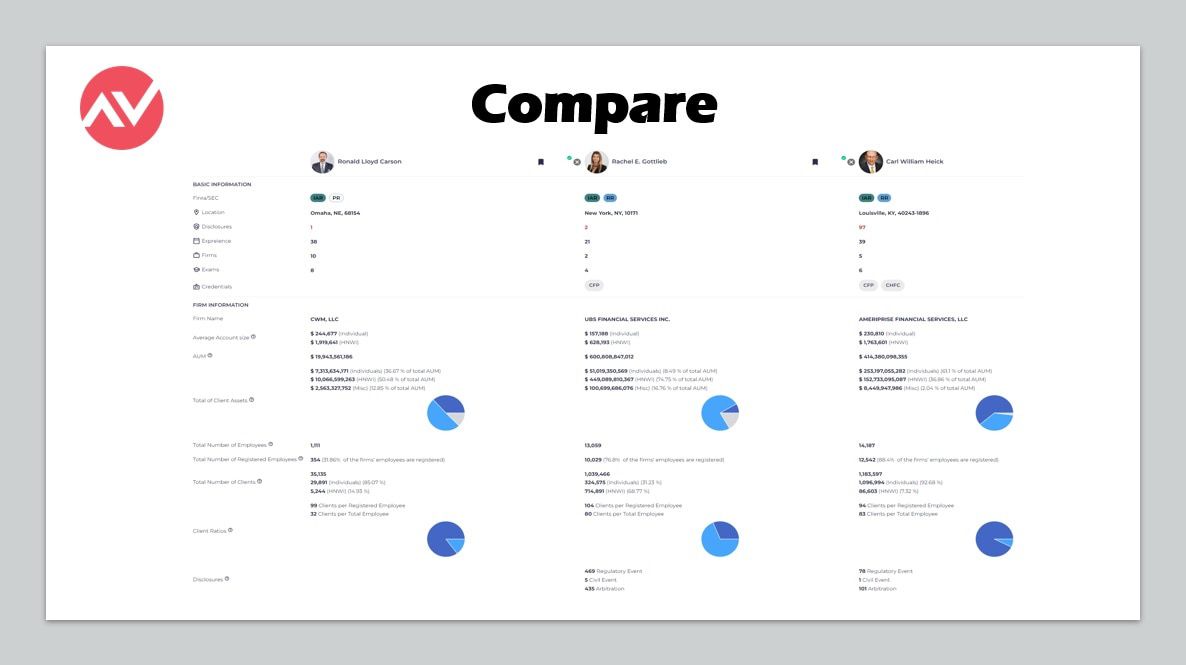

Proprietary Algorithm to Empower Every Investor

What's the User Journey Like?

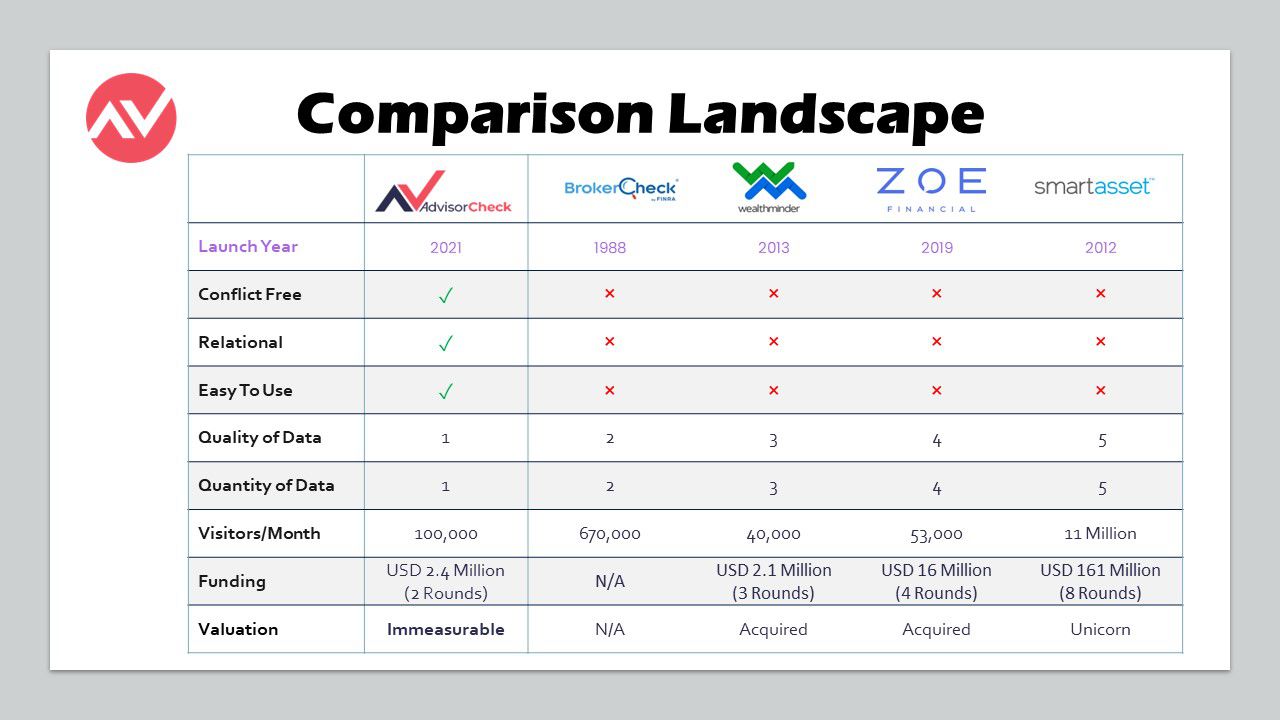

Nothing Exists Today with These Features.

Massive Data Monetization via ML/AI

Traction

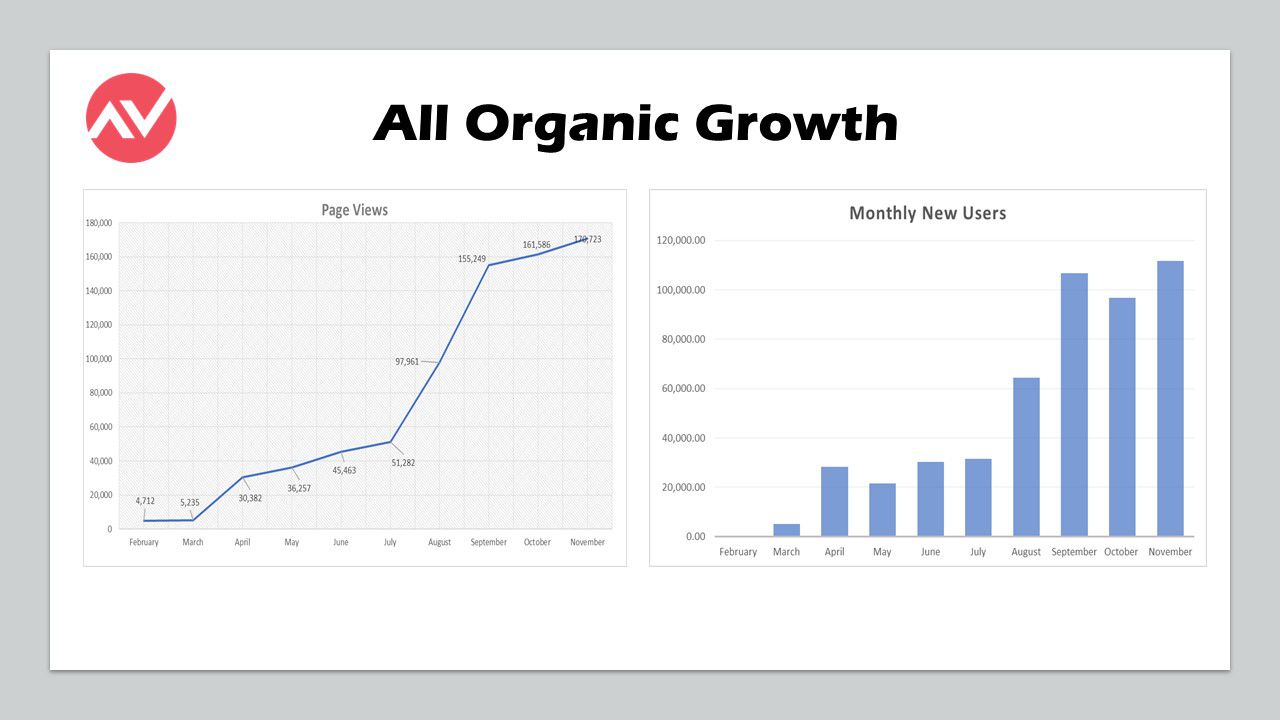

We're Just Getting Started!

And We're Everywhere!

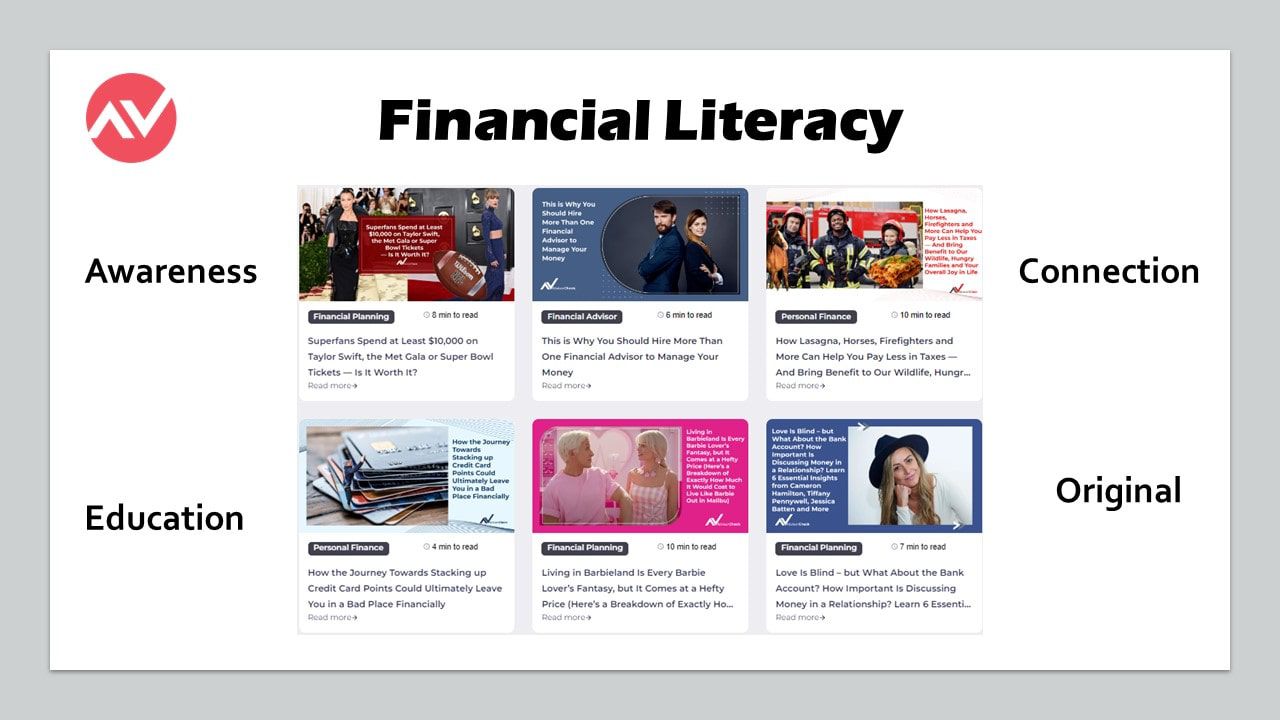

We're Raising Awareness.

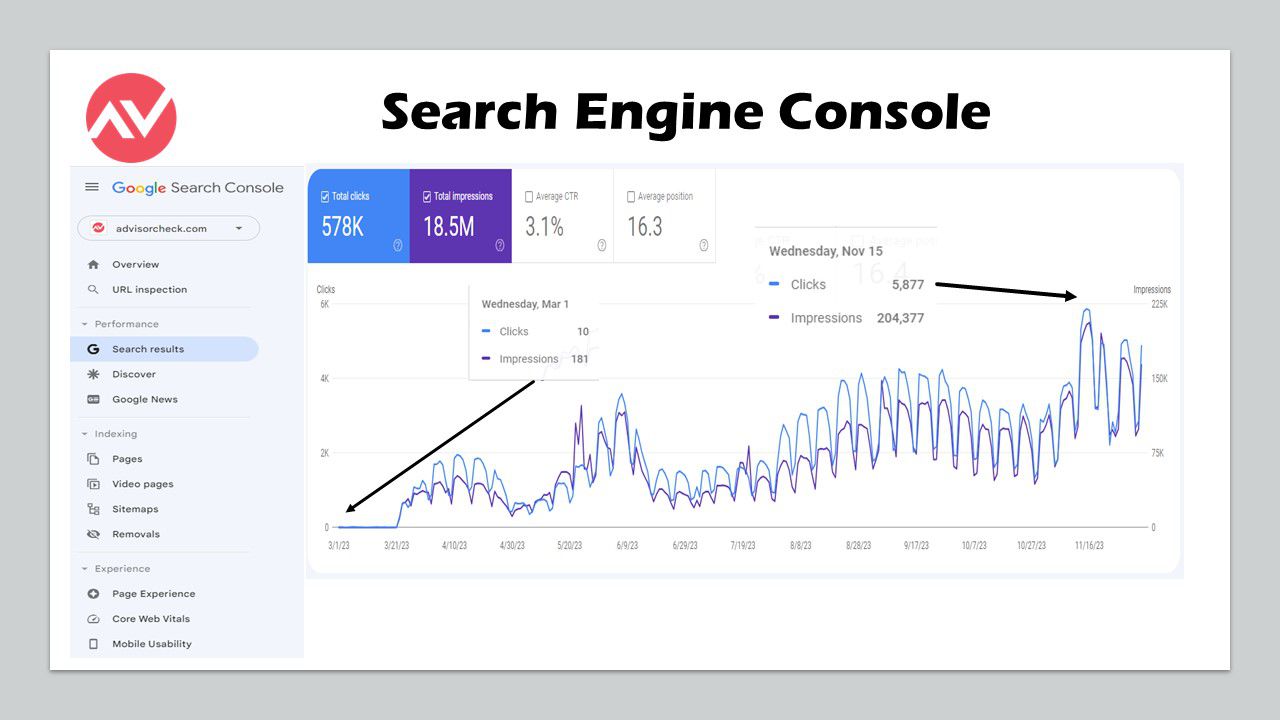

Off to an Incredible Start!

We're Growing Fast - Already Top 30th Percentile in the World for Number of Website Visitors per Month

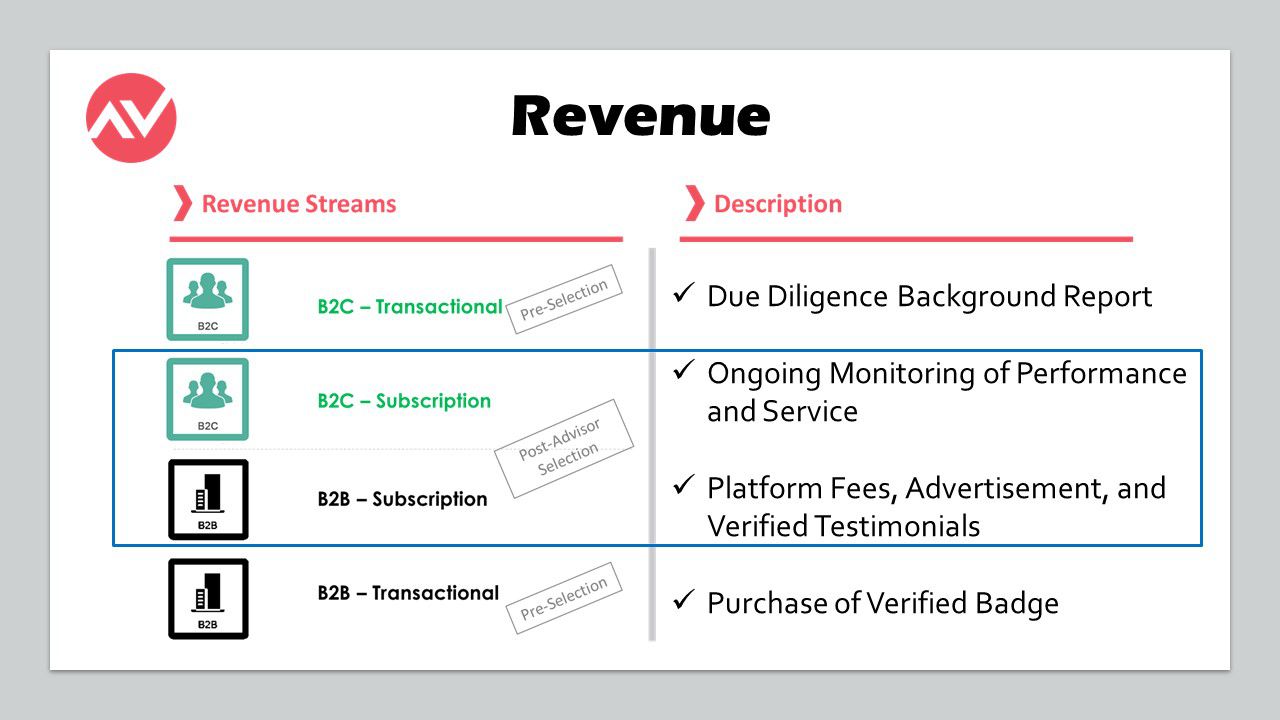

Business model

Enormous B2C and B2B

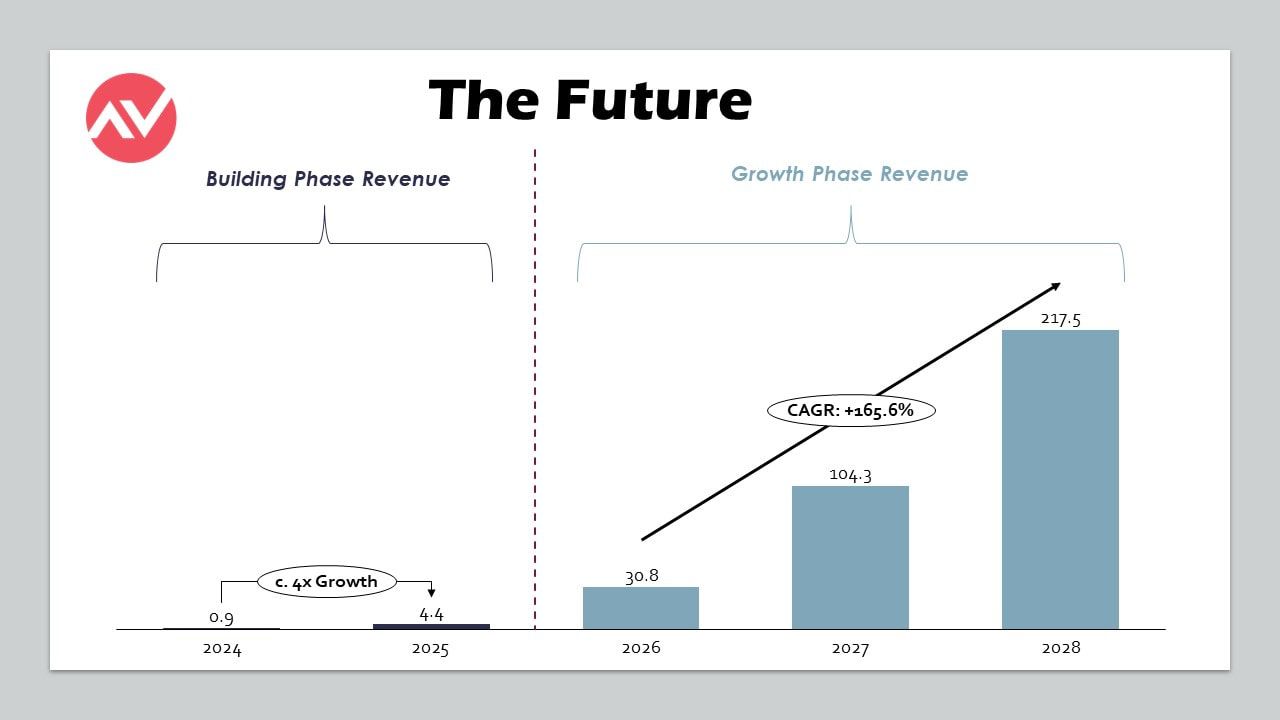

Massive Opportunity for Top Line Growth.

We're Ready to Build Faster and Bigger.

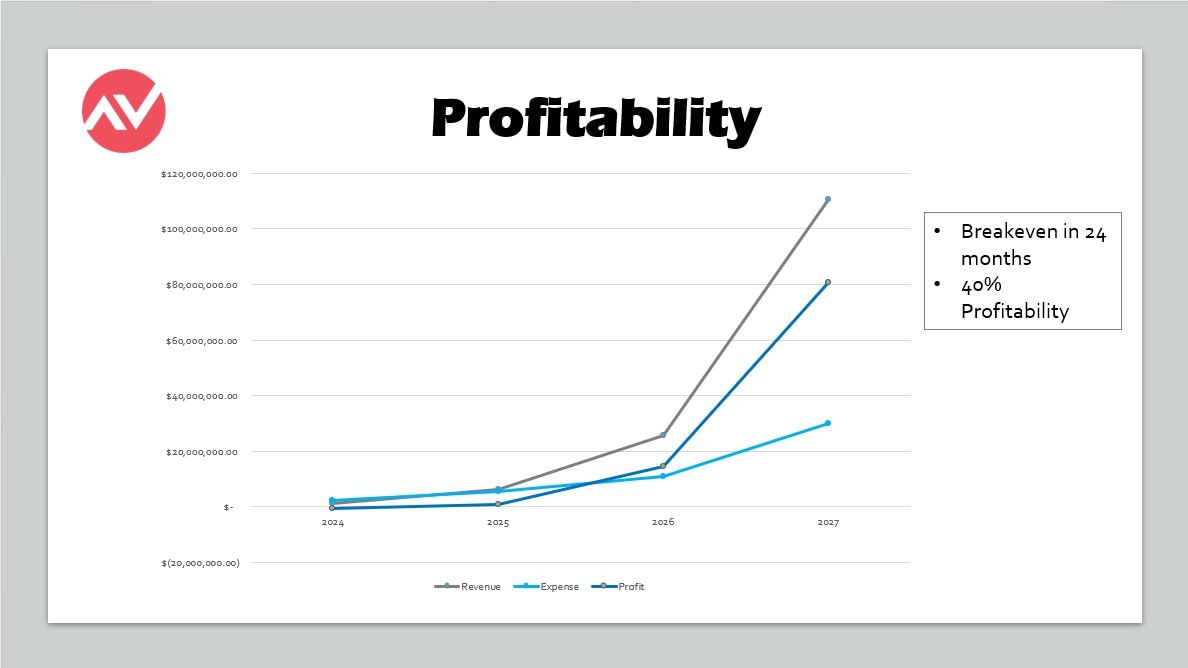

Profitable in the Near Future.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...