Problem

Cancer still is a major global health issue

According to the International Agency for Research on Cancer (IARC), in 2020, the number of new registered cases surpassed 19.2 M globally, whereas over 9.9 M deaths were attributed to this disease [1]. Despite all the recent breakthroughs in cancer treatments, it is estimated that by 2040, the number of new registered cases and fatalities per year will increase to 30.2 M and 16.3 M, respectively [2, 3]. One of the main reasons cancer still has such a high mortality rate is due to the current lack of tests with the required sensitivity and specificity to aid in the early diagnosis of the disease.

When it comes to cancer, the detection of tumors at an early stage is key because the survival rate in most types of cancer is directly related to the stage at which tumors are detected. For example, the 5-year relative survival rate for breast cancer when detected at an early stage is 99%, but drops to 28% when detected at a late stage [4].

Furthermore, early detection has the potential of reducing the financial burden of health care on individuals and public health services mainly because cancer treatments used for treating localized disease are less complex, and therefore, less expensive; according to the World Health Organization (WHO), studies made in high-income countries have shown that the cost of cancer treatment, when detected at early stages, is 2 to 4 times less expensive than at advanced stages [5].

Moreover, there is also a lack of technological resources to provide effective monitoring of the applied cancer treatments’ efficacy, which may significantly reduce the patients’ chances of survival given that the right treatment at the right time for each cancer patient may not be administered due to the lack of information available for physicians.

Since there is an unmet need for tests that can reliably detect cancer at early stages and monitor the applied treatments’ effectiveness, the research community has been actively searching for novel biomarkers that can provide clinical information for these purposes. The isolation of circulating tumor cells (CTCs) from blood is a recent alternative that could address this need. In the last decade, CTCs have attracted a significant amount of attention for their potential use as a blood-based biomarker for a broad range of cancer-related clinical applications.

CTCs are malignant cells that are shed from the primary and/or metastatic solid tumors and then infiltrate into the vascular and lymphatic systems; these cells play a fundamental role in the metastatic process of non-hematological cancers [6, 7].

Technologies that detect and isolate CTCs from blood can be used to develop assays that could enable early cancer detection and monitor the applied treatments’ effectiveness. However, the isolation of these malignant cells from blood represents a major technological challenge due to their heterogeneity and extremely low numbers in comparison to blood cells [8, 9]; on average you can find around 40.5 billion cells in 7.5 mL of blood, while a cancer patient may have between 1 and 1000 CTCs in the same volume [10].

Even though there currently exists multiple cell sorting methods, such as fluorescent-activated cell sorting, magnetic-activated cell sorting, fluorescent-activated droplet sorting, and density gradient centrifugation, these are not compatible with whole blood samples and/or do not have the sufficient sensitivity and specificity to correctly isolate CTCs from blood, which have prevented the development of assays with potential clinical utility... until now.

Solution

Welcome to the next generation of cancer

blood tests

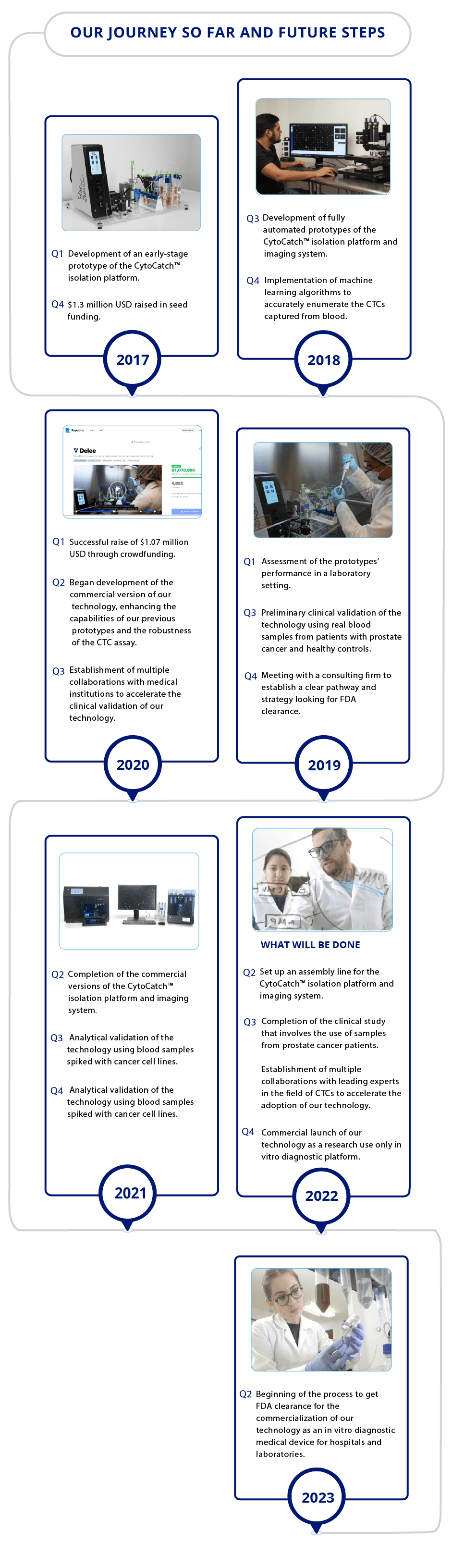

Delee has developed a patent pending technology capable of efficiently isolating and analyzing circulating tumor cells from blood, which could dramatically increase the information that physicians have for detecting cancer at early stages and monitoring the applied treatments’ effectiveness.

CytoCatch™ Isolation Platform and Imaging System

Our technology will enable a broad range of clinical applications in oncology, including:

Benefits of our technology

The early detection of cancer will be translated into invaluable benefits for patients by greatly increasing their chances of defeating cancer. Furthermore, monitoring the treatments’ effectiveness could also significantly increase the odds of defeating cancer by applying the most effective treatment for each patient throughout the course of the disease, while reducing the incurred costs and the negative side effects caused by drugs that wouldn’t be effective for a particular patient.

For what types of cancer?

Our technology can be used for a wide variety of cancer types. There is scientific evidence that indicates the feasibility of developing CTC assays to enable clinical applications in various types of cancer, including prostate, breast, colorectal, lung, cervical, skin, and ovarian cancer, just to name a few. Over 40% of the new cancer cases and a third of the defunctions registered worldwide are attributed to prostate, breast, colorectal, and lung cancer [11].

Product

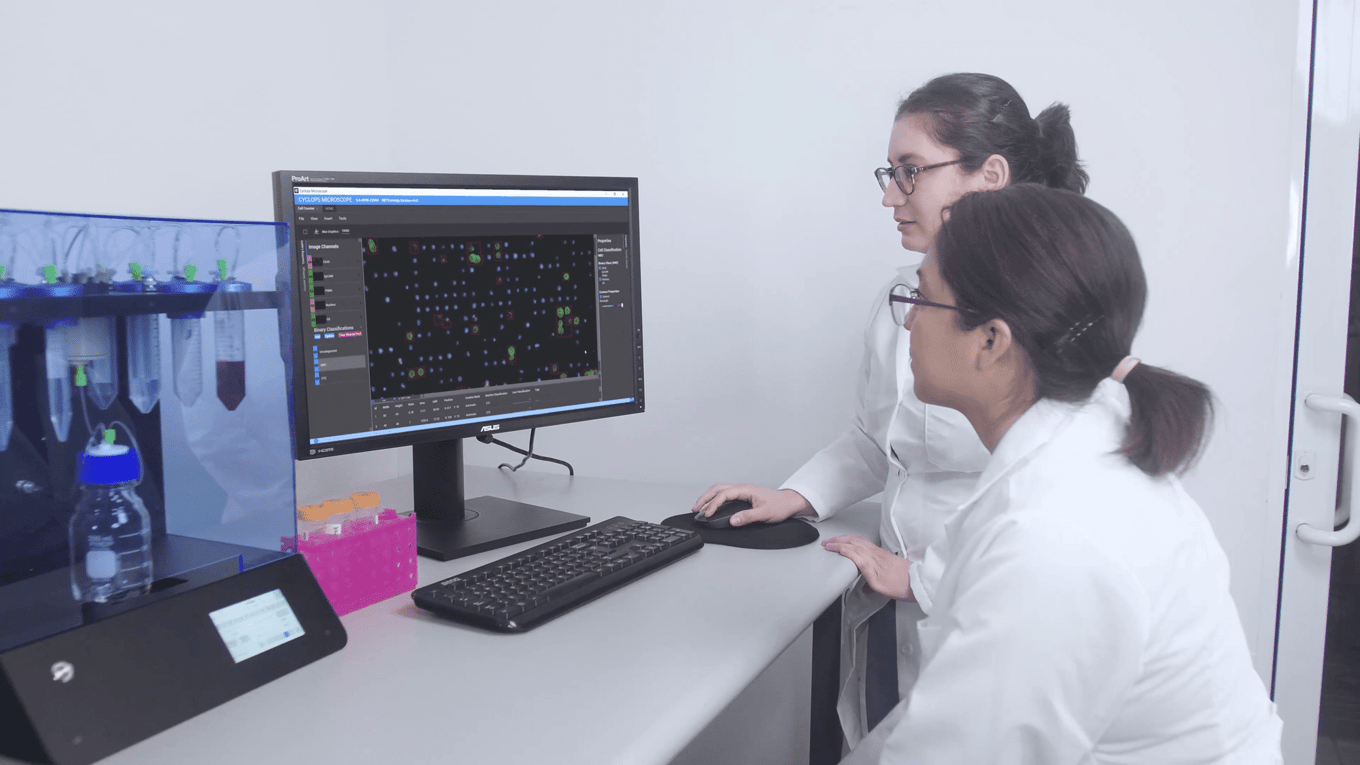

A complete sample-to-answer solution that will help physicians make information-driven decisions

The blood sample (extracted by conventional venipuncture, the collection method that is usually used for laboratory testing) along with several reagents are loaded on the CytoCatch™ isolation platform, which automatically performs the necessary steps to prepare and process the sample, capturing the CTCs contained in it. The unit has an outstanding performance, it has the sensitivity to isolate a single CTC from a background of 56 billion blood cells, and has recovery rates above 96% when processing 10 mL blood samples spiked with tumor cells from prostate, breast, and colorectal cancer cell lines, meaning that the platform recovers at least 96 out of 100 tumor cells spiked into the sample [11].

Once captured, the CytoCatch™ isolation platform executes an automated protocol to stain the collected cells with fluorescent antibodies for their further analysis with the CytoCatch™ imaging system, which possesses special routines and machine learning algorithms that analyze the captured cells based on their morphology and the expression of specific markers. The fact that all these processes are fully automated increases the reliability and reproducibility of the assay by preventing human errors and cell loss due to manual steps.

Furthermore, the collected cells are compatible with traditional molecular biology techniques and next generation sequencing technologies, enabling the performance of molecular analyses to assess the genetic characteristics of the captured CTCs. Finally, the treating physician will get a report with the corresponding results.

Traction

Pre-orders worth a potential value over $2.5 million USD

We’ve gotten great traction since the pre-commercial launch of our technology. To date, pre-orders worth a potential value of over $2.5 million USD have been secured from research centers of various hospitals, including the Stanford University Medical Center and the “Dr. José Eleuterio González” University Hospital. These institutions will use our technology as a research use only device, for which FDA clearance is not required.

Click here for important information regarding Financial Projections which are not guaranteed.

IP and peer-reviewed articles

We have three patent pending applications that protect different aspects of our technology and published two peer-reviewed articles in Nature's Scientific Reports.

Customers

Who buys it?

We'll start sales of our technology as a research use only device by Q4 of 2022, for which FDA clearance is not required, being pharmaceutical companies and research centers our main customers. Once our technology obtains FDA clearance, it will be commercialized as an in vitro diagnostic medical device for its use in hospitals and laboratories.

Business model

Recurring revenue through consumable and reagent sales

We will implement the razor and blades business model, obtaining revenue by selling the CytoCatch™ Isolation Platform and Imaging System, and recurring revenue by selling the necessary reagents and consumables to perform each test.

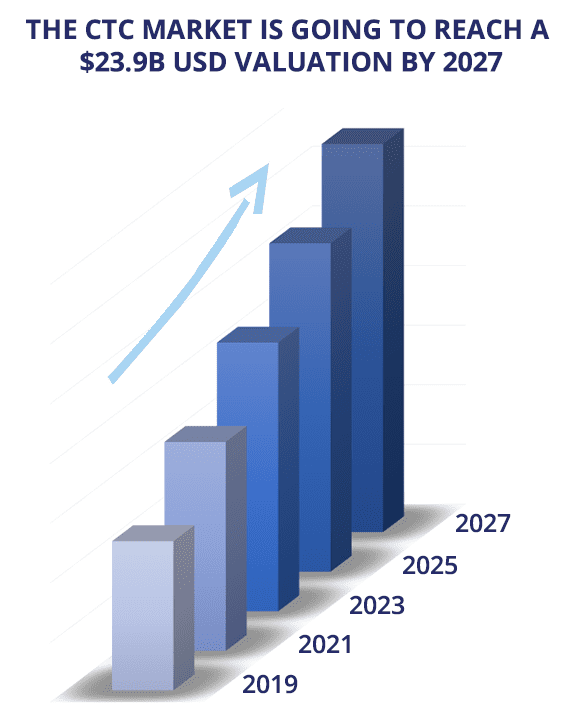

Market

The CTC market is massive and will continue to grow over time

According to a report published by Grand View Research, in 2019, the global circulating tumor cell market was valued at $8.9B USD, and it’s expected to reach a $23.9B USD valuation by 2027 [13, 14]. This valuation is mainly due to the ongoing research that is carried out by numerous research centers to validate the use of these cells as a biomarker for different clinical applications.

Once our technology obtains FDA clearance, it will be commercialized as an in vitro diagnostic medical device for its use in hospitals and laboratories, for early cancer detection and monitoring the applied treatments’ effectiveness, accessing a total addressable market of $543B USD.

Competition

The new standard for capturing and analyzing CTCs

Most of the blood tests employed as auxiliaries in the diagnosis of cancer and monitoring of the applied treatments’ effectiveness measure protein tumor markers levels, such as PSA, CA-125, and AFP. However, there are only a few protein tumor markers that are associated with a particular cancer and are clinically useful; most types of cancer have not been linked to an increase in the levels of a particular protein tumor marker [14]. Furthermore, these types of tests have a poor sensitivity and specificity, meaning that these markers may be elevated in people that do not have cancer and that not every person with a particular type of cancer will have an elevated level of the corresponding tumor marker [14]. Taking the PSA test as an example, which measures the amount of PSA in blood and is used to screen for prostate cancer, approximately 79% of men with increased levels of PSA do not have prostate cancer, whereas 9% of the men with normal levels of PSA may have prostate cancer [15].

The isolation and analysis of CTCs is a relatively new practice, and physicians are starting to recognize all its potential benefits. Most of the current CTCs technologies, including the CellSearch® System, which currently is considered the gold standard, rely on the existence of specific proteins on the tumor cells’ membranes in order to capture them. However, CTCs are incredibly heterogeneous; when entering the bloodstream, they undergo a biological process that downregulates these proteins, limiting the efficiency with which these cells are captured and thereby losing valuable information [16, 17]. Our technology changes the norm by isolating CTCs irrespective of the proteins expressed in their membranes, allowing us to capture tumor cells that other technologies can’t.

Vision and strategy

Funding

Delee has raised

over $2.6M USD

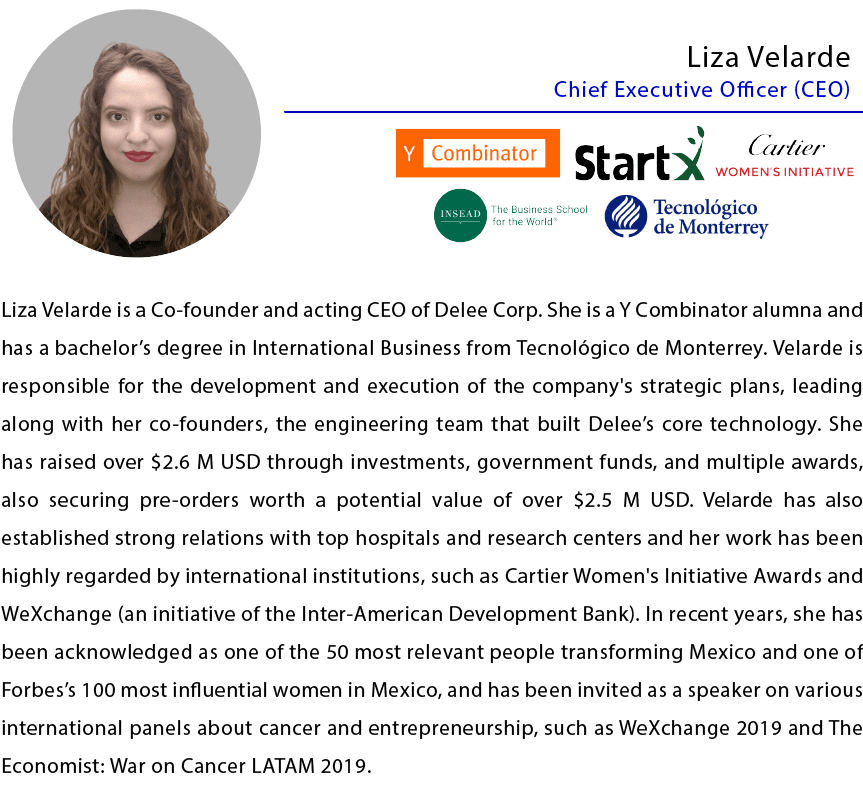

We are backed by Y Combinator and StartX, two of the most important startup accelerators in the world. Delee is also funded by Emles venture partners and raised over $1.4M USD on equity crowdfunding from more than 5250 investors.

Founders

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...