Jumpstart Insurance Solutions Inc. is on the move in the earthquake-prone West - and the company is now working with insu...

Problem

Natural disasters cause financial ruin.

And most of us have little to no financial cushion:

Public aid? Often too little, too late.

Insurance? Floods and earthquakes are routinely excluded. Even where it's available, only 1 in 10 people opt-in. Disaster coverage is notoriously costly, complicated, and slow.

Savings? What savings? A majority of Americans can't even cope with a $500 surprise.

A recent McKinsey report emphasizes the market opportunity of insuring natural catastrophes.  Building financial resilience is also a social imperative. The UN Sustainable Development Goals emphasize the role of disaster risk reduction.

Building financial resilience is also a social imperative. The UN Sustainable Development Goals emphasize the role of disaster risk reduction.  By building disaster resilience for individuals, Jumpstart speeds up recovery for whole communities.

By building disaster resilience for individuals, Jumpstart speeds up recovery for whole communities.

Solution

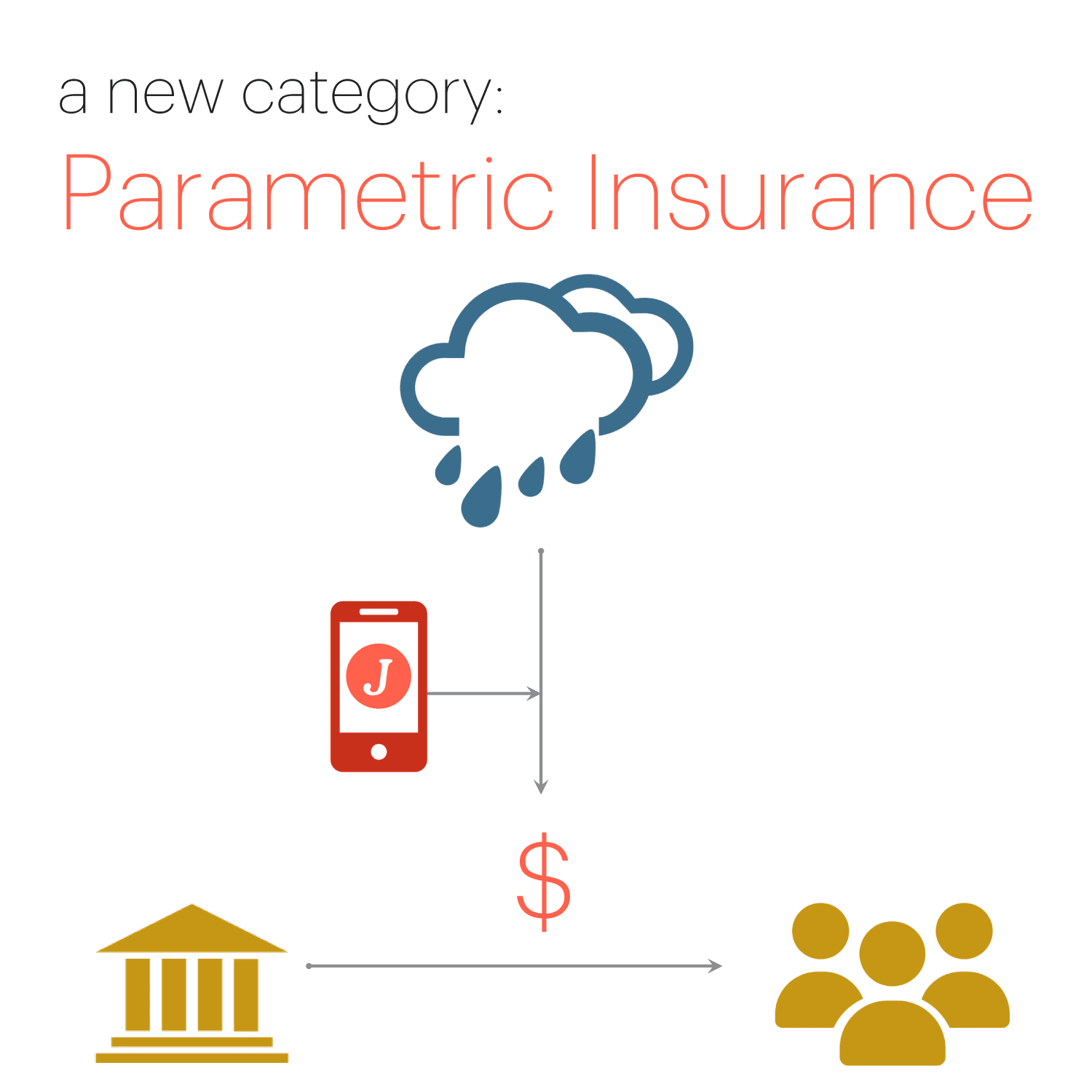

A new category: Parametric insurance

Jumpstart provides a financial jumpstart after the shock of a natural disaster, through a new product category: parametric insurance.

Parametric uses technology to pay a lump-sum immediately after occurrence of a pre-specified data metric. Jumpstart was the first to bring parametric to consumers in the US.

Parametric transforms disaster insurance from being costly, complicated and slow, to frictionless and affordable, and fast. In this way, we fulfill our mission to make money available to more people, right when they need it most.

Product

Customers receive $10,000 immediately after a disaster

Jumpstart is like a first-responder for your finances. It's like having a disaster savings account, except for the part where you have to save.

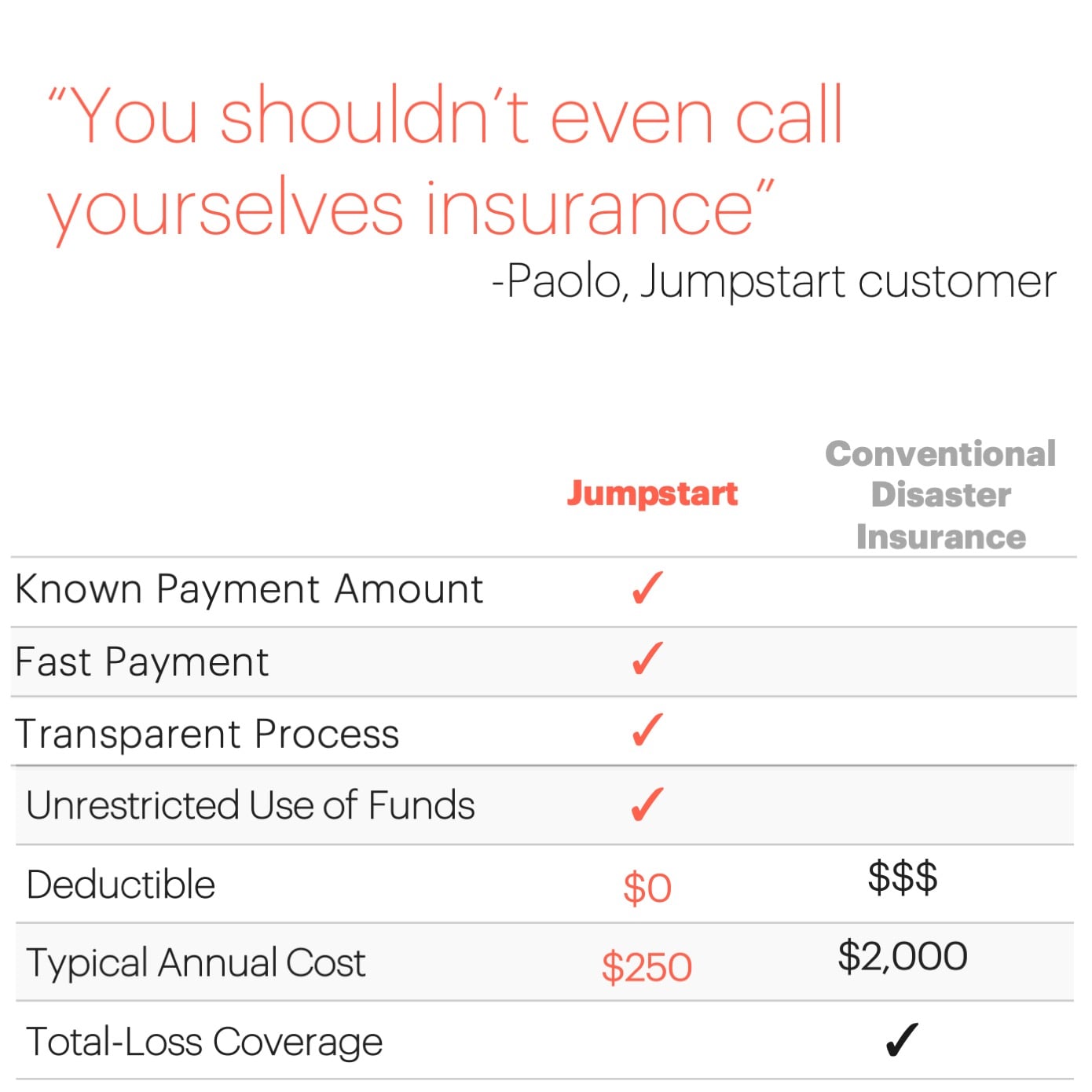

We keep all the good parts of insurance - getting money when you need it - while eliminating the high costs, hassle, and delay.

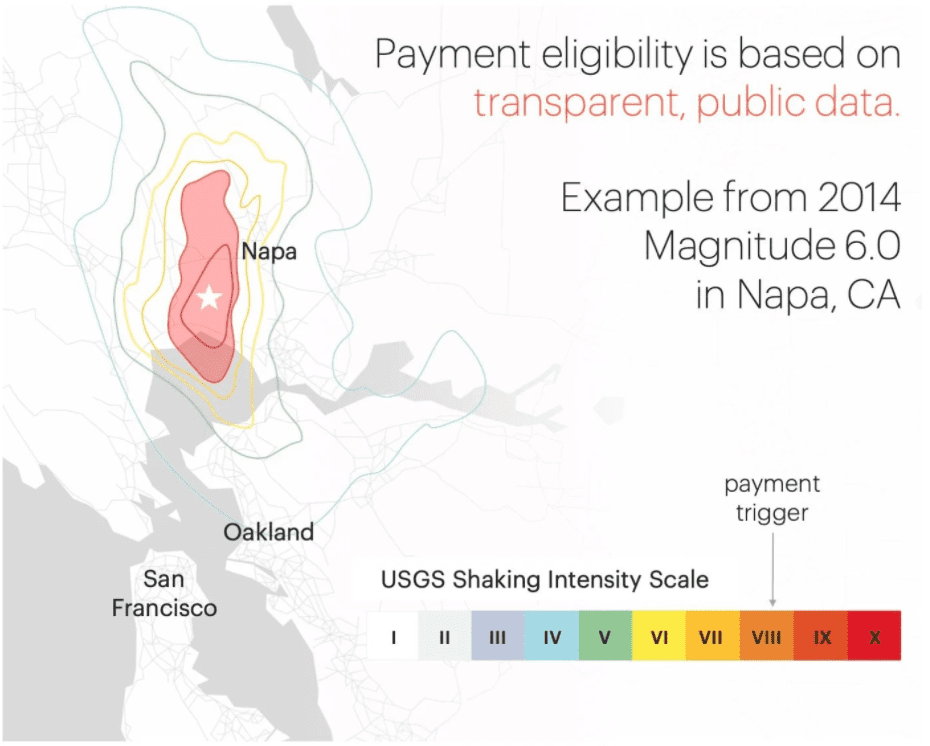

Our initial product pays customers $10,000 right away after a large earthquake in California.

Here's how it works:

Here's how it works:

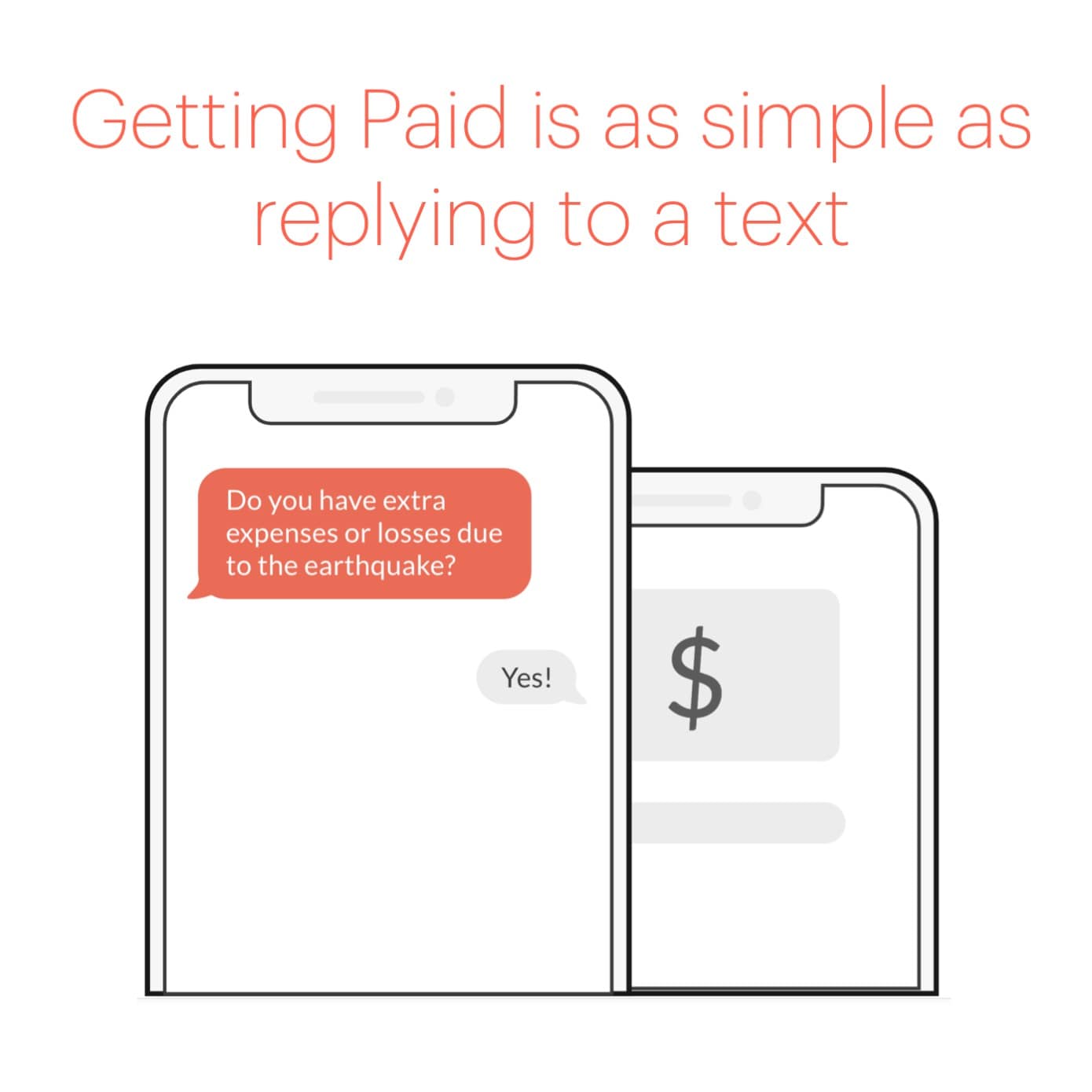

- Customers pay a low monthly cost in premiums.

- When disaster strikes, customers in the hardest-hit areas are automatically eligible for payment.

- Customers simply reply to our text message to confirm they've been affected.

- We then deposit payment directly.

- No paperwork, no deductible, no claims adjuster.

Traction

Value Proposition? Check. Next? Scaled Growth.

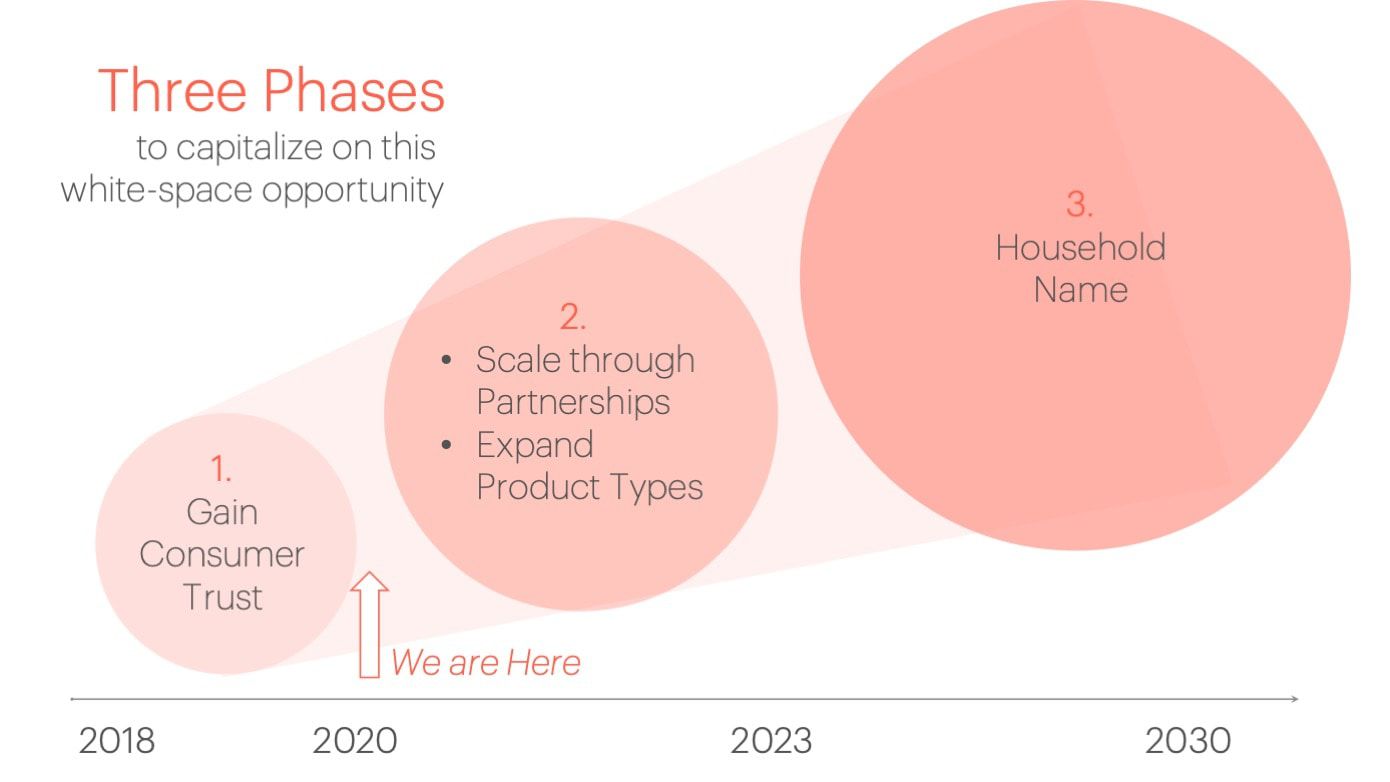

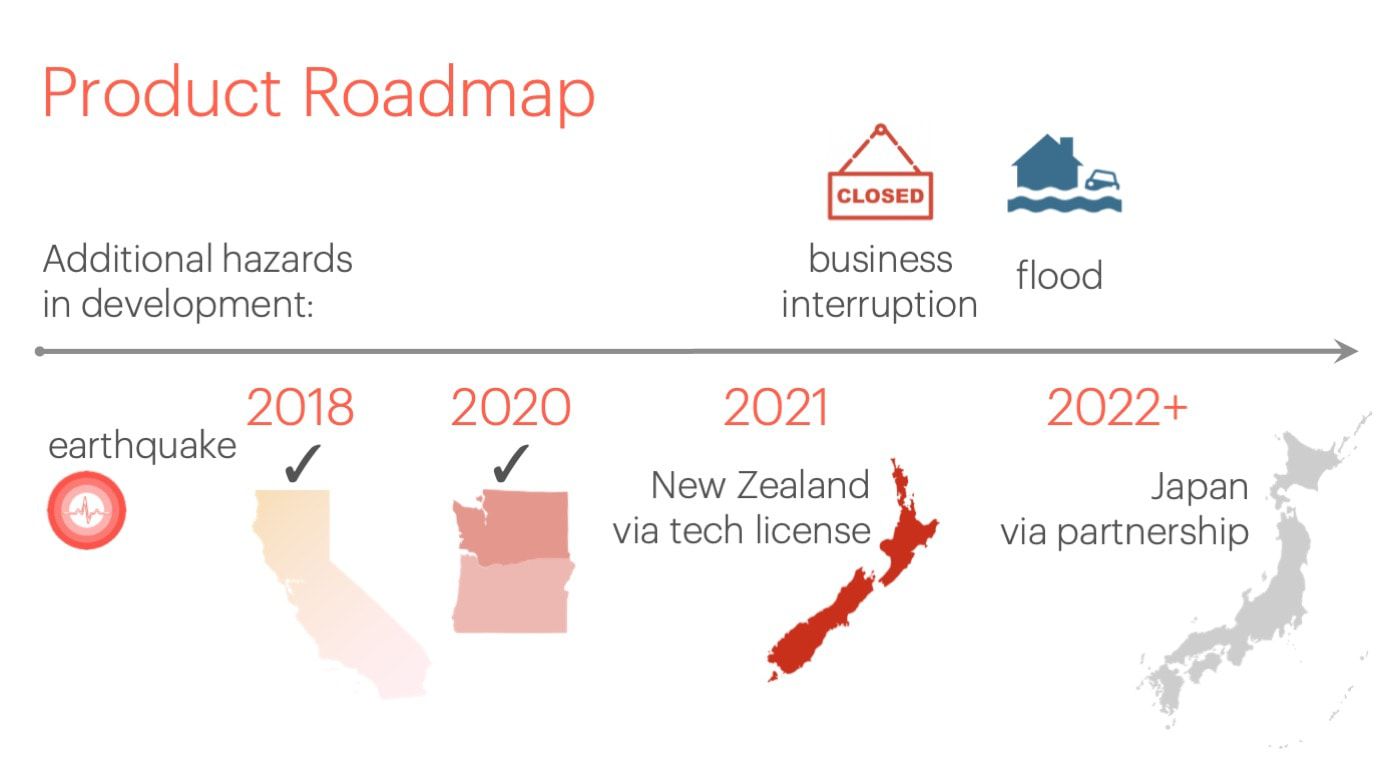

Jumpstart launched our first-of-its-kind parametric product in October 2018. We're executing a growth strategy specifically tailored for a first mover in this new category.

Our prior raise on Republic attracted nearly 4,000 investors and more than $900k. With those funds we accomplished key milestones in our growth strategy:

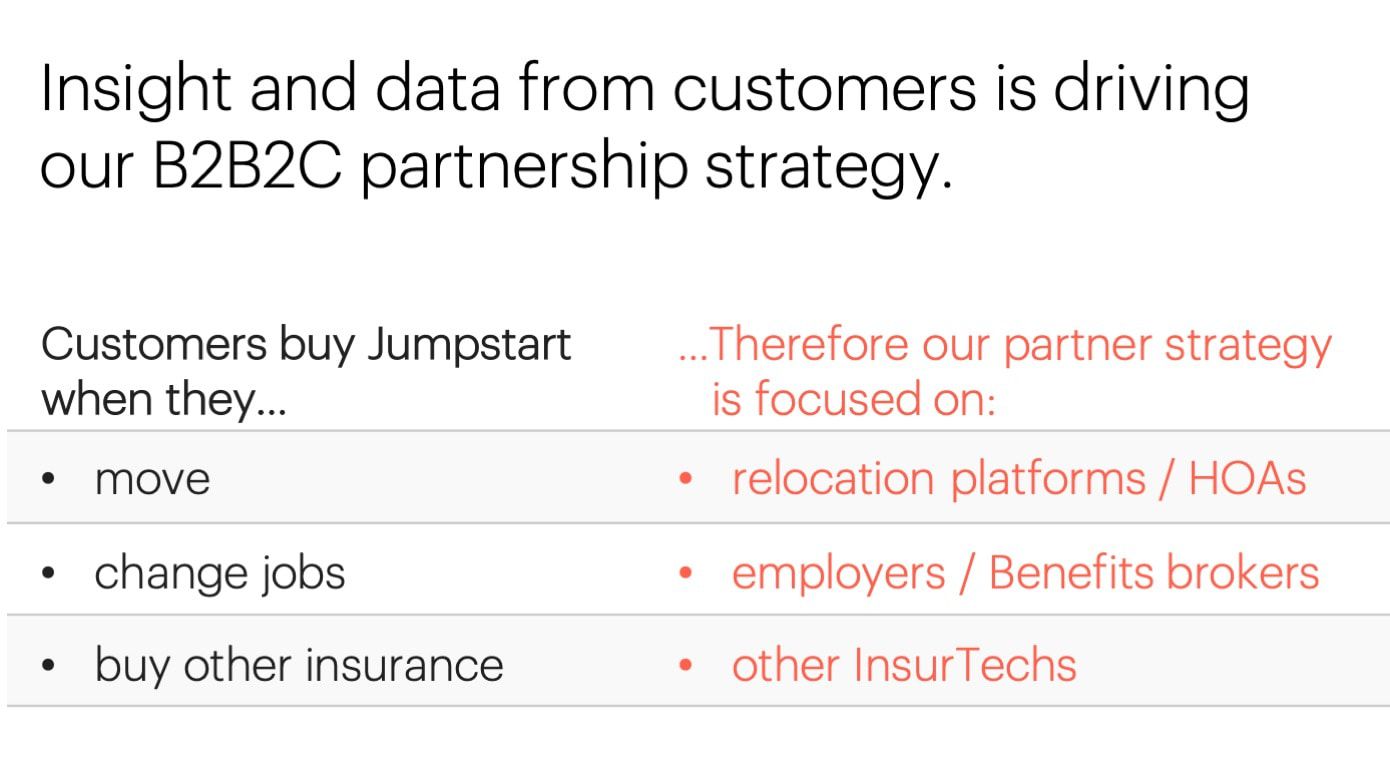

- Established product market fit by understanding customer value proposition: who's buying, why, and when.

- Laid the foundation to grow via partnerships:

- hire key partnership teammates

- upgrade technology for seamless partner integrations

- Expanded the product:

- Now Live: Washington & Oregon

- coming soon: New Zealand

We've also attracted press coverage: both mainstream and from the insurance industry.

Customers

"Where has this been all my life?" (real customer quote)

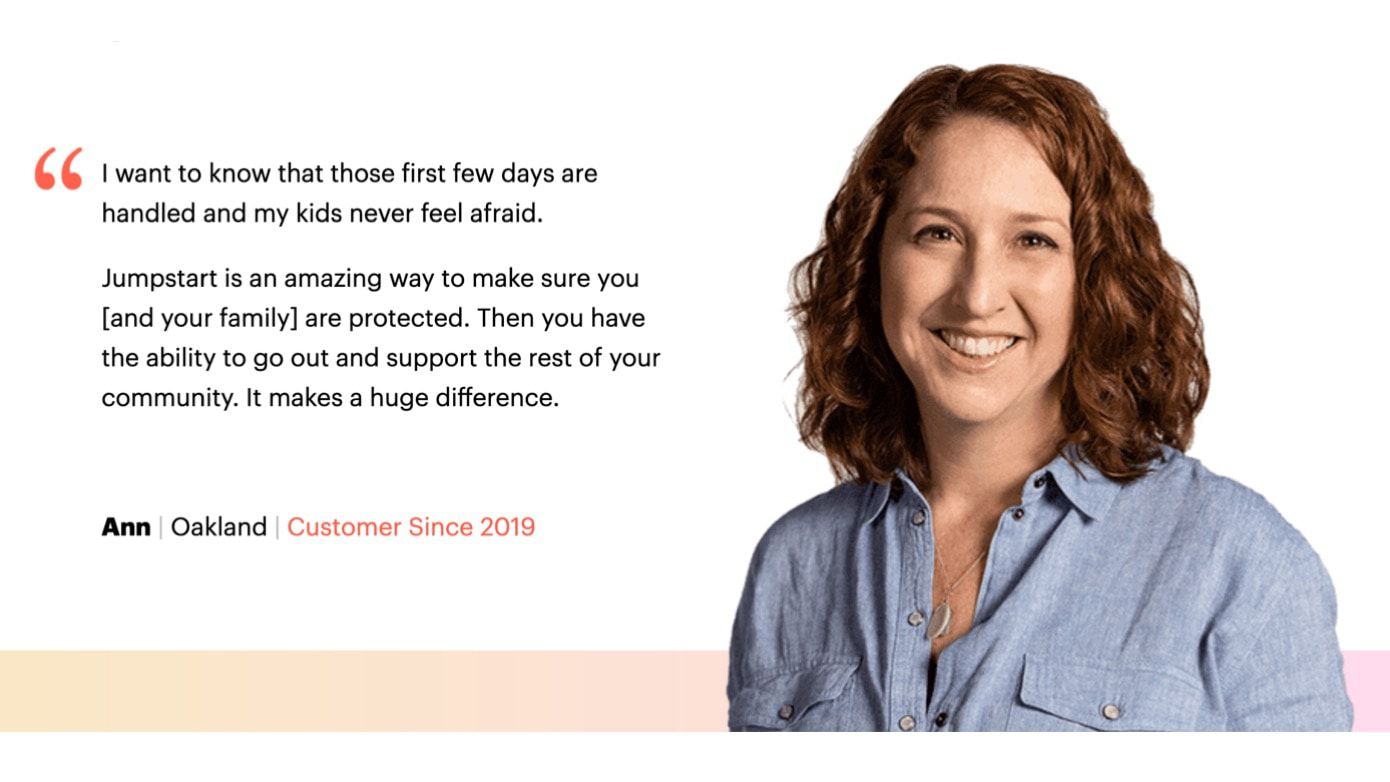

Customers love Jumpstart. We know because we've talked to them - literally hundreds of them. Time and time again we hear testimonials like these:

The data tell the same story. We're seeing metrics that indicate a clear value proposition:

The data tell the same story. We're seeing metrics that indicate a clear value proposition:

- 95% annual retention

- 40% conversion from starting the sign-up process

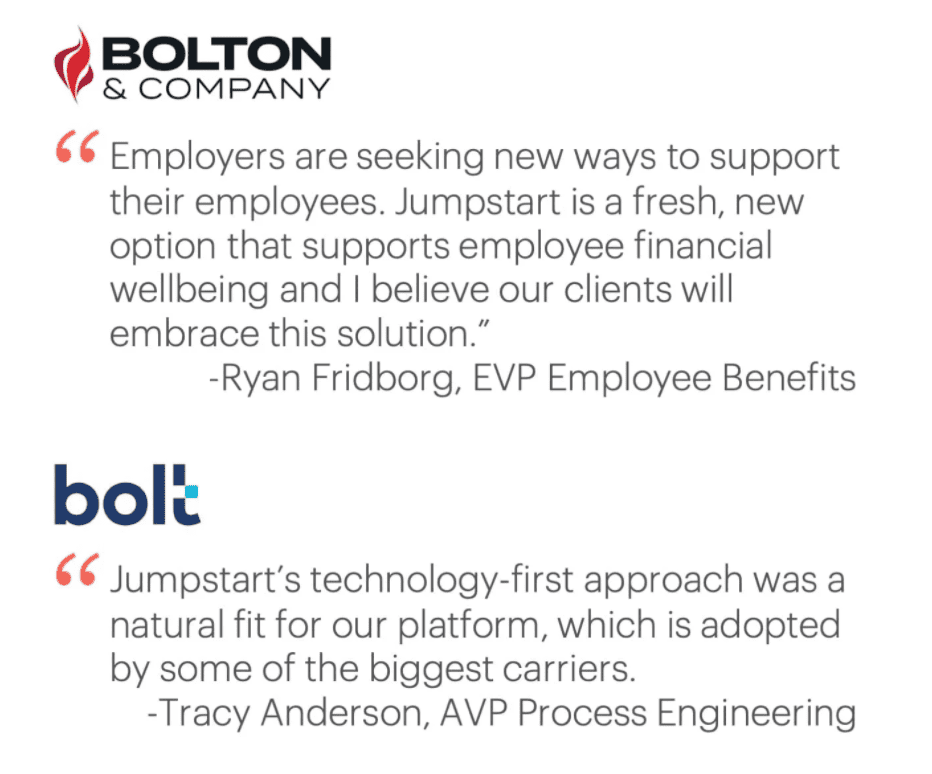

We're also learning from our customers when and why they buy Jumpstart. And as we add B2B2C partners, we're getting more rave reviews:

And as we add B2B2C partners, we're getting more rave reviews:

Business model

Recurring revenue with 10x growth in each of the next 2 years

We earn a recurring-revenue insurance commission, while bearing no risk of making post-disaster payouts. We work with underwriters at Lloyd’s who take responsibility to make payouts.

Customers pay an average of $250 per year, and we retain a typical commission of 25%.

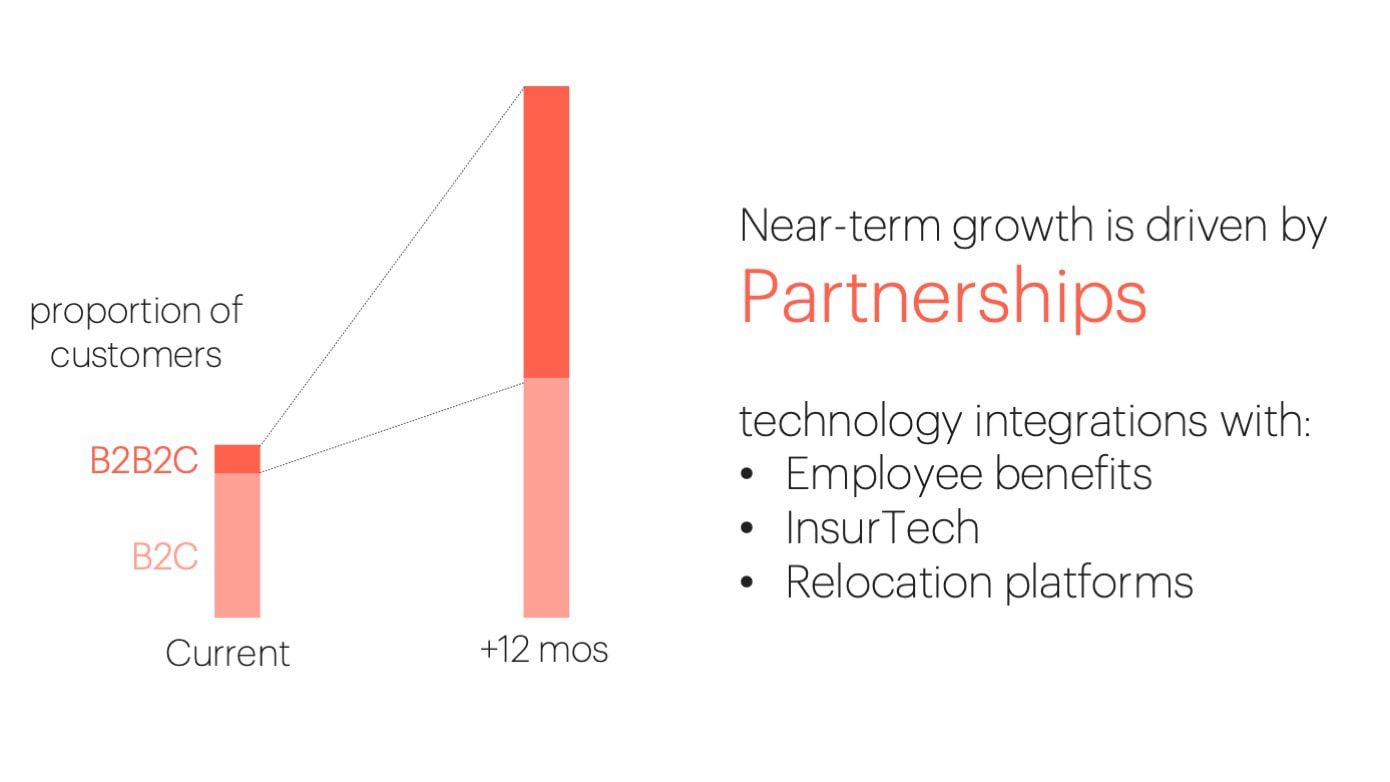

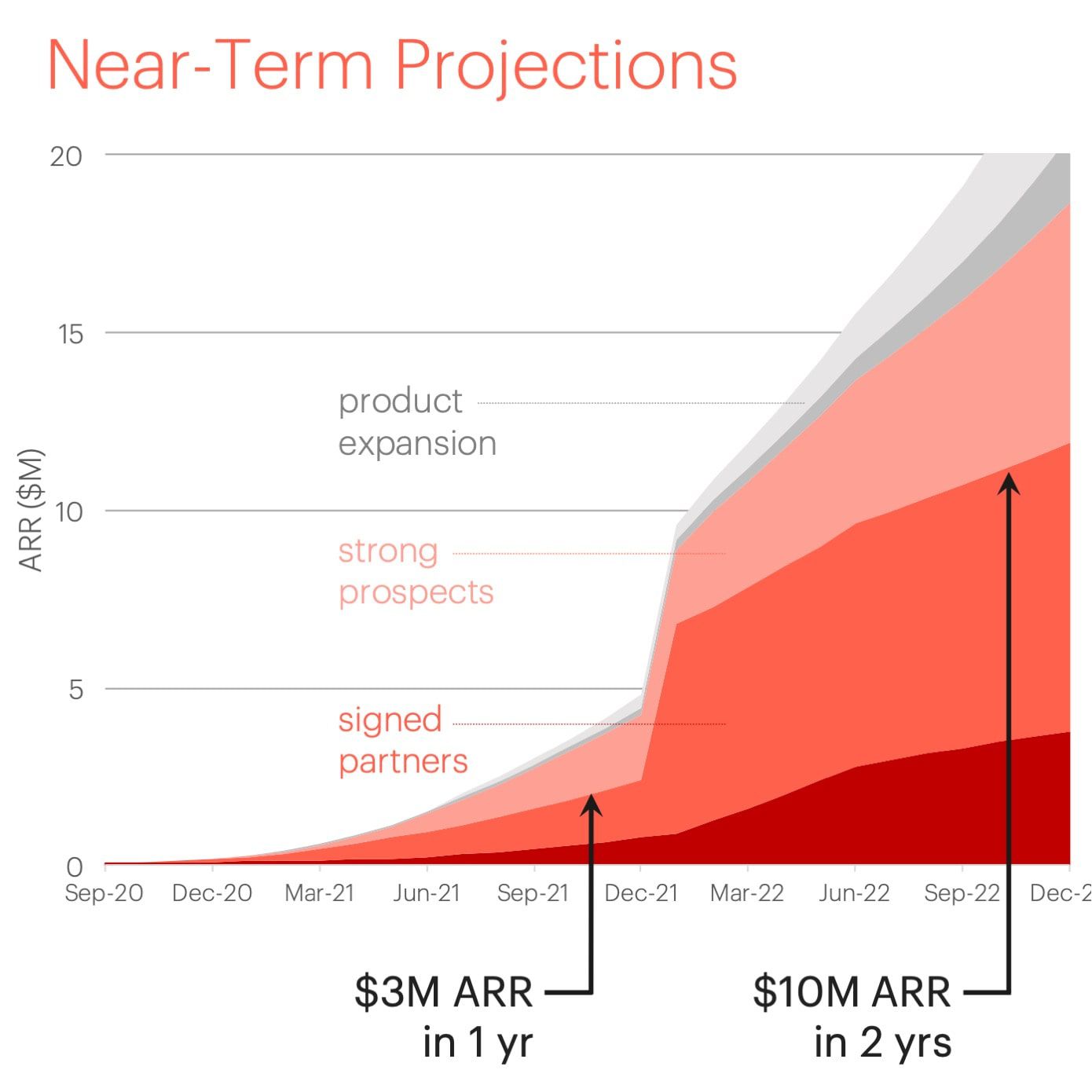

We project 10x growth per year for the next two years, driven mainly by partnerships.  As of December 2020, we have signed agreements with 12 partners with a collective 300,000 potential customers.

As of December 2020, we have signed agreements with 12 partners with a collective 300,000 potential customers. The late-2021 jump represents one of the largest California employers, who has plans to offer Jumpstart as a voluntary employee benefit.

The late-2021 jump represents one of the largest California employers, who has plans to offer Jumpstart as a voluntary employee benefit.

Longer-Term Upside

Our most likely exit opportunity will be acquisition by a large incumbent within 4 to 10 years. By that time, we project 400,000 customers, 3 to 5 disaster types, and $100M of revenue.

Market

A $150B blue-ocean market of under-insurance

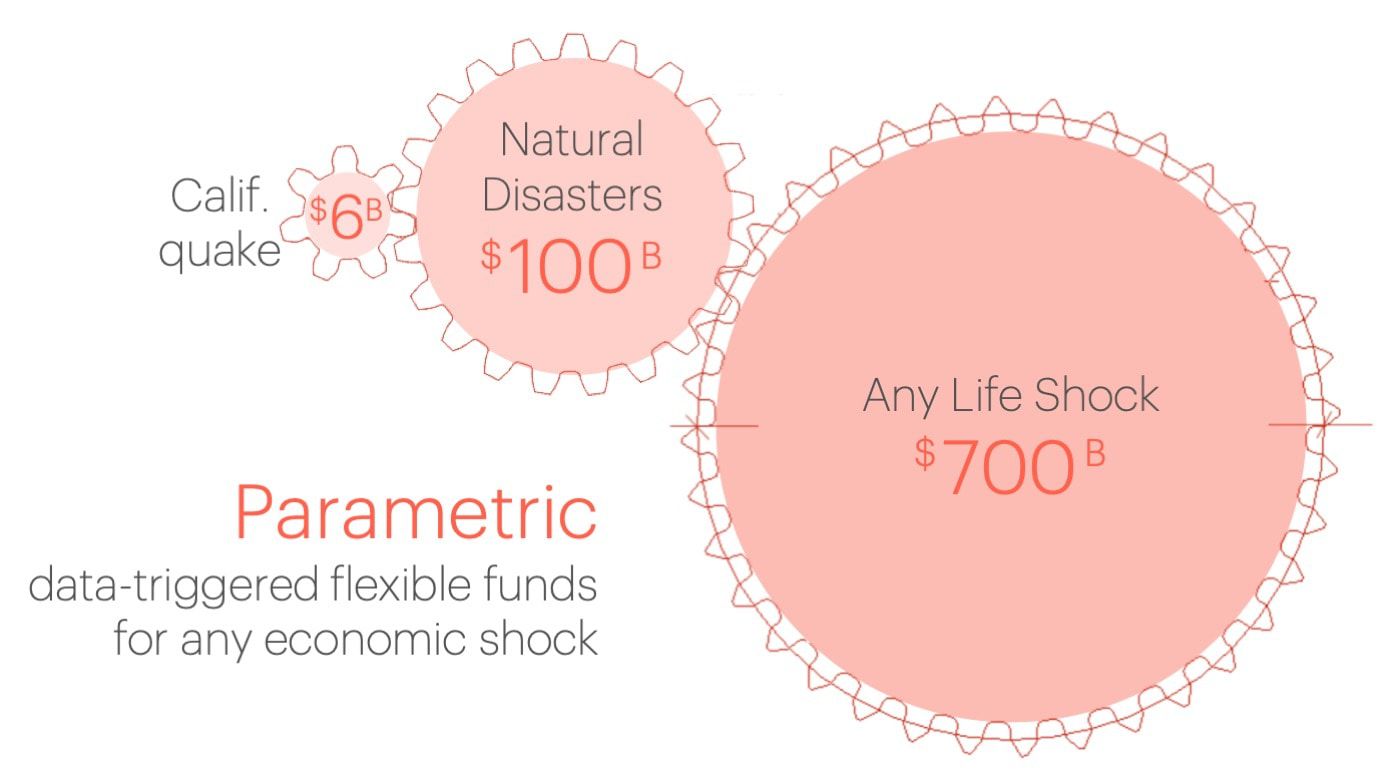

The insurance market is $1.6T. But for each amount insured, untold emerging risks go un- or under-insured: cyber, pandemic, climate change, and more. These create major insurance gaps with a market size in the hundreds of billions.

For natural disasters alone, this "protection gap" exceeds $150B annually. Even if we capture less than 1% market share, we become a billion-dollar company.

Here's how we "gear-up" this massive market potential:

- $6B initial market: earthquakes in California

- $30B: expand earthquake to more locations (WA & OR; New Zealand)

- $100B market: expand across natural disasters, particularly flood & wildfire

- $700B market: any un-insured shock: financial meltdown, cyber-terrorism, political risk...pandemic?

Competition

Imitation is the highest form of flattery

The Jumpstart experience is so opposite from conventional insurance that one customer told us, Our customers love that they can use Jumpstart money for any extra expense, even if they have no damage.

Our customers love that they can use Jumpstart money for any extra expense, even if they have no damage.

We may have been first-mover, but parametric insurance is catching on. It's so appealing that a large-scale incumbent has created a copycat product - but at double the price.

Why? In typical insurance, there are 4 to 5 "middle men" who each skim 5-20%, which can double the cost to the consumer.

With our full-stack of technology, Jumpstart can remain the only intermediary between the customer and the risk-bearing entity.

We pass along this savings to the customer, while keeping enough upside to grow profitably.

Vision and strategy

From Earthquakes to Floods and Beyond

Floods are the natural next step for Jumpstart's parametric approach. Like earthquakes, they are routinely excluded from normal coverage.

However, floods occur more often. The more frequent the hazard, the sooner we'll have "success stories" of delighted customers, and the sooner we'll go viral.

In the meantime, we're exploring how parametric can buffer small businesses from shocks in their revenue - no matter what caused the shock, from natural disaster to pandemic.

Our larger ambition is for a "jumpstart" policy to become synonymous with any insurance that pays an immediate lump sum - to be the defining brand of this new consumer category.

Our larger ambition is for a "jumpstart" policy to become synonymous with any insurance that pays an immediate lump sum - to be the defining brand of this new consumer category.

Funding

Wildly-successful prior raise on Republic: $900k

We're thrilled to be back on Republic. Our previous campaign generated a resounding vote of confidence from almost 4,000 investors.

We're especially heartened to share our journey with those of you who know first-hand what it takes to recover from disaster. (After 2020, that's all of us.)

We'll use funds from the current raise to reach milestones that will fuel our growth and multiply your investment:

- Integrations with key distribution partners

- Efficient direct-to-consumer growth

- Reach $10M ARR within 24 months

Our chances of success have never been higher. We've already received one inquiry from a prospective acquirer. But for now, staying independent will retain more upside for investors.

Founders

The Right Team to Drive Success

Founder and CEO Kate Stillwell has 20 years of domain expertise in the science and risk of earthquakes.  Kate recounts the origin story of Jumpstart:

Kate recounts the origin story of Jumpstart:

"At the time of Hurricane Katrina I was a practicing structural engineer. But I realized there's more to disaster recovery than safe buildings. A big missing piece is getting enough post-disaster funding."

In business school Kate learned about large-scale parametric financial instruments. She wondered, why couldn't we create micro-parametric insurance for consumers? Thus the idea for Jumpstart was born.

Kate is joined by a leadership team with the experience and credibility to execute and adapt.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...