OpenDeal Broker LLC charges you a non-refundable two percent (2%) administrative fee on the gross principal transaction with a minimum fee of $7 and a maximum of $300. The fee is added to the total amount of your investment at checkout. This administrative fee does not apply to crypto payments.

This is an offering for the right to certain defined digital assets offered by Fondation Massa. It is not an offering for a share, membership or partnership interest in Fondation Massa or any of its affiliates.

Deals involving crypto and/or digital assets such as NFTs are extremely speculative and present additional risks. Investor sophistication and enhanced independent reviews are highly recommended.

MAS Tokens may trade at lower prices on public token exchanges than the prices that the MAS Tokens are purchased in this Offering.

Shortly after this Offering, the Company may seek listing of the MAS Tokens on public exchanges. The MAS Tokens may trade at lower prices on those public exchanges than the prices Contributors acquired them in this Offering, and Contributors would be unable to sell their MASTokens during the lockup and vesting periods.

This Issuer operates from a foreign jurisdiction; and therefore, many of your country's common laws may not apply or be enforceable.

Investments in private companies are particularly risky and may result in total loss of invested capital.

This is a new company and has neither generated revenue, nor has it had any significant operating history.

There may be other available opportunities that are similar to this investment but have different attributes, characteristics, cost factors, and fees.

Disclosures & Disclaimers

Opportunity

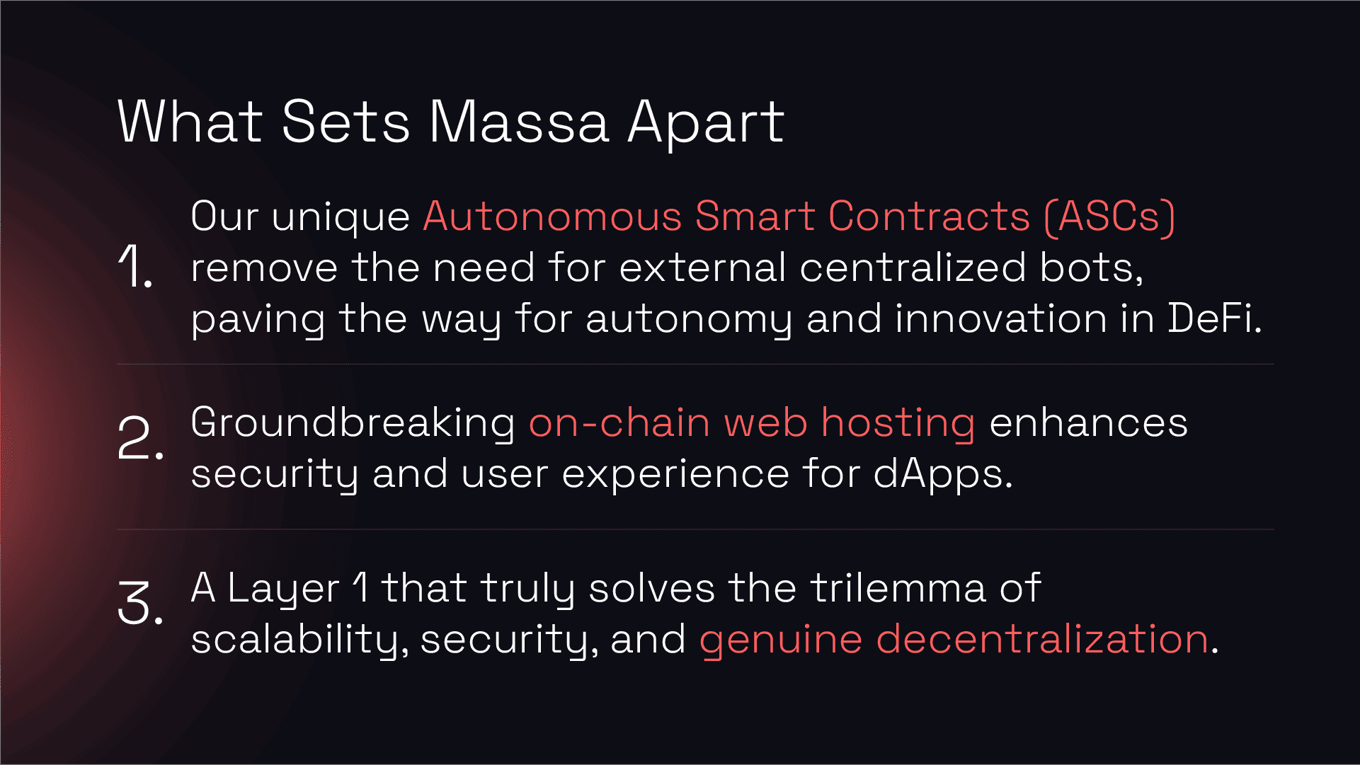

Massa's innovative approach to Web3 addresses key crypto challenges like scalability, decentralization, and introduces on-chain web and Autonomous Smart Contracts. This advancement isn't just a leap in efficiency; it also creates new prospects for developers and businesses to explore groundbreaking dApps in ways that aren't possible with traditional smart contracts. Participants in the Massa ecosystem have the chance to be part of a transformative platform that could redefine how blockchain technology is utilized across various industries.

The opportunity:

Market Potential: Massa's singular approach, incorporating Autonomous Smart Contracts and on-chain web capabilities, positions it to capture a significant share in the market and to revolutionize various industry sectors.

Decentralization Benefits: Embracing genuine decentralization, Massa provides a robust alternative to traditional centralized systems, offering enhanced security and autonomy.

Community and User Base Expansion: The platform's engaging and growing community indicates a strong potential for widespread adoption.

Concept

Autonomous smart contracts

How they work…

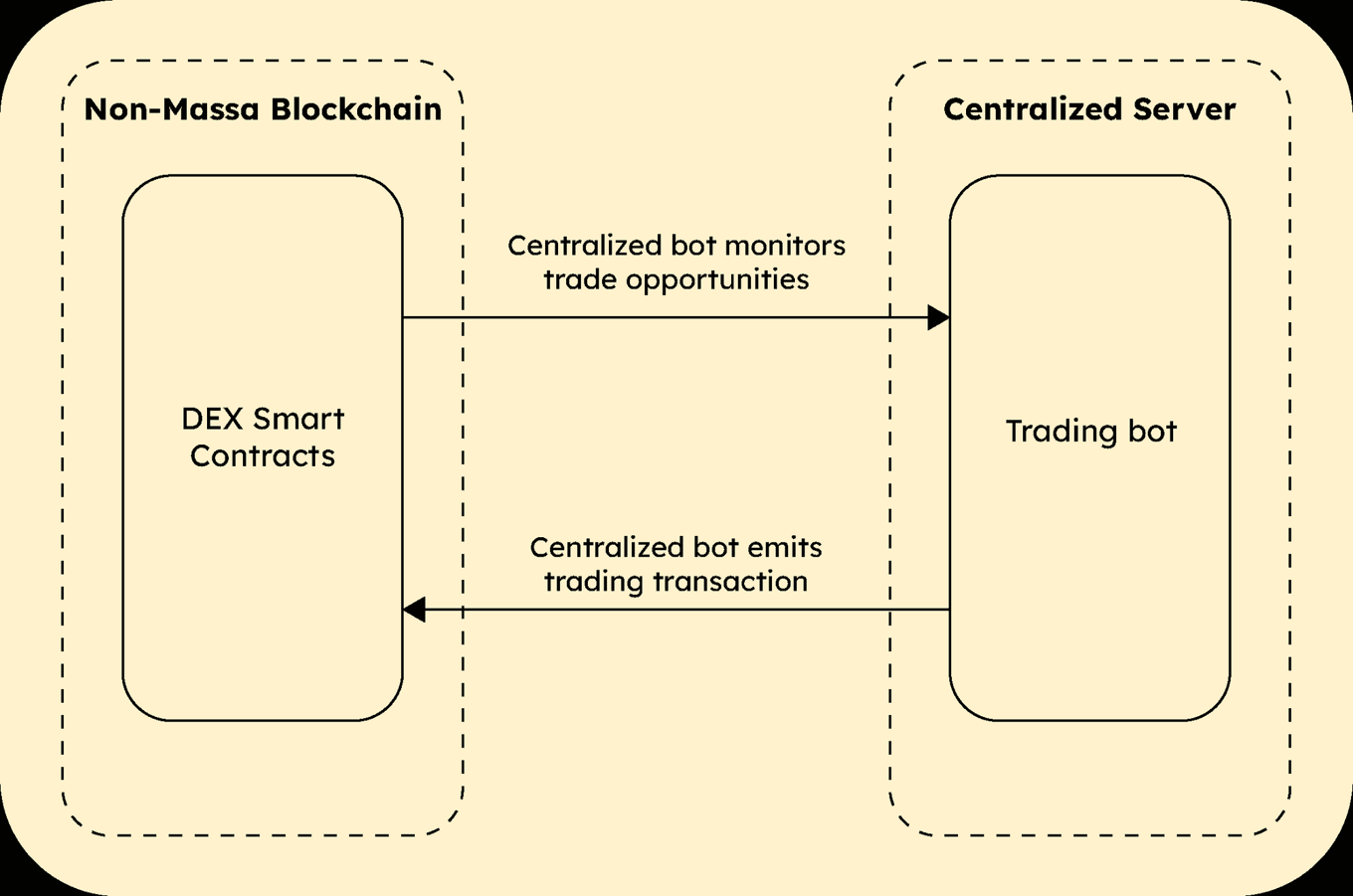

Traditional smart contracts require external triggers, rely on centralized services like AWS and GCP, and cannot autonomously interact with multiple contracts or other chains.

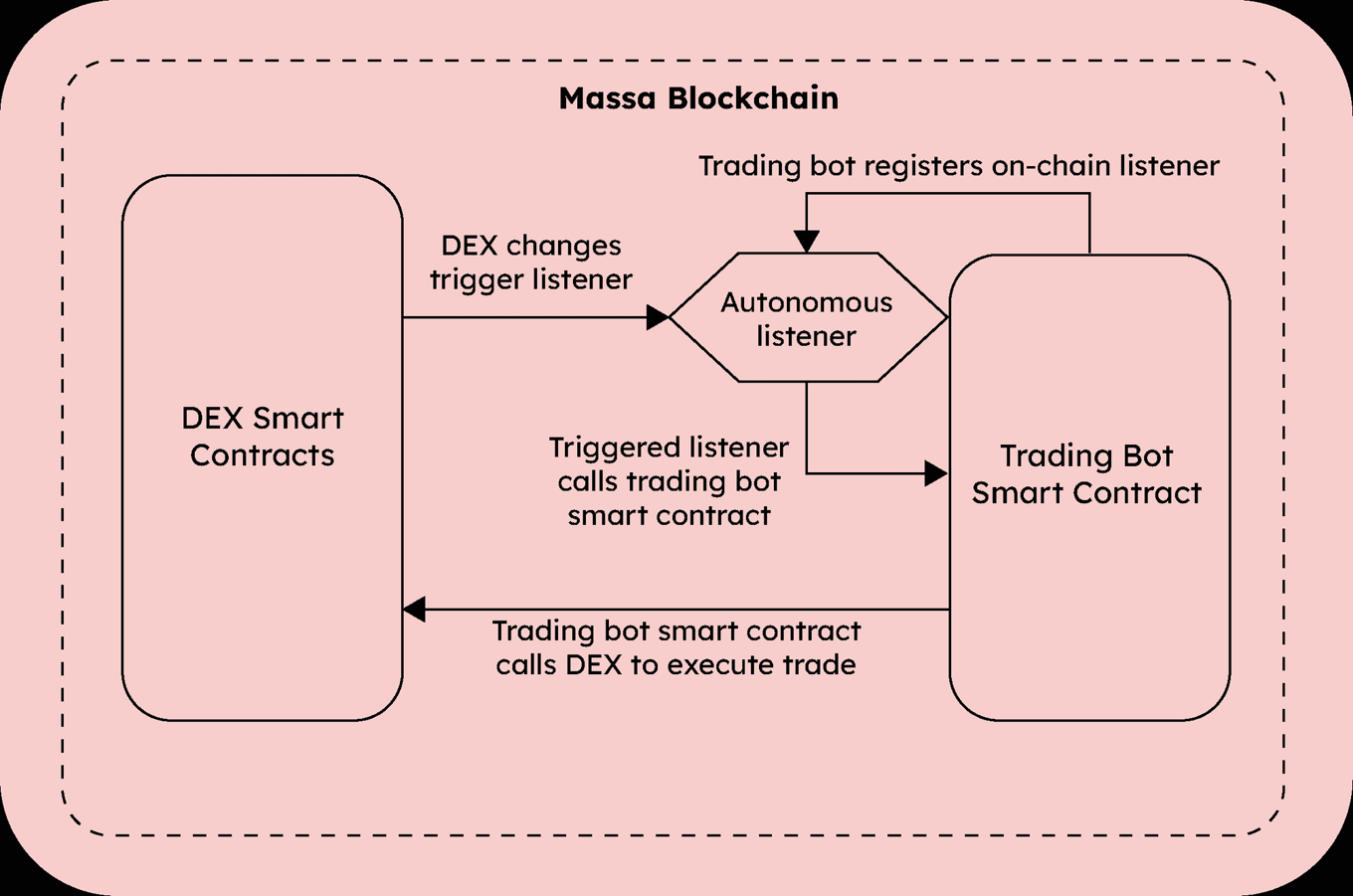

But Massa’s Autonomous Smart Contracts can self-activate - without needing any external triggers! They operate fully on-chain, which enhances security and transparency. This means:

- Service with no single point of failure

- No risk of automation-layer hacks

- Censorship-resistance: fully decentralized and pratically unstoppable

ASC’s in DeFi:

With traditional smart contracts, current DeFi has the following shortcomings:

- Often missing essential features like limit orders and liquidations

- Reliance on unsafe centralized frontends and bots

- High financial losses due to lack of automation

Massa ASC’s now allow for a more feature-rich DeFi…

- Automated Trading: Execute limit orders autonomously, without the need for external monitoring

- Loan Management: Automatic loan payments and collateral liquidations, reducing default risks

- Increase yields: Better use of liquidity through automated portfolio management

… giving rise to new DeFi offerings that are more secure, efficient, and truly decentralized.

Autonomous smart contracts - other use cases:

- Gaming: Now, non-player characters can interact without player triggers; virtual worlds can evolve based on collective behaviors; and in-game items can level up or degrade based on use

- Cross-chain-automation: With ASC’s, you can use Massa as a decentralized backend (for example, autonomously tap into Ethereum liquidity or trade NFTs on Solana).

- Governance: ASC’s facilitate automated voting systems and decentralized decision-making

- NFTs: ASC’s enable features like autonomous breeding and evolving traits in crypto-collectibles

On-chain web hosting

Shift from from Web2's vulnerability to an empowered, user-friendly, hack-resistant Web3 ecosystem.

- Completely on-chain: Massa hosts websites on-chain for a total Web3 experience.

- Enhanced Security: Eliminates various common recent attack vectors like frontend vulnerability and DNS hijacking in DeFi.

- True Decentralization: Secure and immutable frontends, with no need for centralized servers.

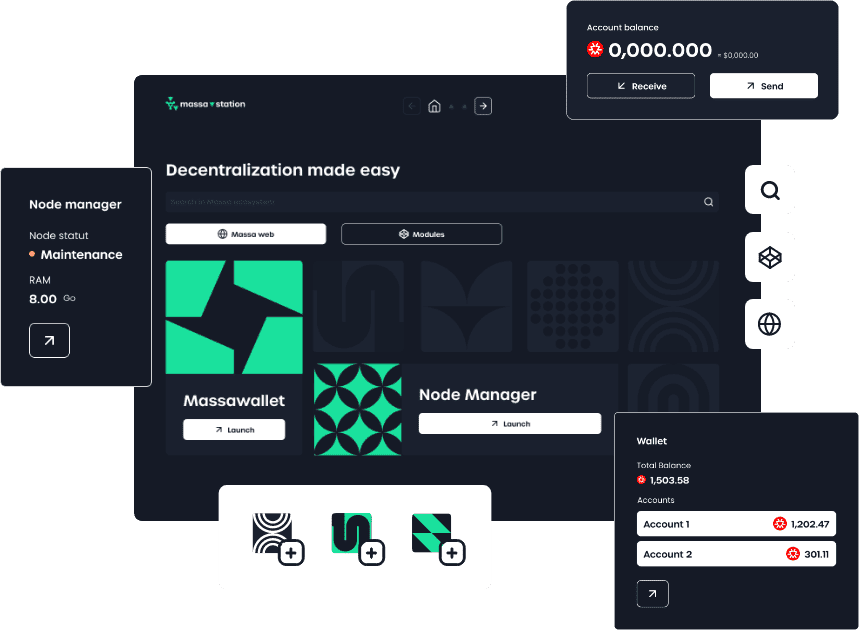

Developers can register theirdomain.massa on the DNS and design their apps fully on-chain. People interact through their favorite browser, seamlessly switching between web2 and web3.

Genuine decentralization

Centralization can ruin crypto for users:

- Hacks and theft due to central points of failure

- Censorship, deplatforming, and manipulation by centralized entities and large token holders

- Governance models lacking transparency and accountability

Massa's Revolutionary Approach to Decentralization:

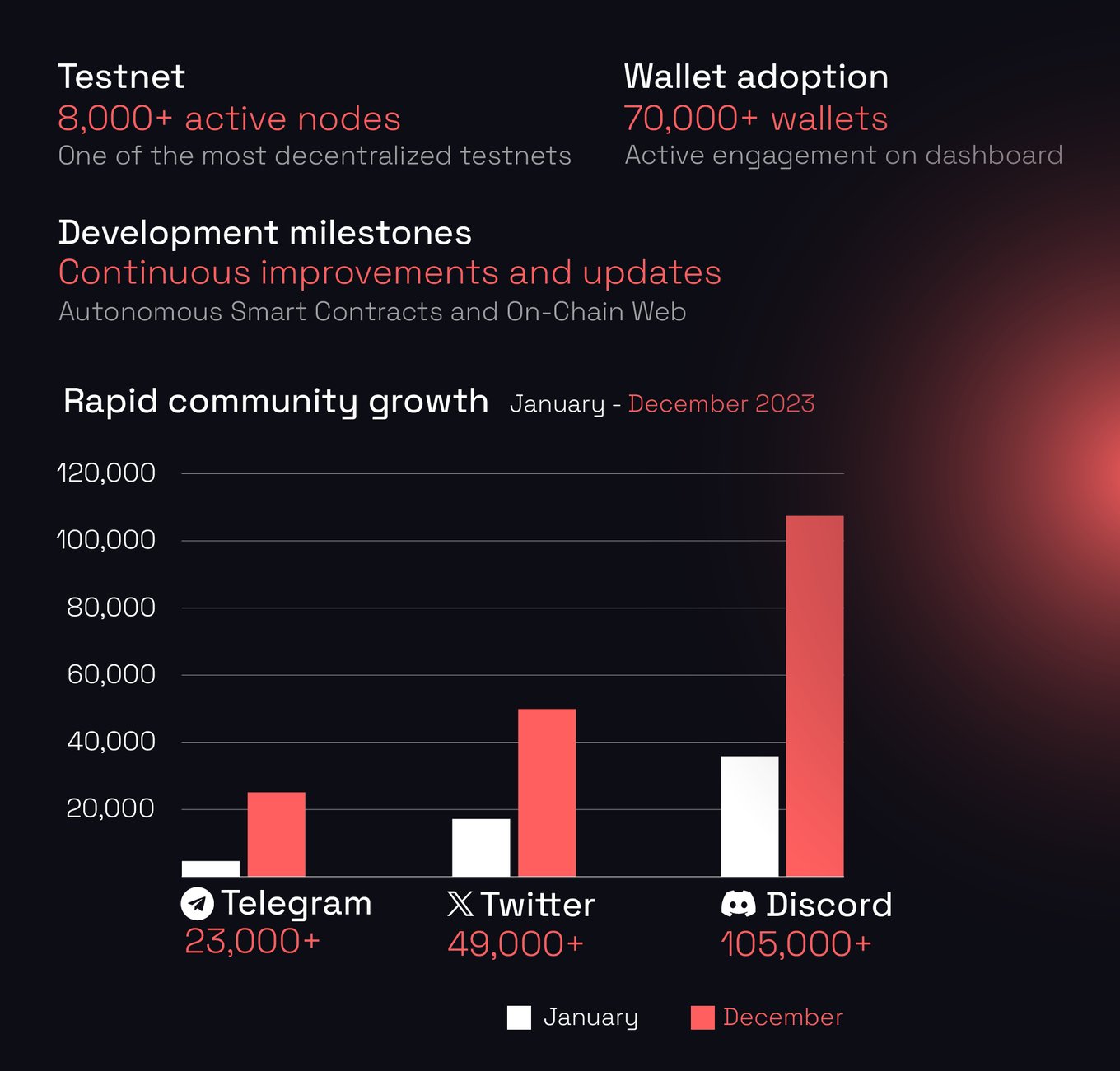

- Extremely high Nakamoto decentralization coefficient (1,000+)

- Over 8,000 testnet nodes (Based on internal data)

- Accessible staking with consumer hardware and a low staking minimum (100 Massa)

- No identifiable central points of failure

- Truly aligned with the spirit and ethos of web3

- Blockclique architecture without trade-offs between decentralization and scalability

*Information based on our whitepaper and technical paper.*

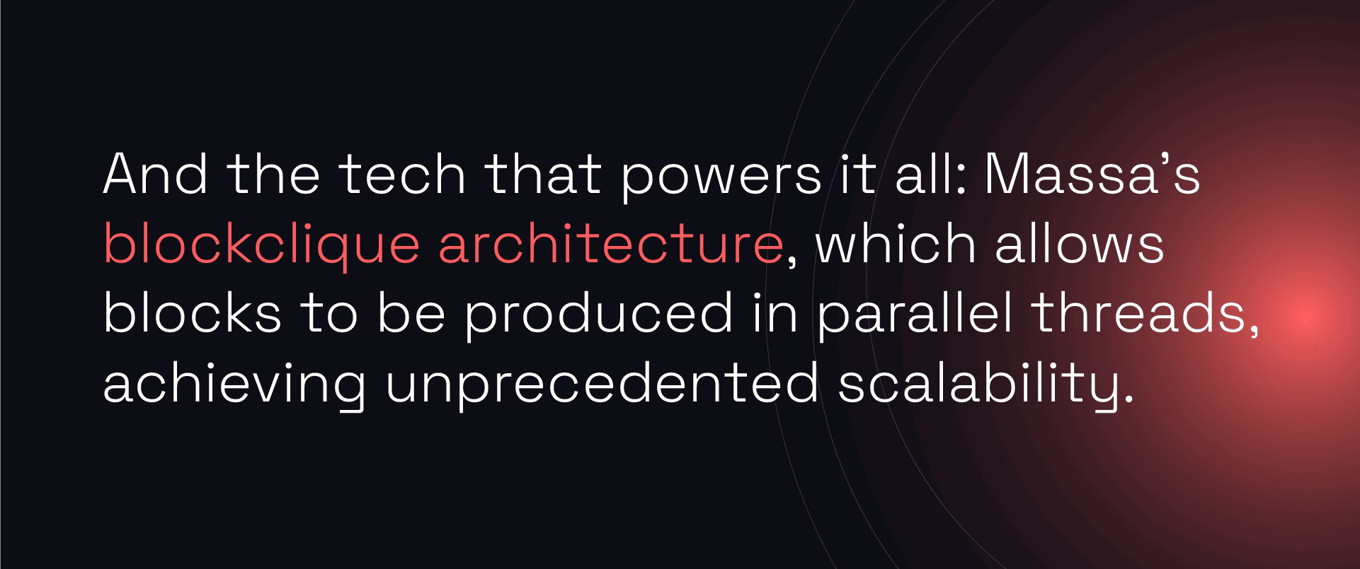

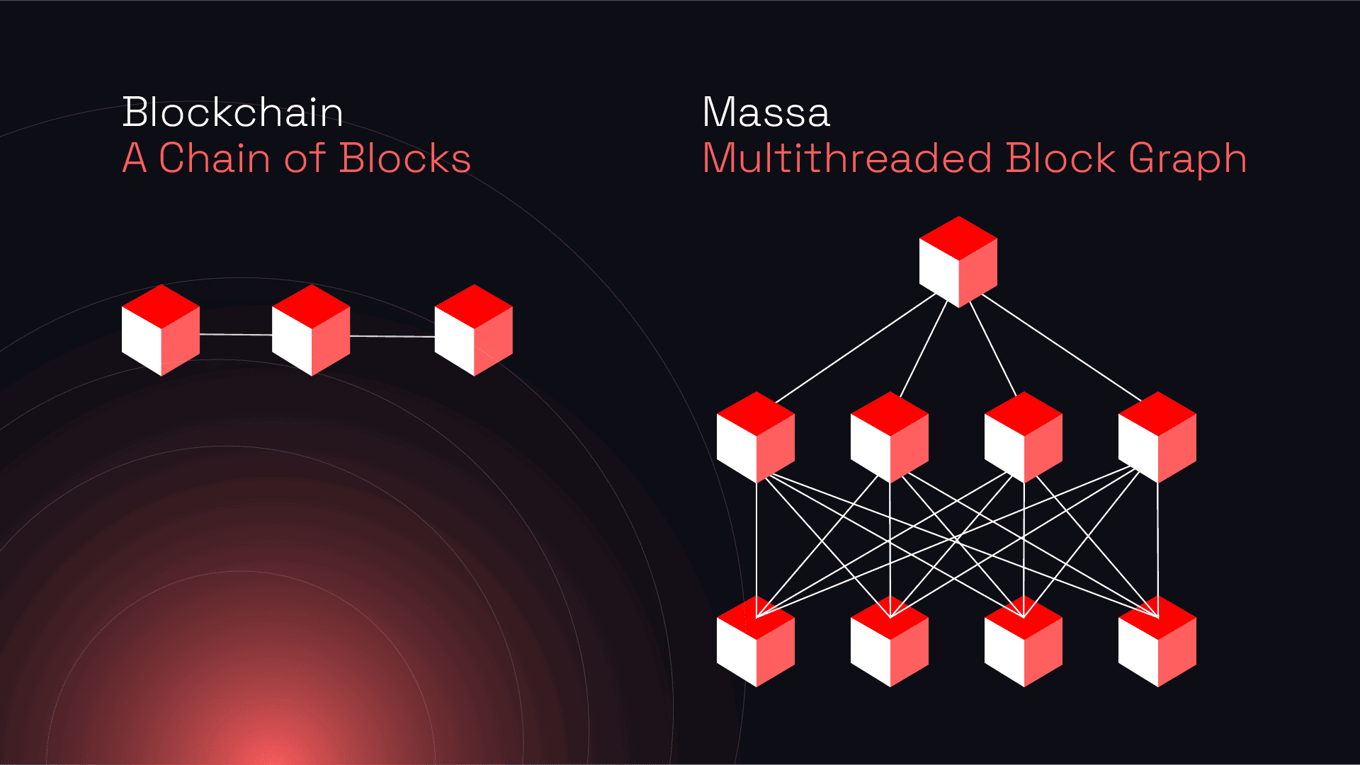

Underlying magic: our parallel blockchain architecture

- Parallel threads enable high throughput (10k op/s!) without sacrificing decentralization

- Concurrent blocks increase capacity while maintaining security

*Information based on our technical paper.*

Traction

Growth Trending Upward

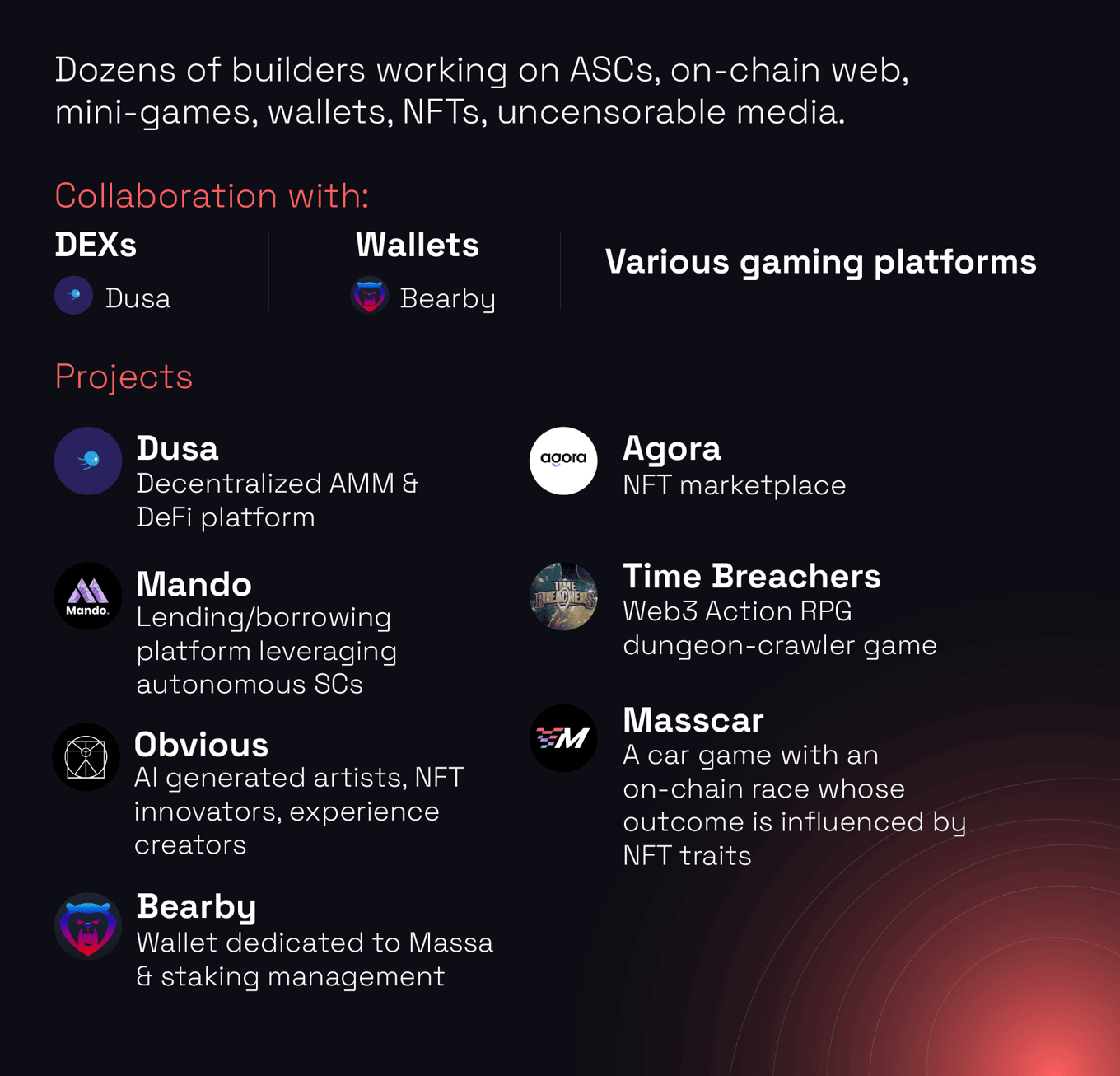

Ecosystem

Ecosystem

Massa's ecosystem is characterized by a diverse range of components and collaborations:

DApps

Developer Community: A supportive and active developer community, creating and sharing resources, tools, and DApps on the Massa network.

User Community: A strong and engaged user base across various platforms, contributing to network growth and governance.

Educational Initiatives: Programs and resources to educate and onboard new users and developers into the Massa ecosystem.

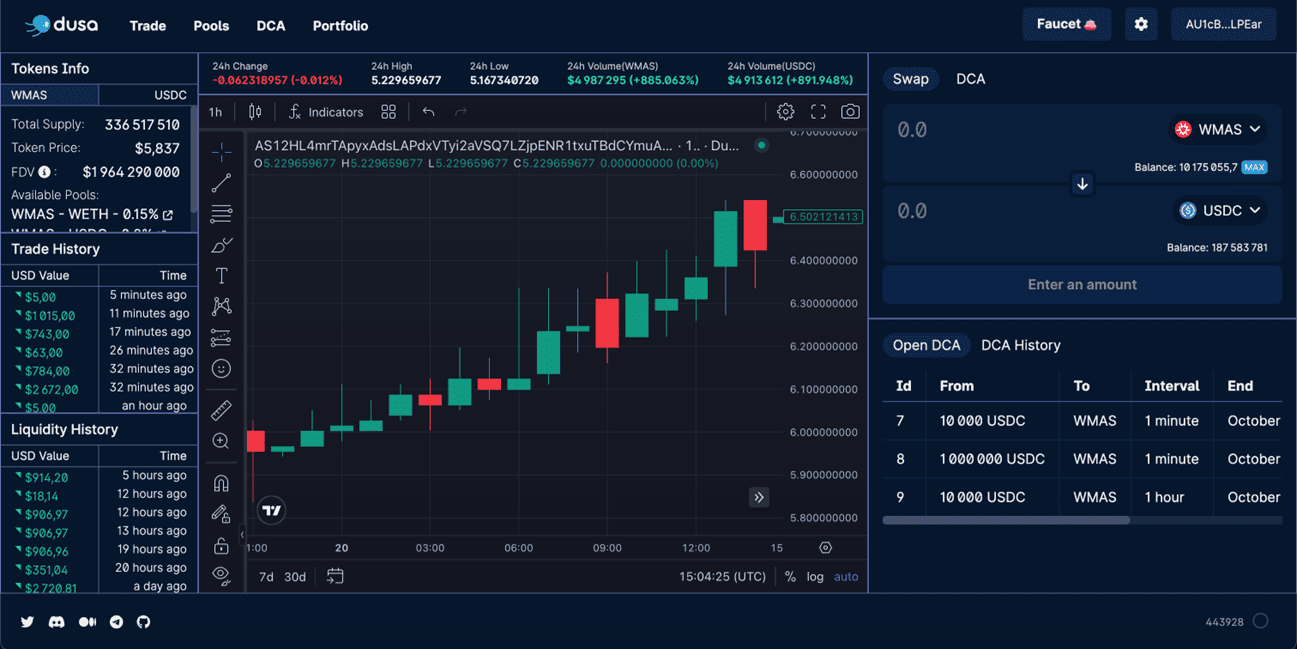

Spotlight: Ecosystem Project Dusa – Autonomous Smart Contracts in DeFi

- A unique DEX with automatic orders and a decentralized frontend - hosted on Massa!

- Automating liquidity management leads to Increases yield for liquidity providers

- No need for monitoring or centralized keeper bots

- No Uniswap-like censorship, no Curve-like hacks

*Please note that Dusa is not apart of Massa*

Tokenomics

Massa token

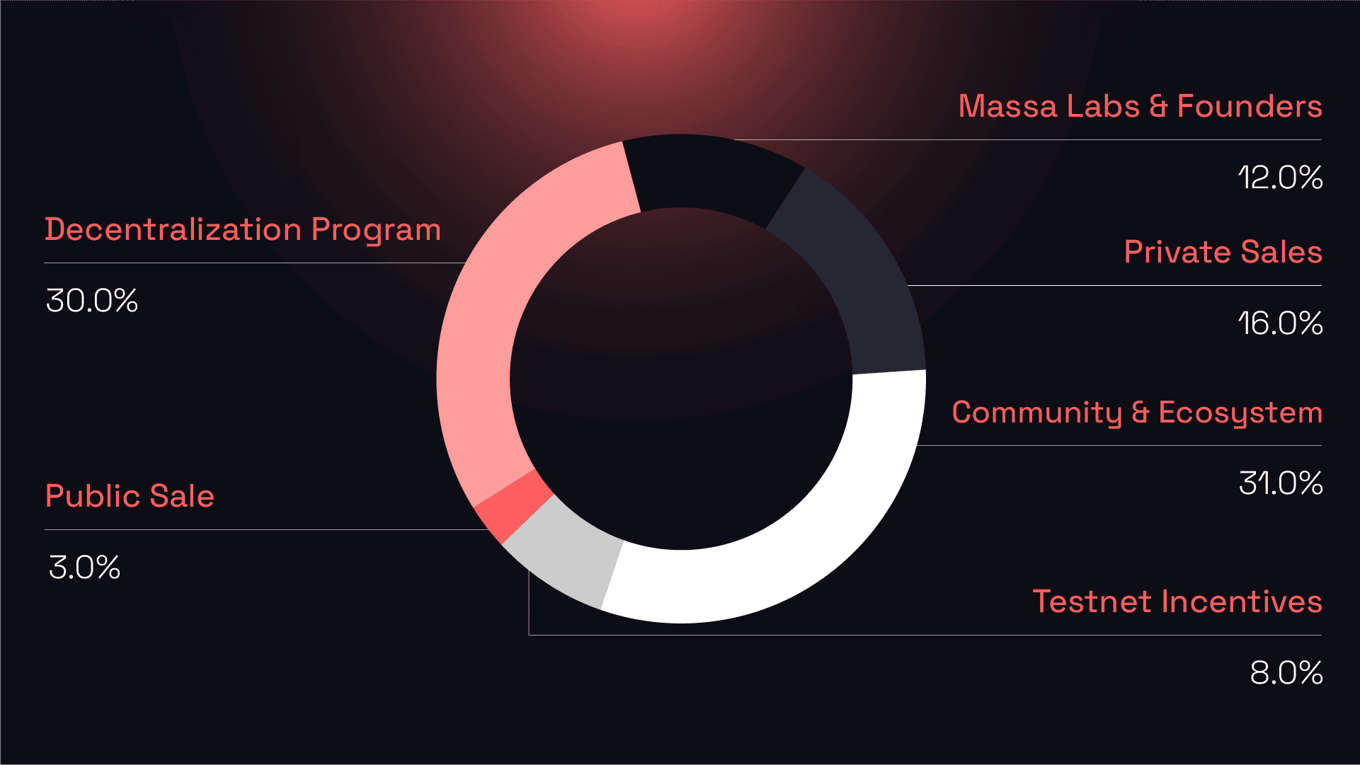

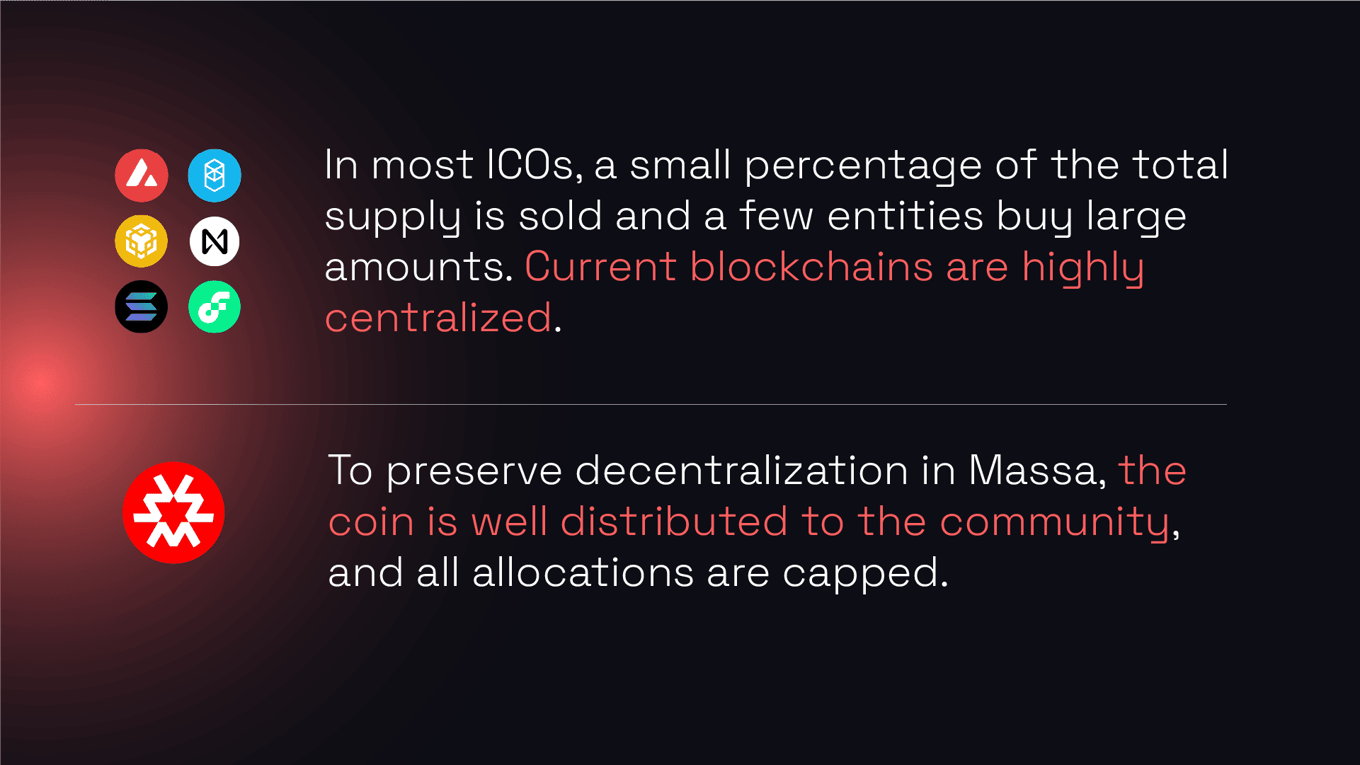

Massa, true to its values, has implemented a tokenomics model that emphasizes fairness and decentralization. This model ensures that the Massa token is distributed widely among the community, reducing the risk of centralization that can result in unfair voting practices, price manipulation, and security compromises.

Massa is committed to maintaining the highest standards of decentralization, with the goal to achieve a Nakamoto coefficient of over 1,000, ensuring that control and decision-making power are widely distributed across the community (roughly 72% of tokens are reserved for the community). Achieving this not only requires efforts on the technical and legal design, but also on the coin distribution: with less tokens for insiders and more tokens for the community, builders and node runners.

Vision and strategy

Vision and strategy

Massa's vision is to create a fully decentralized blockchain that empowers users through true ownership and control over their digital interactions. The strategy encompasses:

The strategy also includes expanding Massa's reach by partnering with various sectors, promoting educational initiatives, and building a marketplace for decentralized services. Through these efforts, Massa aims to become a leading blockchain platform recognized for its innovation, security, and community-driven approach.

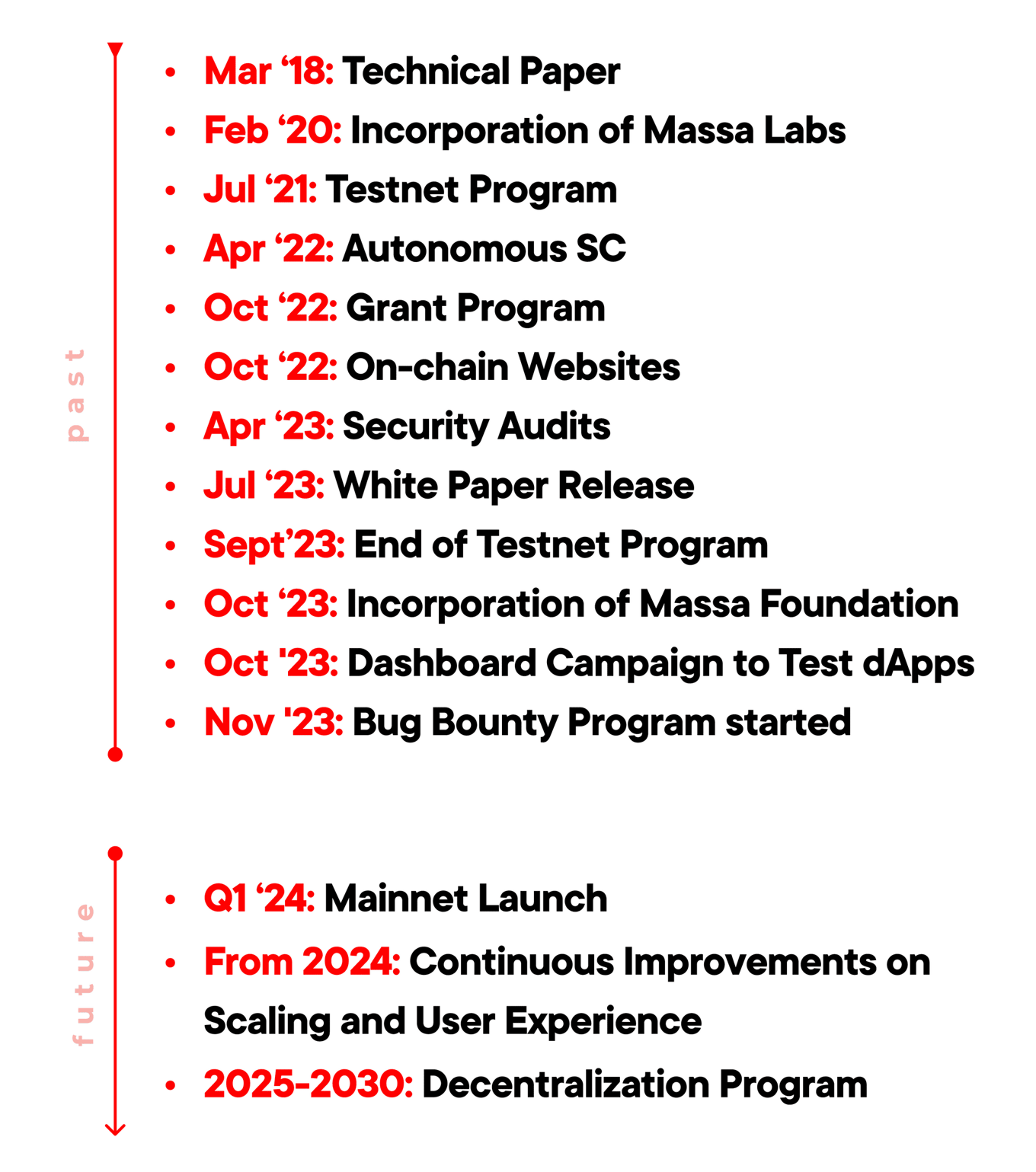

Roadmap

Leadership

A strong 20-person team led by founders with backgrounds in crypto

Adrien Laversanne-Finot - Co-Founder & CEO of Massa Labs

Adrien is a graduate of Ecole Polytechnique and holds a Ph.D. in Quantum Cryptography. His background in advanced cryptography research ensures that Massa's technology remains cutting-edge and secure.

Damir Vodenicarevic - Co-Founder & CTO of Massa Labs

Damir brings a wealth of experience to his role as CTO at Massa, including a Ph.D. in Computer Science and Physics and a track record of successfully launching a tech startup. Prior to this, he worked in the banking sector at Treezor, where he focused on detecting fraud.

Brian Felsen - CMO of Massa Labs

With a comprehensive marketing background, Brian has served as the head of marketing at Harmony and the President of AdRev, CD Baby, and BookBaby. His marketing expertise is crucial to Massa's growth and brand recognition.

Grégory Libert - Head of Innovation at Massa Labs

As the former CTO at Treezor, Grégory is well-versed in payment flows and has a strong background in technology and innovation. His expertise in fintech and payment systems is instrumental to Massa's development.

Sébastien Forestier - Co-Founder & Head of Massa Foundation

Sébastien is a graduate of Ecole Normale Supérieure and holds a Ph.D. in Computer Science from Inria. His leadership role is underpinned by a strong vision that combines robust technical knowledge with ambitious goals for Massa.

Jean-Christophe Baillie - Council Member of Massa Foundation

Jean-Christophe is the former head of Softbank Robotics Europe AI Lab and the founder of Novaquark, one of the pioneers of the Metaverse sector. Holding a Ph.D. in AI, his combined expertise in artificial intelligence, strategy, and management offers valuable insights and direction to Massa.

Disclaimers

Risks of early stage investment. The following disclaimer is not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured.

Investors may be subject to additional fees including but not limited to exchange rates, gas fees, processing charges, and other investment processing payments.

Certain information set forth in this presentation contains “forward-looking information”, including “future-oriented financial information” and “financial outlook”, under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, the information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of the shares being offered hereunder; (iii) the expected development of the Company’s business, projects, and joint ventures; (iv) execution of the Company’s vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company’s projects; (vi) completion of the Company’s projects that are currently underway, in development or otherwise under consideration; (vi) renewal of the Company’s current customer, supplier and other material agreements; and (vii) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained in this presentation are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

This notice should not be construed as an offering of securities or as investment advice or any recommendation as to an investment or other strategy by OpenDealBroker LLC dba the Capital R ("ODB"). OpenDeal Broker LLC is compensated in cash commission and tokens issued by Fondation Massa. Fondation Mass will pay OpenDeal Broker LLC: a 6% cash commission for up to $1 million raised, a 5% cash commission for funds raised above $1 million, with a minimum fee to ODB of $25,000 per Offering, and 2% of the dollar value issued in securities/tokens to Investors pursuant to each Offering at the time of closing (as such terms are defined in the offering engagement agreement between ODB and Fondation Massa.

Fondation Massa has engaged ODB to conduct an offering ("the offering") of digital assets (MAS) issued by Fondation Massa to eligible persons on the Republic platform (the "Platform").

The offering will be in digital assets (MAS) issued by Fondation Massa, and not equity in the company Fondation Massa, or any other entity.

This is a speculative, risky investment and may be illiquid or pricing may substantially fluctuate in value. You may lose money.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 149 5th Avenue, 10th Floor, New York, NY 10010, please check our background on FINRA’s BrokerCheck. Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest. Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

https://www.finra.org/#/

https://www.sipc.org/

THIS OFFERING IS CONDUCTED PURSUANT TO RULE 506(C) OF REGULATION D PROMULGATED UNDER THE SECURITIES ACT AND IS LIMITED SOLELY TO ACCREDITED INVESTORS AS DEFINED IN REGULATION D UNDER THE SECURITIES ACT. ONLY PERSONS OF ADEQUATE FINANCIAL MEANS WHO HAVE NO NEED FOR PRESENT LIQUIDITY WITH RESPECT TO THIS INVESTMENT SHOULD CONSIDER PURCHASING THE [token name] TOKENS OFFERED HEREBY BECAUSE: (I) AN INVESTMENT IN THE [token name] TOKENS INVOLVES A NUMBER OF SIGNIFICANT RISKS; AND (II) NO MARKET FOR THE [token name] TOKENS CURRENTLY EXISTS, AND EVEN IF ONE WERE TO DEVELOP, THE [token name] TOKENS OFFERED HEREBY ARE SUBJECT TO TRANSFER RESTRICTIONS AS DESCRIBED HEREIN. THIS OFFERING IS INTENDED TO BE AN OFFERING THAT IS EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS.

This Offering is limited solely to Purchasers who are “accredited investors” as defined in Regulation D. To be eligible to participate in the Offering, you will be required to represent to the Company in writing that you are an accredited investor and must have provided a third-party certification attesting to such status as required by Rule 506(c). You must also represent in writing that you are (i) purchasing the Subscription Agreements for your own account and not for the account of others and not with a view of reselling or distributing the [token name] Tokens, (ii) not domiciled or a citizen of a country in which cryptocurrency offerings are illegal, and (iii) not from countries which the Office of Foreign Assets Control has deemed a “sanctioned” country.

In order to qualify as an “accredited investor,” a potential Purchaser must meet one of the following conditions of the date on which the Token Purchase Agreement is executed and as of the date of the purchase:

(i) Individual – Income Test. An individual who had an income in excess of $200,000 in each of the two most recent years (or joint income with his or her spouse in excess of $300,000 in each of those years) and has a reasonable expectation of reaching the same income level in the current year;

(ii) Individual – Net-Worth Test. An individual who has a net worth (or joint net worth with his or her spouse) in excess of $1,000,000 (excluding the value of such individual's primary residence);

(iii) IRA or Revocable Company. An Individual Retirement Account (“IRA”) or revocable Company and the individual who established the IRA or each grantor of the Company is an accredited investor on the basis of (i) or (ii) above;

(iv) Self-Directed Pension Plan. A self-directed pension plan and the participant who directed that assets of his or her account be invested in the Partnership is an accredited investor on the basis of (i) or (ii) above and such participant is the only participant whose account is being invested in the Partnership;

(v) Other Pension Plan. A pension plan which is not a self-directed plan and which has total assets in excess of $5,000,000;

(vi) Irrevocable Company. An irrevocable Company which consists of a single Company (a) with total assets in excess of $5,000,000, (b) which was not formed for the specific purpose of investing in the Partnership, and (c) whose purchase is directed by a person who has such knowledge and experience in financial and business matters that he or she is capable of evaluating the merits and risks of the prospective investment;

(vii) Corporations and Other Entities in General. A corporation, partnership, limited liability Company or Massachusetts or similar business Company, that was not formed for the specific purpose of acquiring an interest in the Partnership, and which has total assets in excess of $5,000,000; or

(viii) Entity Owned by Accredited Investors. An entity in which all of the equity owners are accredited investors. OpenDeal Broker LLC is a New York limited liability company. Neither OpenDeal Broker LLC nor Republic Crypto LLC d/b/a Republic Advisory Services (“Republic Advisory Services”) nor any of their affiliates has independently verified any of the information provided or makes any assurances as to the completeness, accuracy or reliability of any such information provided by the Company.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...