What is your 30-second pitch to investors? StayFi is building the guest marketing stack for short-term rental companies t...

Problem

The problem for Short-Term Rental (STR) companies:

—

"We booked an Airbnb"

—

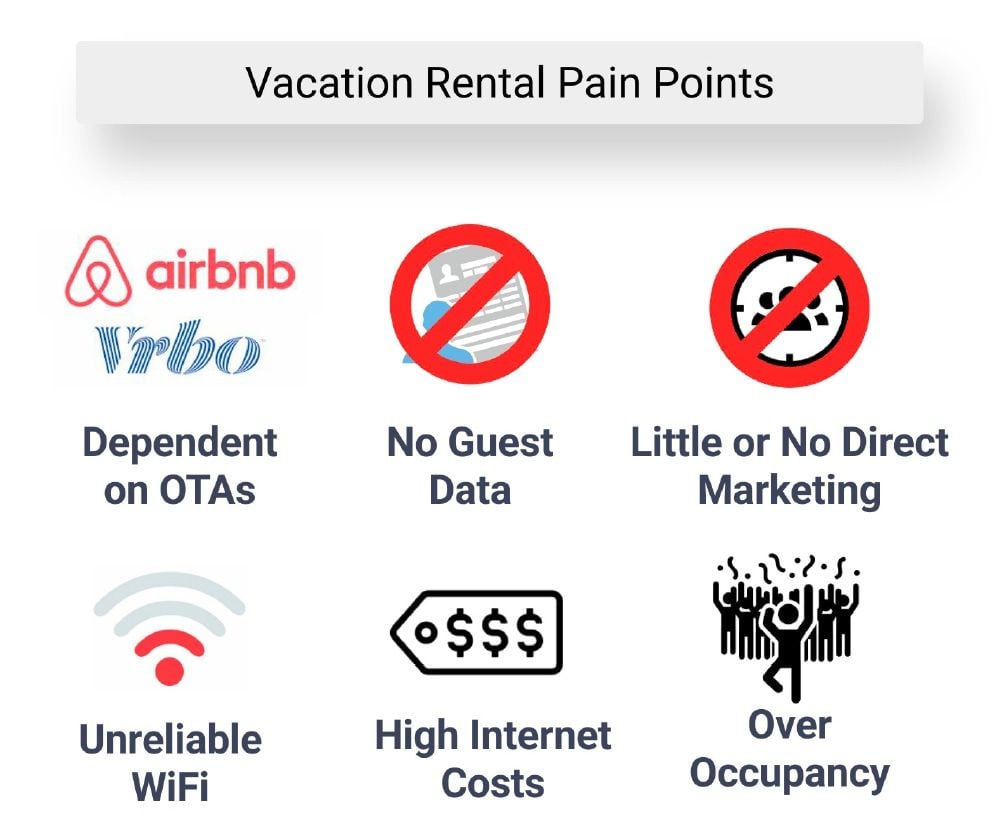

- STR companies can't collect guest data & can't market to guests directly

- STR companies are dependent on 1-3 channels for most bookings

- STRs companies pay 15%+ of revenue to Airbnb, Vrbo and other OTAs (Online Travel Agents)

Solution

Vacation rental WiFi that collects valuable guest data

StayFi is a guest engagement platform that collects valuable marketing data, and makes short-term rental companies more profitable.

StayFi brands the WiFi, collects guest data, and increases direct bookings—all while providing a better WiFi experience for vacation rental guests.

—

We bootstrapped captive WiFi for STRs

—

StayFi's solution collects marketing data from all guests in STRs.

Product

StayFi WiFi marketing details

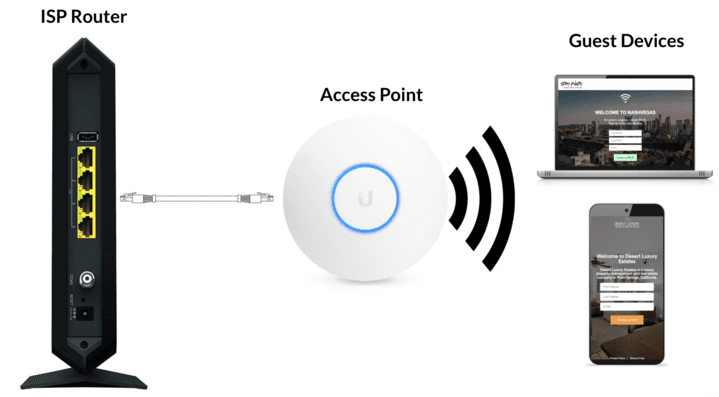

StayFi is built for property managers of any size to create an account, order equipment, and set up WiFi marketing—with no IT support.

- Order plug-and-play access points from our store

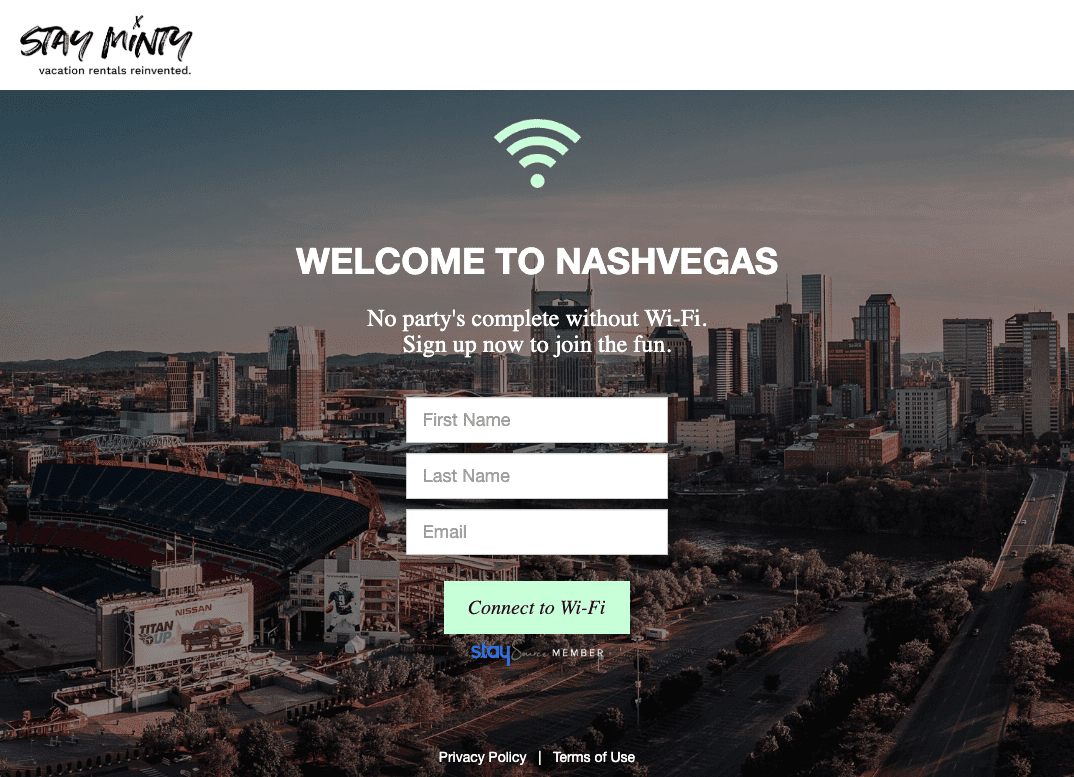

- Create custom splash pages in our portal

- Collect emails & more from 80%+ of all guests

—

—

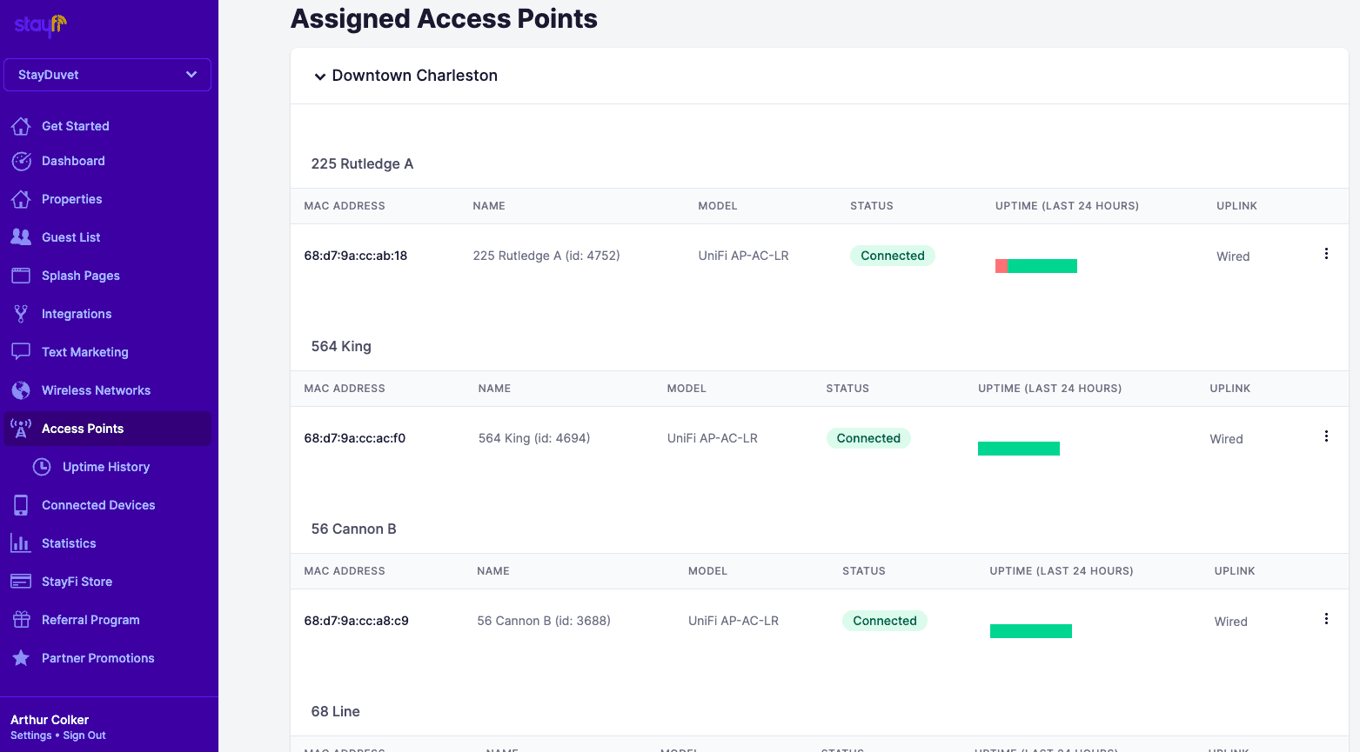

StayFi simplifies WiFi management

StayFi also reduces WiFi complaints from guests by making it easy to manage networks from one dashboard.

"I couldn't recommend StayFi more. The service removes so many barriers of frustrations for both our staff and guests. For other short term rental managers, just start taking notice of how many times you're answering questions and inquiries about your internet, and start aggregating the time that you're troubleshooting a particular how with these connectivity issues. If you want to simplify the process and grow rapidly, you need StayFi." - Quinn Foster, Managing Partner StayDuvet

Traction

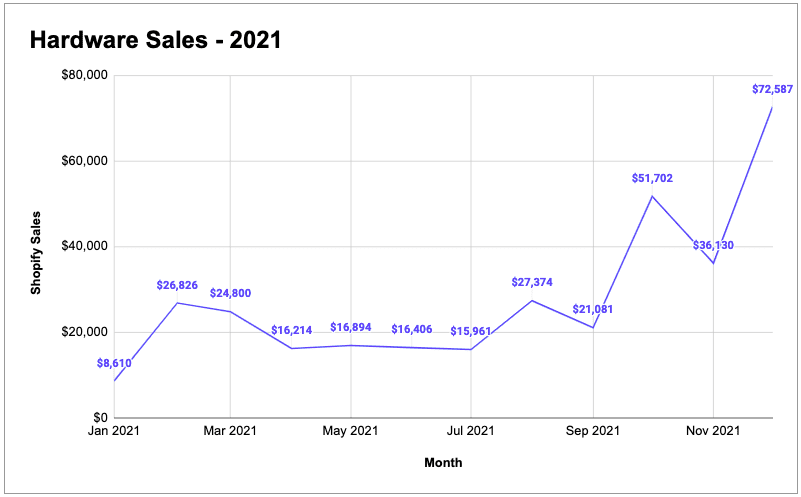

Captive WiFi is gaining traction

—

Hardware sales above $72K in December '21

—

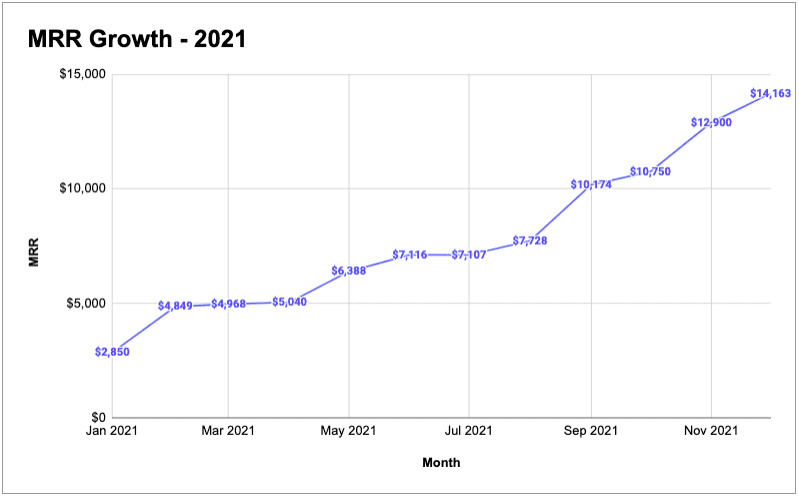

MRR growing 13% MoM in 2021

—

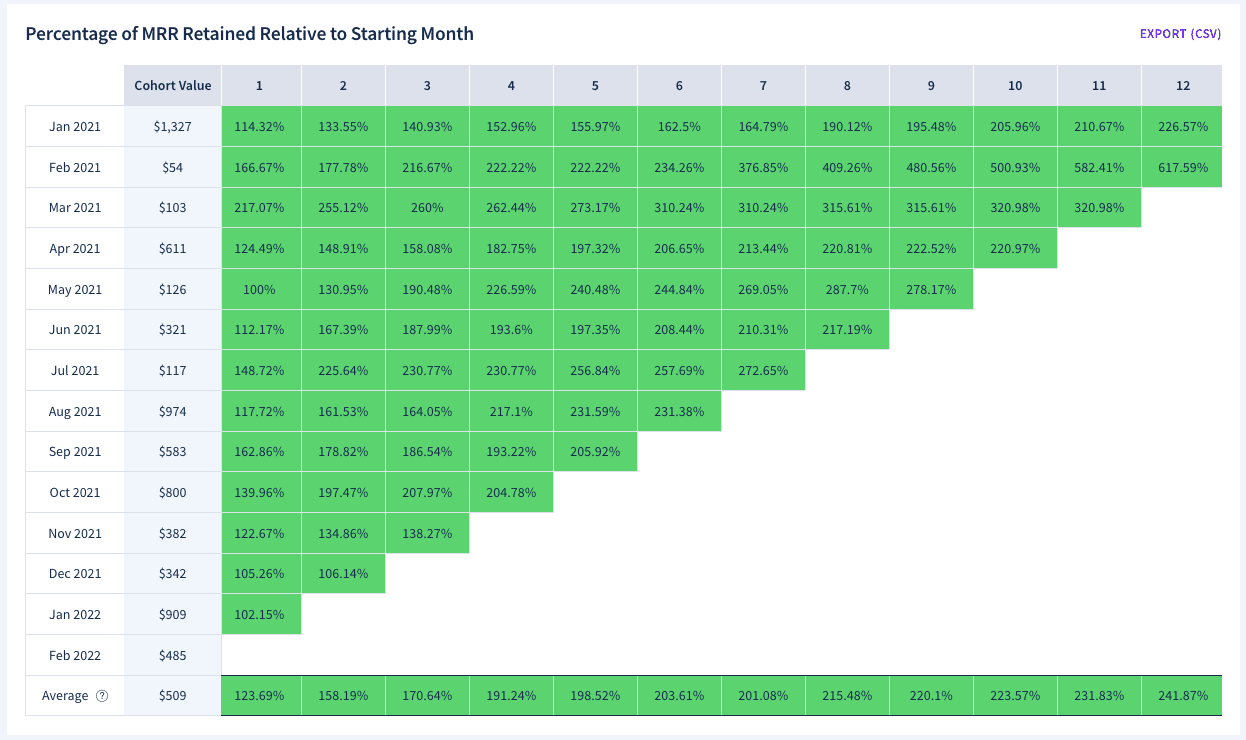

MRR from each cohort of customers grows 2-3x over 12 months as they add more properties to their StayFi accounts.

Our awards

Customers

Our customers base is sticky & growing

Customer Case Study

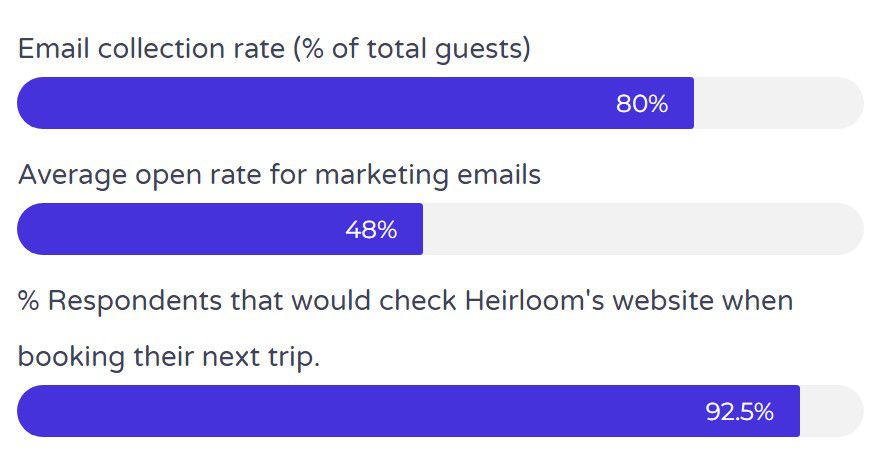

In partnership with our customer, Heirloom, we accessed their PMS data and surveyed their guests to measure the effectiveness of StayFi in the first six months of service.

- Installed StayFi in 40 homes

- Collected emails from 80% of guests (8,000)

- Generated $50,000 in direct bookings — saving $7,500 in OTA fees

—

Data from Survey of Heirloom Guests:

—

Business model

We sell WiFi hardware and charge a monthly fee to use it on our platform

—

Hardware

$100 average per device (15% margin)

—

Subscription

$3–$6 per month (85% margin)

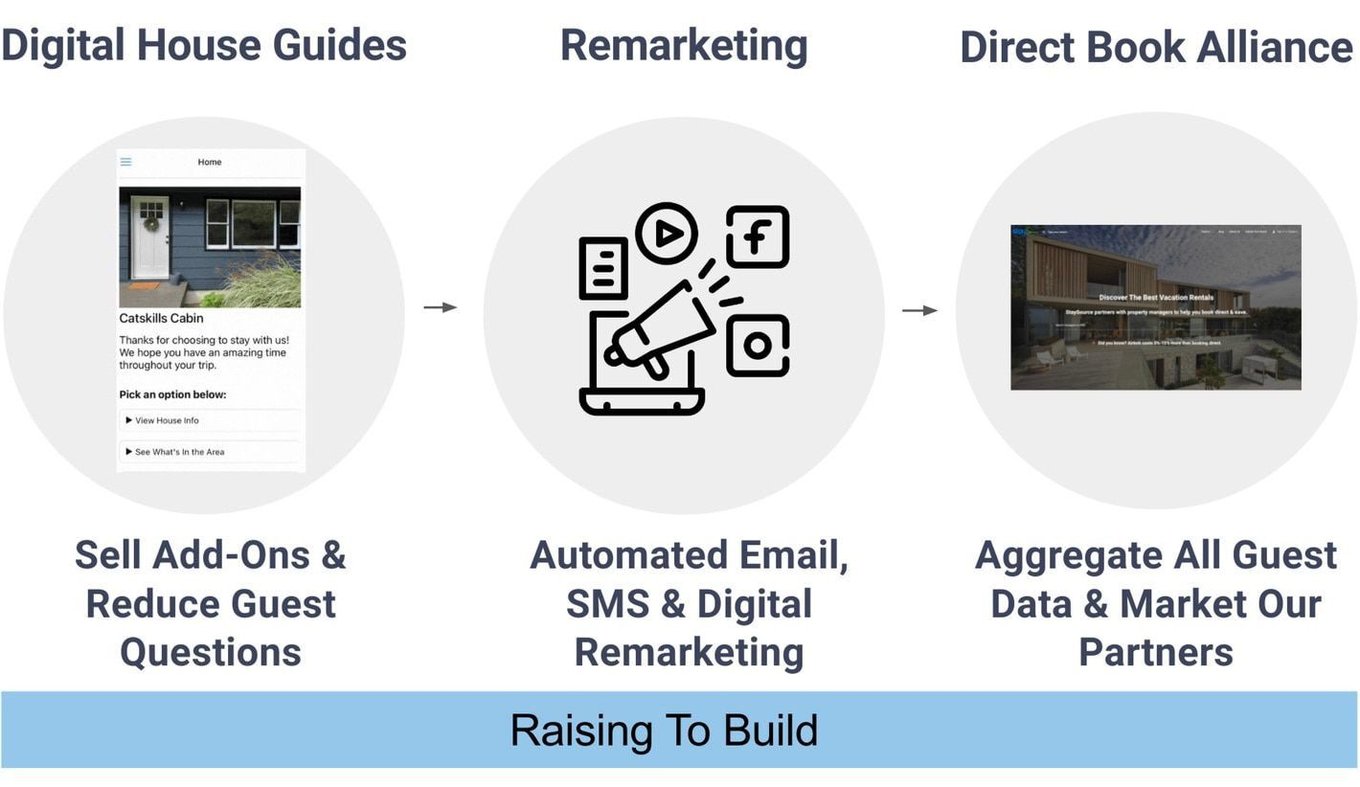

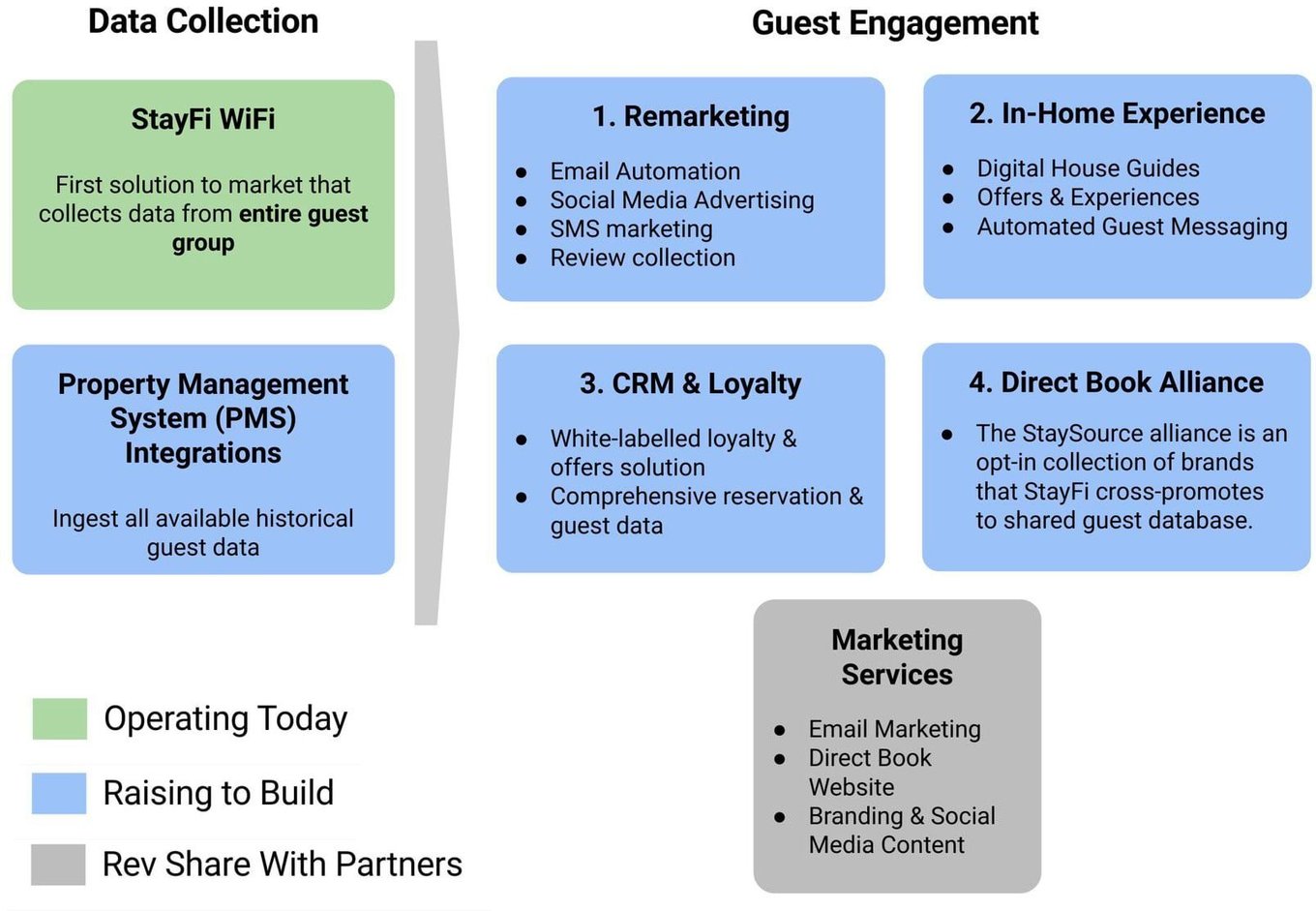

Product roadmap for 2022

StayFi WiFi is the best solution available to collect STR guest data. We will add incremental marketing, CRM, and integration features, increasing prices, stickiness, and growth.

—

SMS marketing & PMS integrations

Q1 2022

Add SMS marketing/review collection and add Property Management Software (PMS) integrations to pull in additional guest data.

—

Digital marketing & email automation

Q2 2022

Enable social media targeting and easy email automation directly through the StayFI platform.

—

Direct-book websites & digital guidebooks

Q3 2022

Incorporate direct-book website building & digital house guides from StayFi partners.

—

White-labeled loyalty & StaySource

Q4 2022

Enable STRs to launch their own loyalty program and engage with their top guests through our CRM.

Market

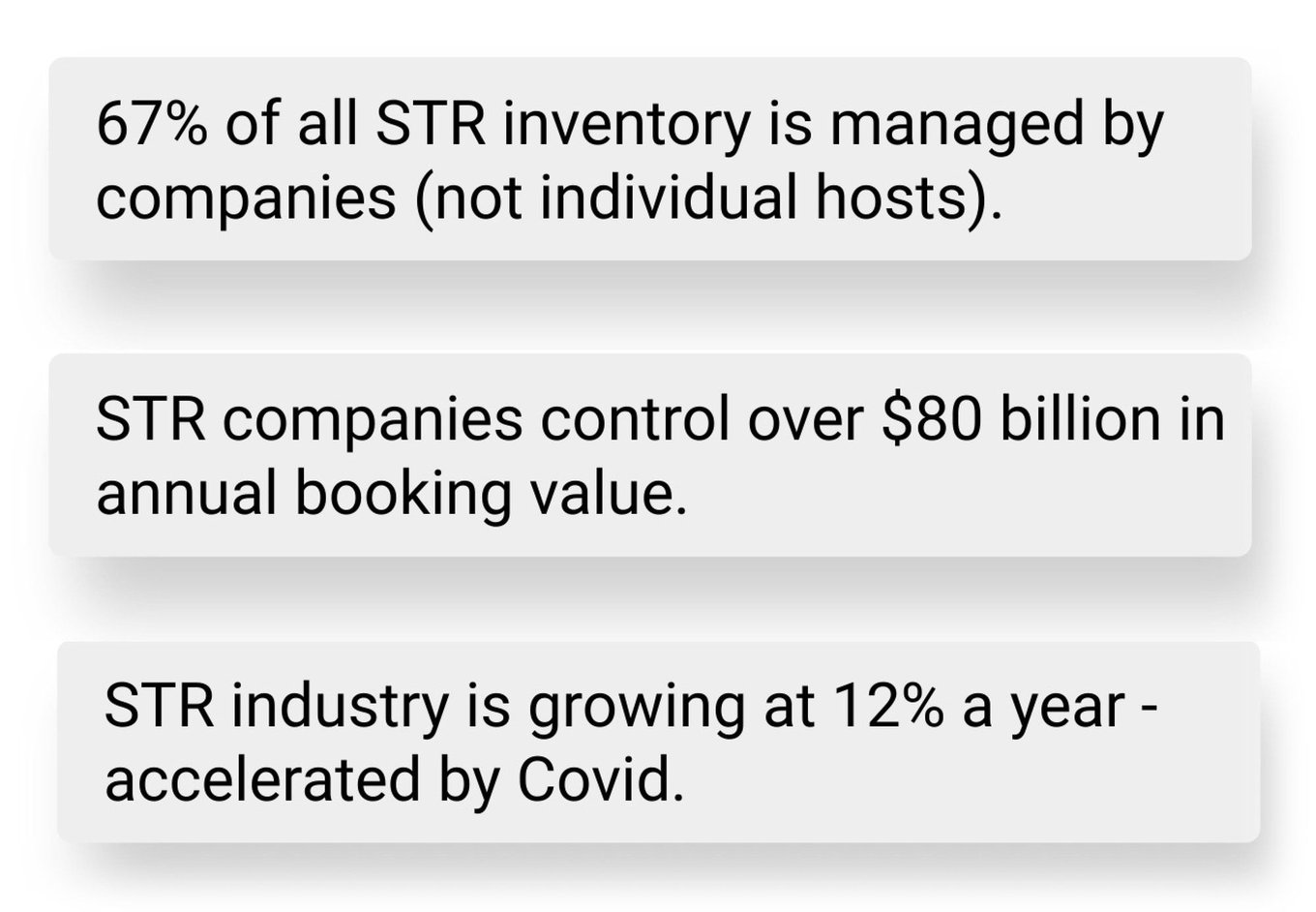

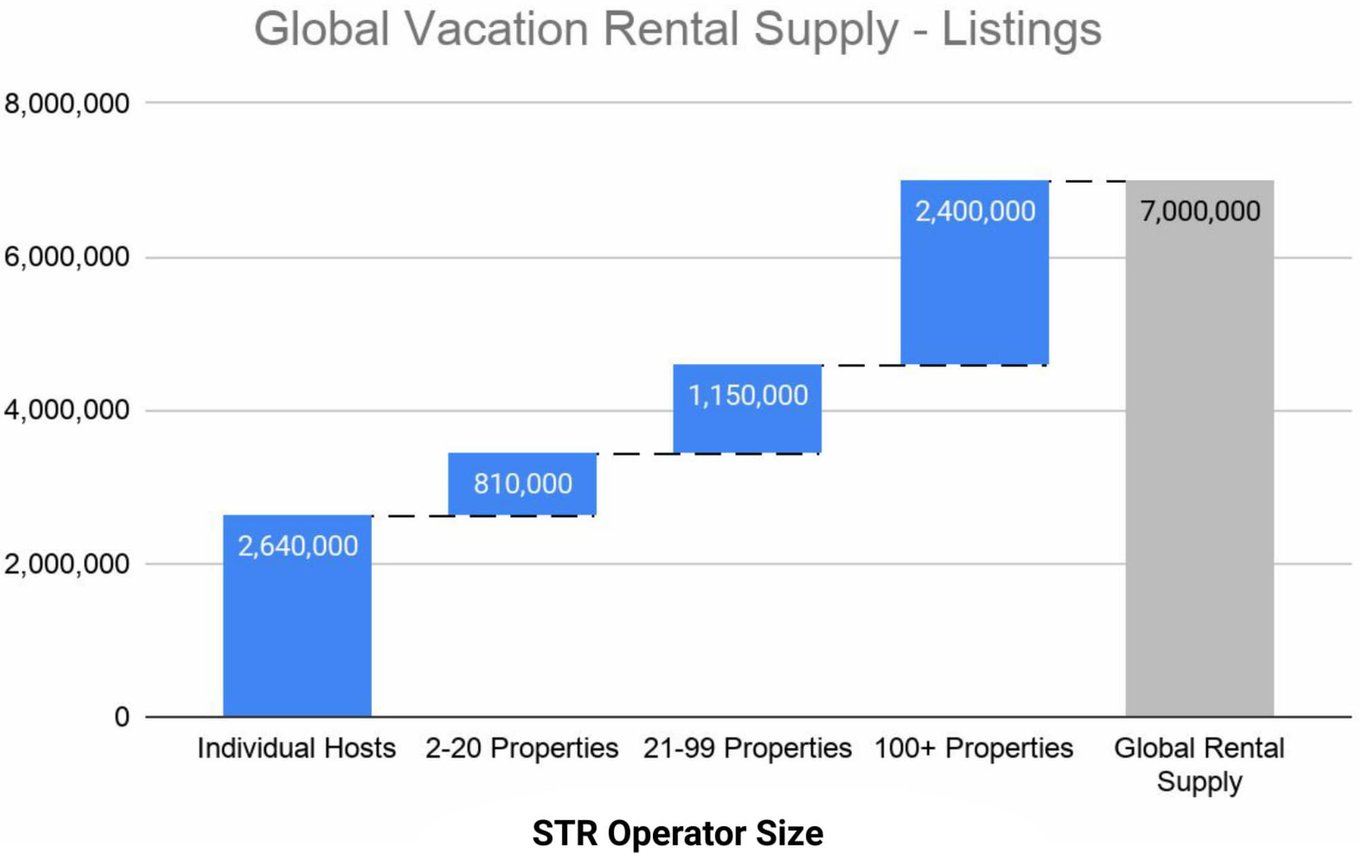

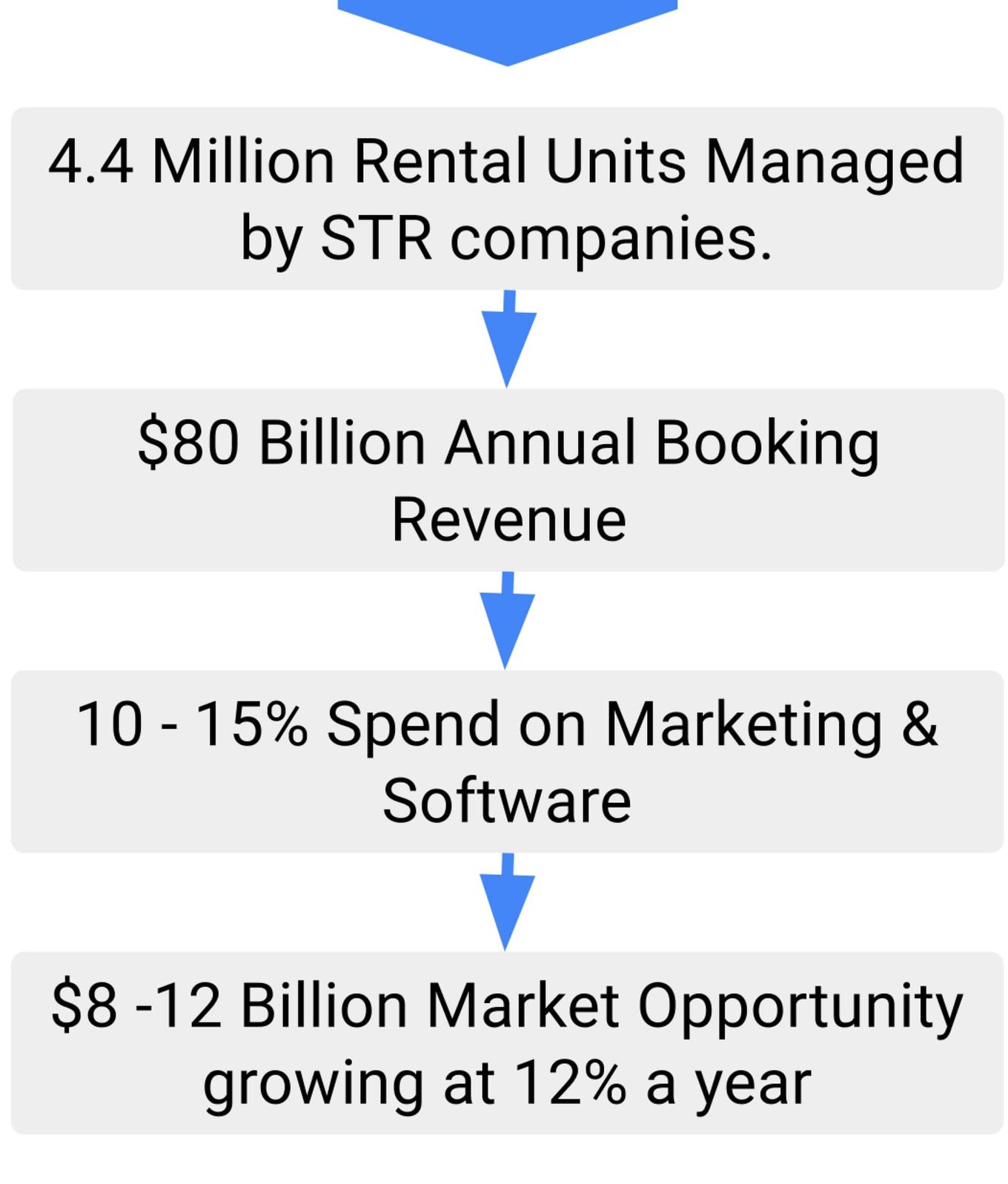

Short-term rental (STR) companies are booming

—

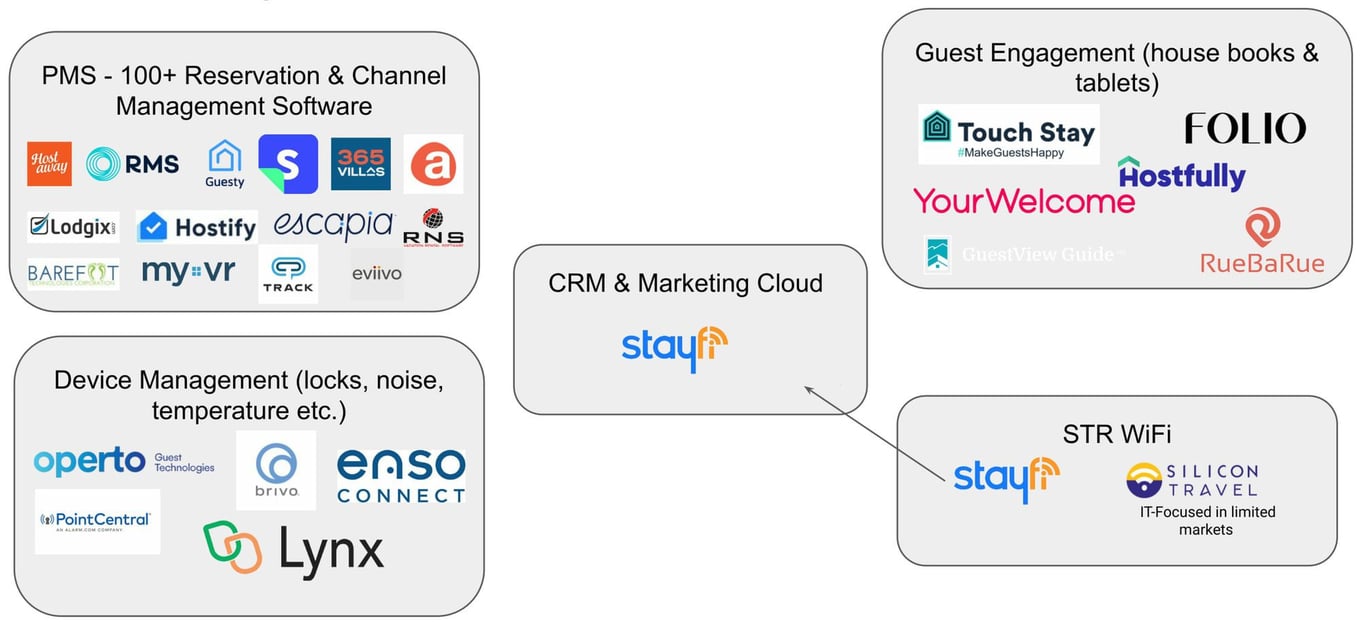

Competition

Market landscape

With access to the most 1st-party guest data, StayFi is uniquely positioned to create the brand marketing engine for STRs and connect with other data resources (PMS)—to provide the all-in-one direct marketing solution.

Vision and strategy

Our growth plan

Growing from $200K ARR to $1.0–1.5M+ ARR in 2022*

—

1. Hire VP of business development

Already hired Biz Dev VP from PriceLabs who started in Jan '22

—

2. PMS integrations

Completed OwnerRez integration (sending us 5-10 customers/months) and will integrate with 15+ PMS in 2022

—

3. Charge for new features

Upsell SMS, Email, Guestbook and other new features

—

4. Increase spend on digital marketing, conferences, and direct mail

Amplify successful tactics from 2021

* Click here for important information regarding Financial Projections which are not guaranteed.

Building guest engagement in 2022

Comprehensive STR guest engagement powered by StayFi's WiFi marketing tools.

Milestones

- $1.0M ARR in 12 months

- Integrations with major PMS

- New pricing tier for StayFi WiFi + CRM tools

- Biz Dev, Tech and CS teams built out

Allocation of funds

- 60% - Headcount (Engineers, Bis dev, Account management & fulfillments/CS)

- 15% - Marketing (sponsorships, digital ads, affiliate fees & content)

- 25% - Other

Funding

Bootstrapped until current funding round

In 2022, we have raised over $200k so far in our first round of external funding. Investors in our Seed Round include:

- Georgetown Angel Investor Network

- Founder & CEO of The Platinum Experience (Large Vacation Rental Company)

- Jonathan Wasserstrum's PropTech Seed Fund

StayFi is located at the Columbia University Startup Lab in New York City.

Founder

Arthur Colker

Founder & CEO

Former director of marketing @VestaHealthcare & @Hotelied

MBA, Columbia business school

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...