Problem

Outdated financial systems impact college athletics

The impact of bad credit & no credit |

|---|

Studies show that the difference between exceptional credit and poor credit can amount to nearly $400,000 over the course of a lifetime. |

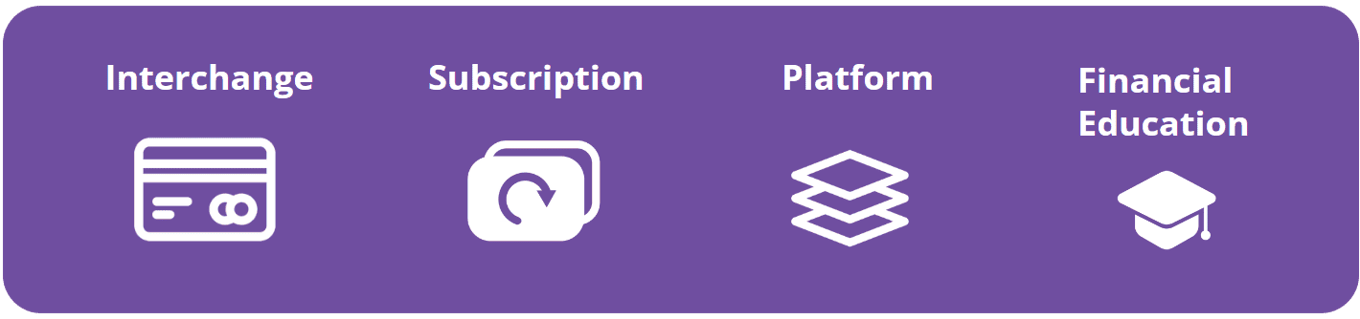

Solution

Tackling your team’s

financial challenges

Unique banking that helps student athletes

and athletic departments take control of spending

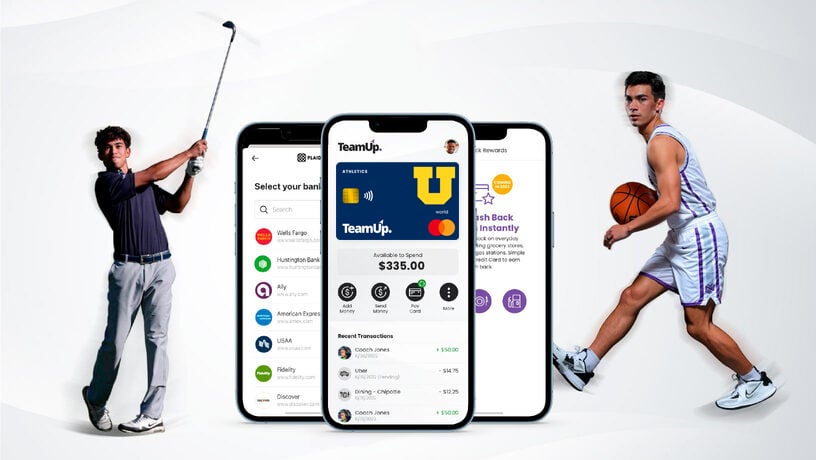

Product

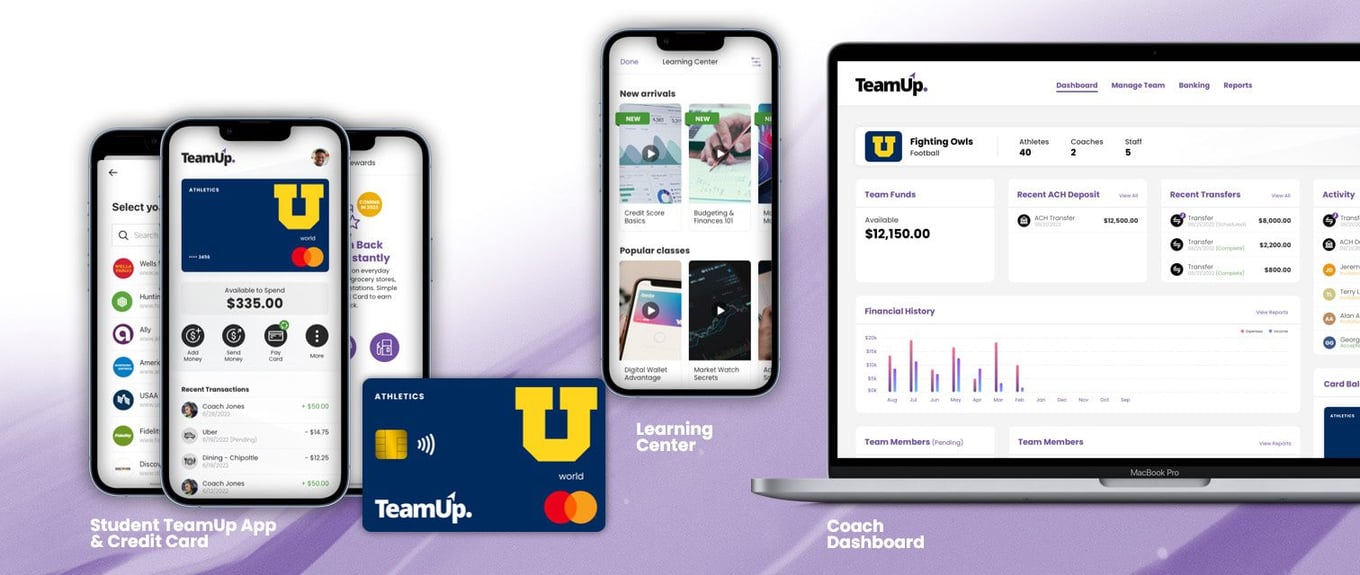

The TeamUp platform

Simplifying team budgeting and spending for students, coaches and athletic directors.

Educational learning center teaching financial literacy launching soon!

Our team-branded cards are both physical and digital, designed to simplify spending for students while helping build their credit scores.

- A debt-free credit card

- Build credit on everyday purchases

- No interest

- No credit check required

- Zero-liability protection from Mastercard

- Financial education lessons

—

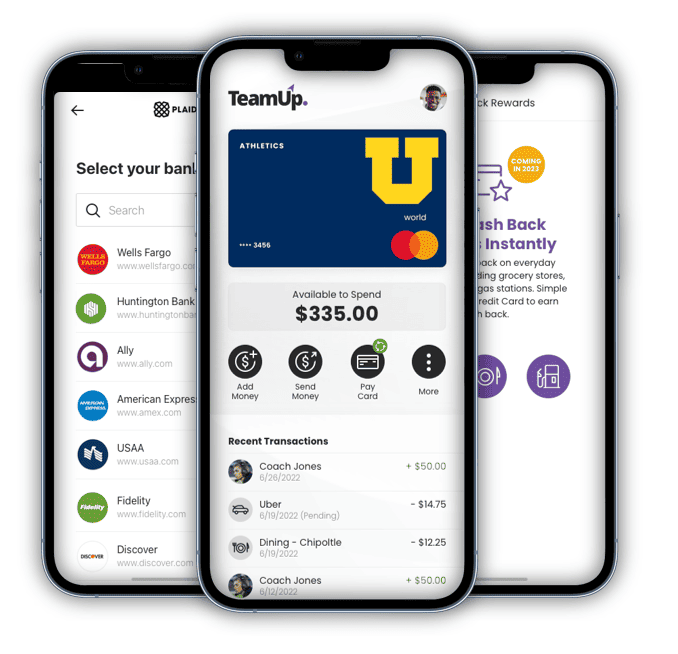

TeamUp

Mobile App

—

Helping your team WIN, on and off the field.

Helping your team WIN, on and off the field.

- Co-branded WIN Credit Builder Credit Card

- Autopay card balance with SurePay™

- Digital wallet with Apple Pay and Google Pay

- Connect bank accounts

- Rewards (coming soon)

—

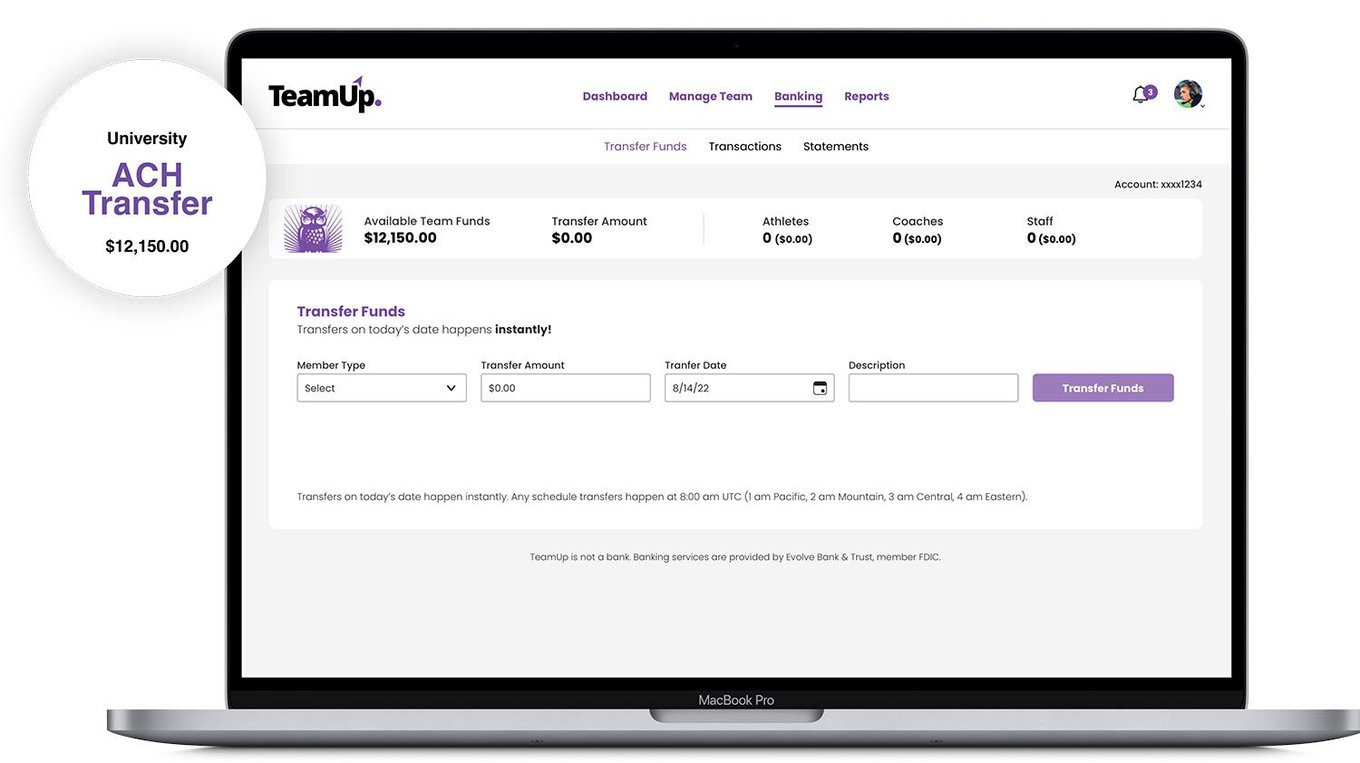

Easy Fund Transfers

—

It’s easy to transfer funds digitally — in bulk, or to an individual team member.

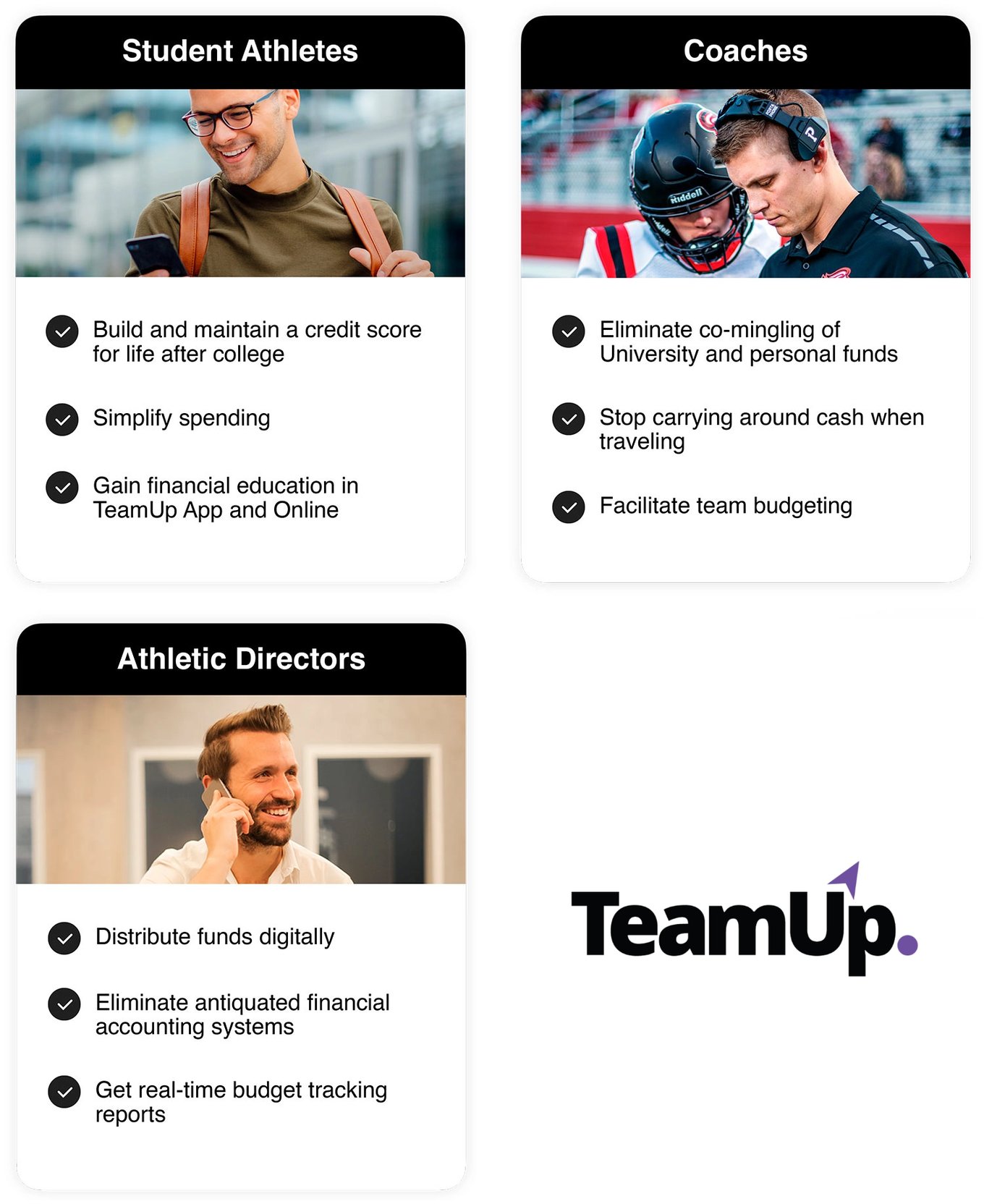

Customers

Unique marketing

channels for

user acquisition

Business model

Multi-layered

monetization

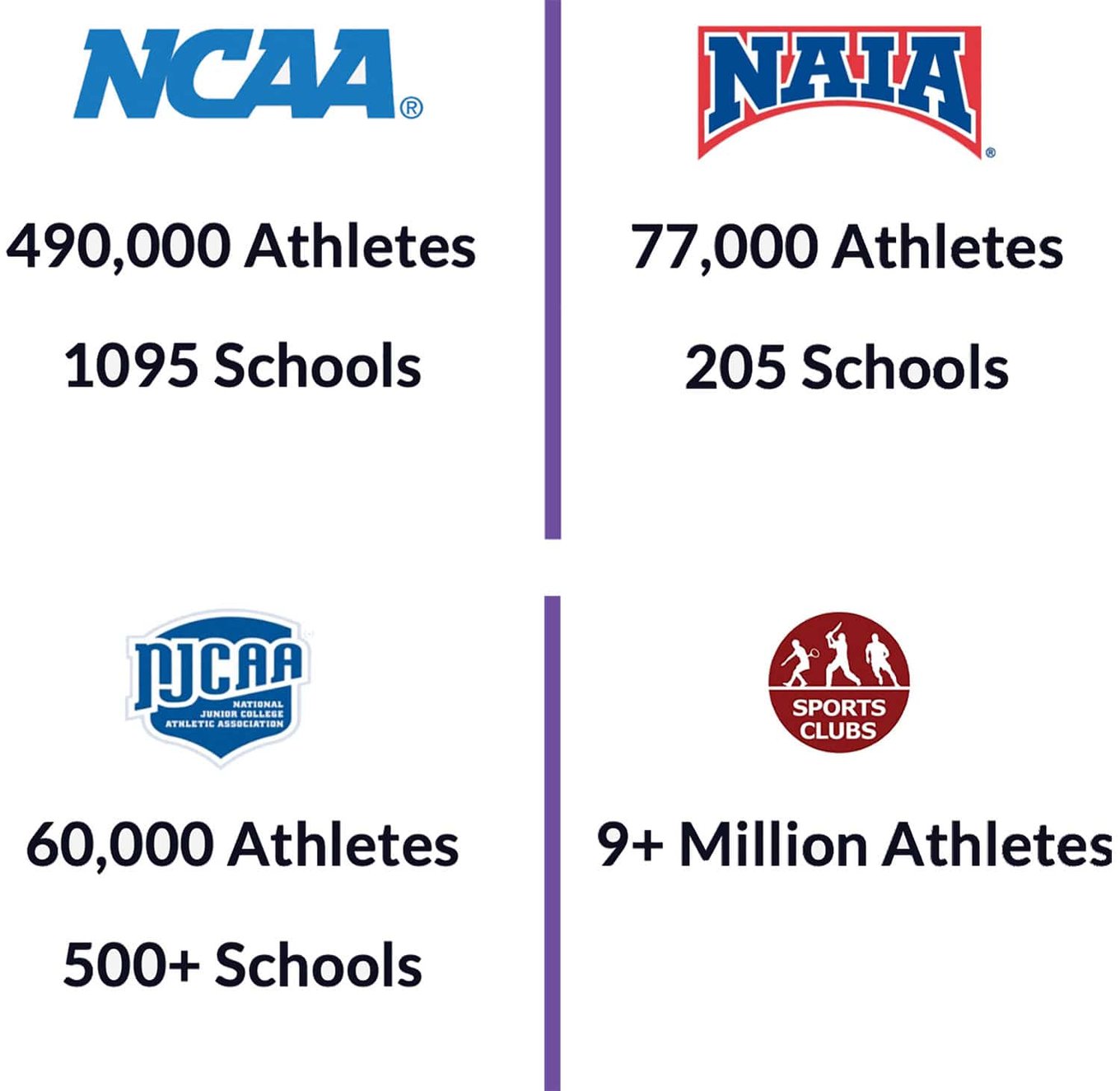

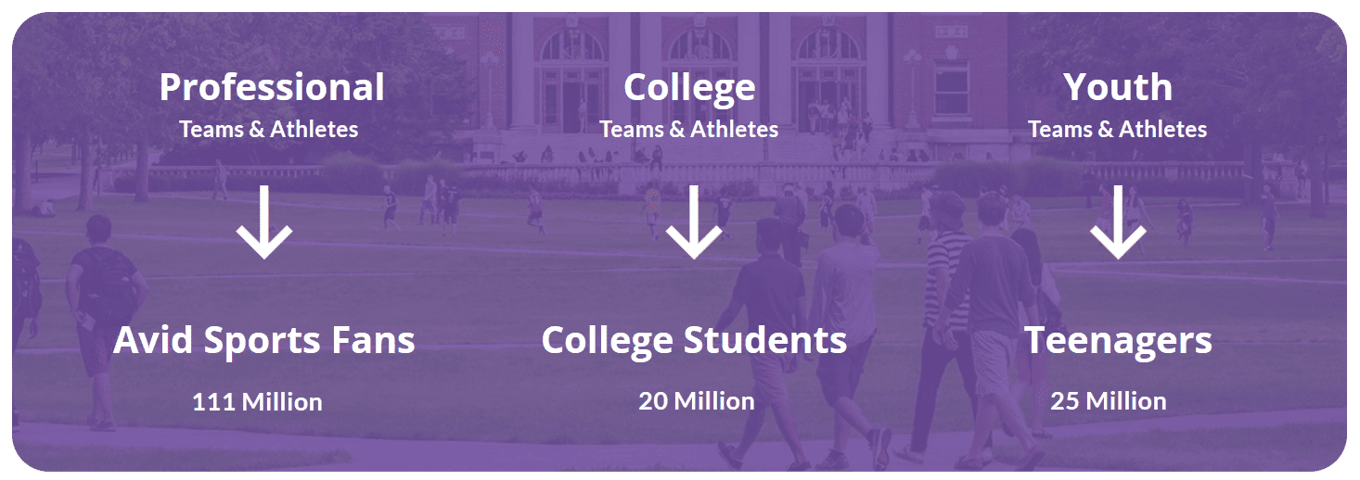

Market

TeamUp is addressing a robust college

athletics market

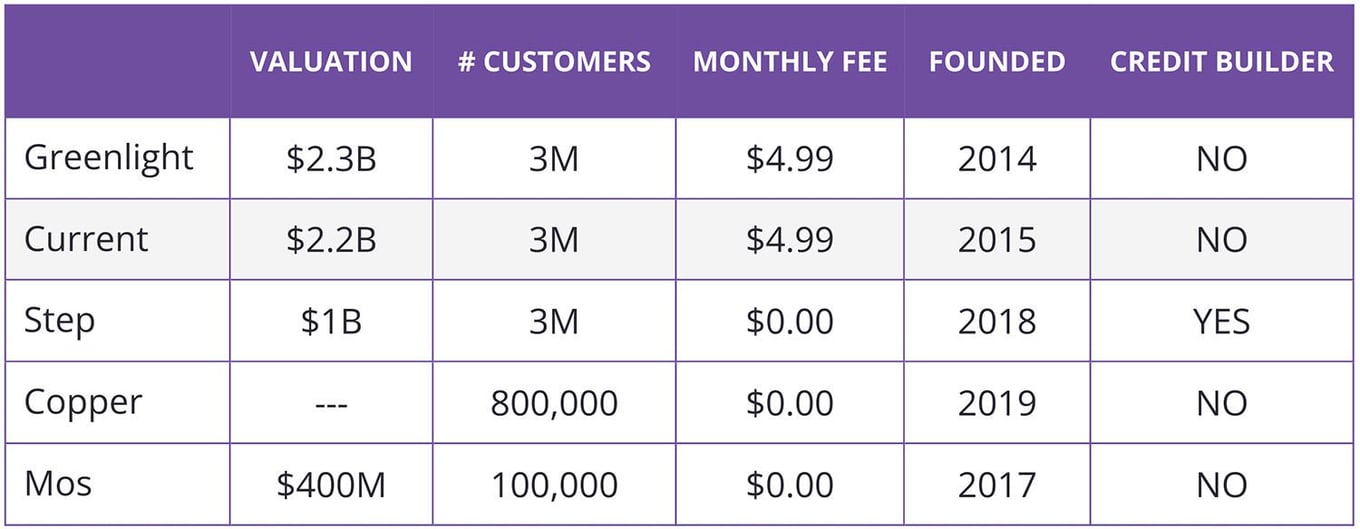

Competition

Limited existing banking options for teens

Additional Competitors: Redcard Athletics, Athlete+, PlayersHealth.com, Zelle, Cash, Pre‐paid Debit cards, and Checks

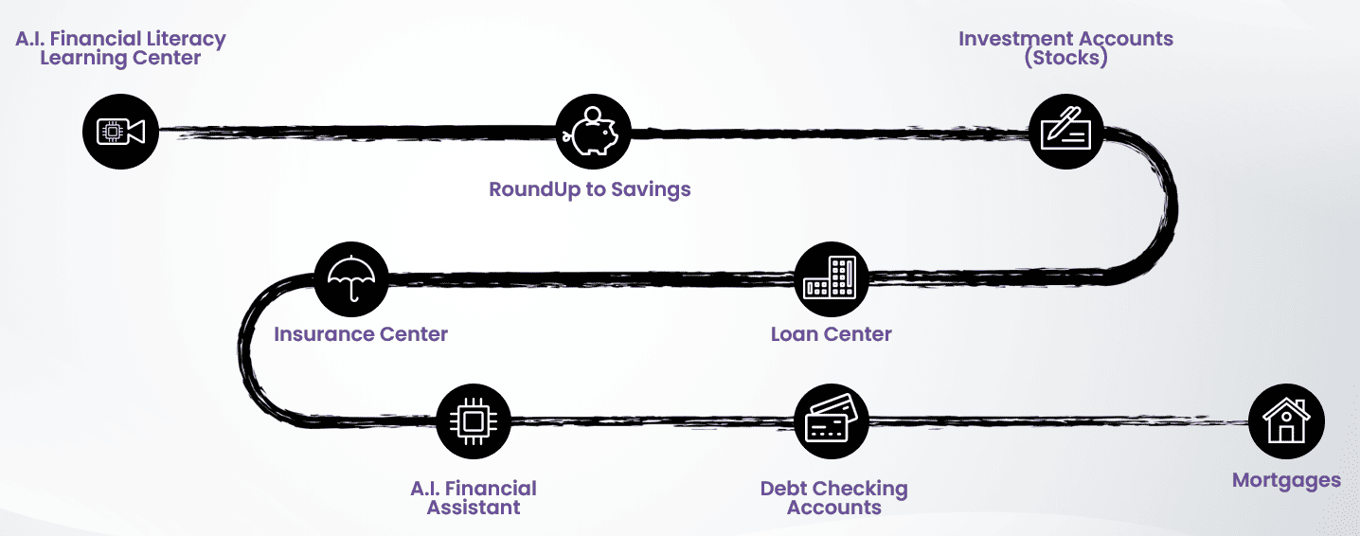

Vision and strategy

TeamUp Product

Roadmap

Founders

Alan Akina,

Founder & CEO

101 Financial

- Built one of the largest financial education companies in the US

- 20 years teaching personal finance across the country

- Host of KHON2 News "Financial Fitness Report" for 10 years

- Best-selling author

Alan's kids

Ambassador Team

Summary

TeamUp for success

Helping your team WIN on and off the field

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...