PRESSWIRE] Denmark - 25.05.2023 -- DigiShares has announced support for Fireblocks' highly secure self-custodied wallet i...

Opportunity

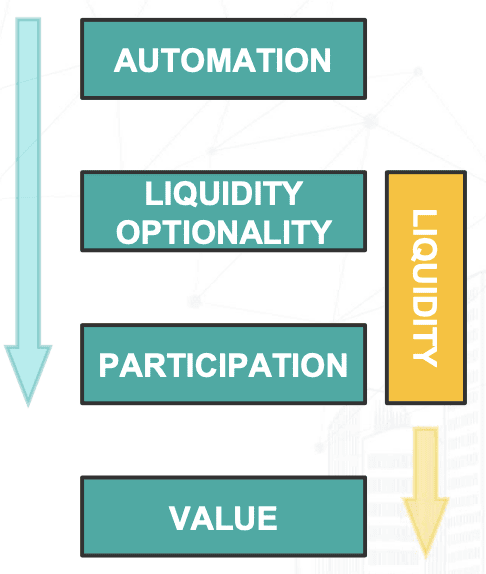

Blockchain technology is changing the way real-world asset shares are bought & sold

The archaic infrastructure of private markets destroys value

- Today, buying and selling shares in private shares (such as real estate) is a slow, complex, and inefficient process with intermediaries

- There is no infrastructure to trade easily, so minimum investment requirements are high and investors are generally locked into their positions for years. This is called "illiquidity."

- Therefore, retail investors have low exposure. Institutions also limit their investments because of the risk that not being able to trade entails where institutions, such as pension funds and insurers, have cash obligations they must meet

- Illiquid assets trade at approximately a 20% lower valuation than identical liquid assets, meaning trillions of dollars of value are destroyed in the real estate market and beyond, simply because there is no adequate trading infrastructure!

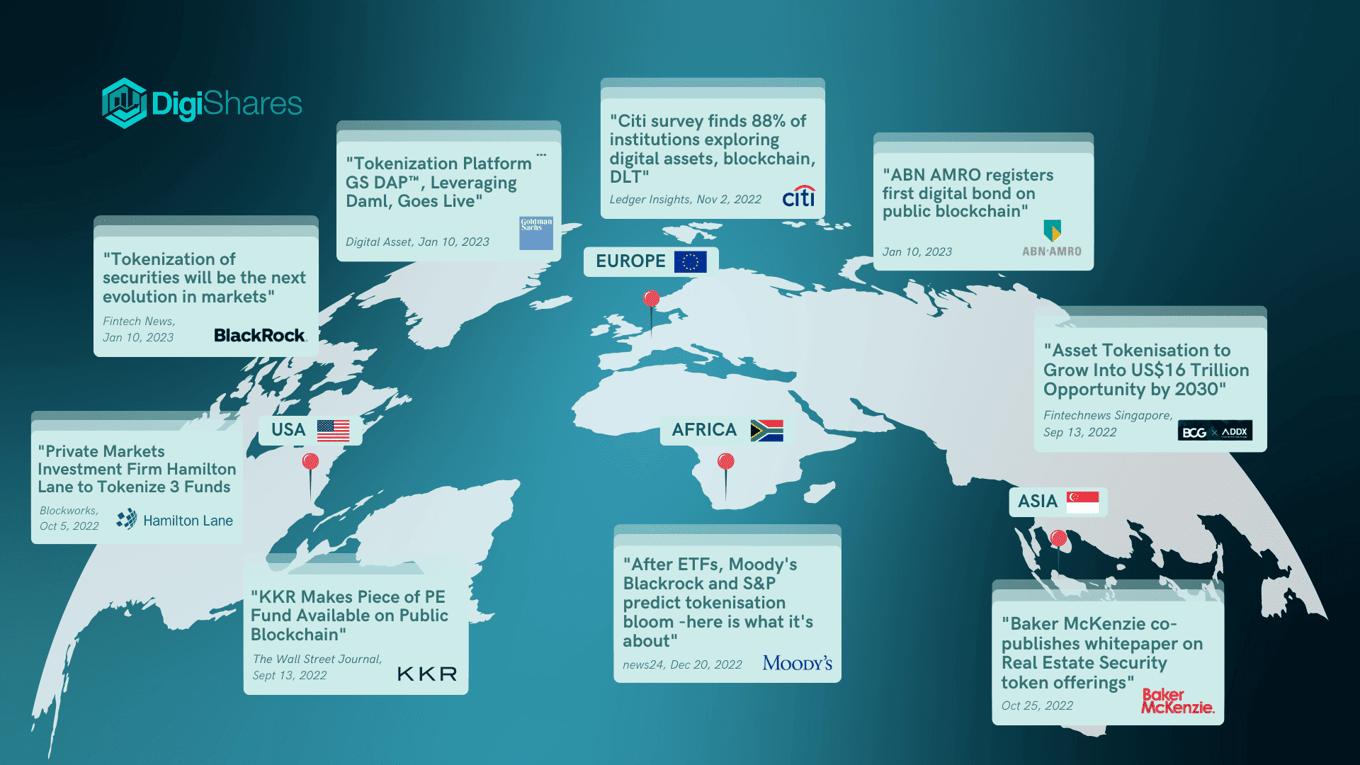

The automations enabled by blockchain & smart contracts are the key to bringing liquidity and value to real-world assets

- Smart contracts enable private entity shares (in the form of security tokens) are to be bought and sold without the need for most intermediaries

- Investors from around the world can easily trade on blockchain-based exchanges, in a compliant way

- Retail investors can access a market from which they were previously excluded; institutional investors can increase their allocation to real estate assets as their risk is reduced

- Trillions of dollars in value can be created!

BlackRock CEO Larry Fink said that, "the next generation for markets will be tokenization of securities."

Citi & BCG project respectively $4T & $16T in assets tokenized by 2030.

Real estate is the world's largest asset class at $326T in value, and is one of the most illiquid markets in the world. It has been our focus for the past few years, alongside many clients tokenizing other types of real-world assets.

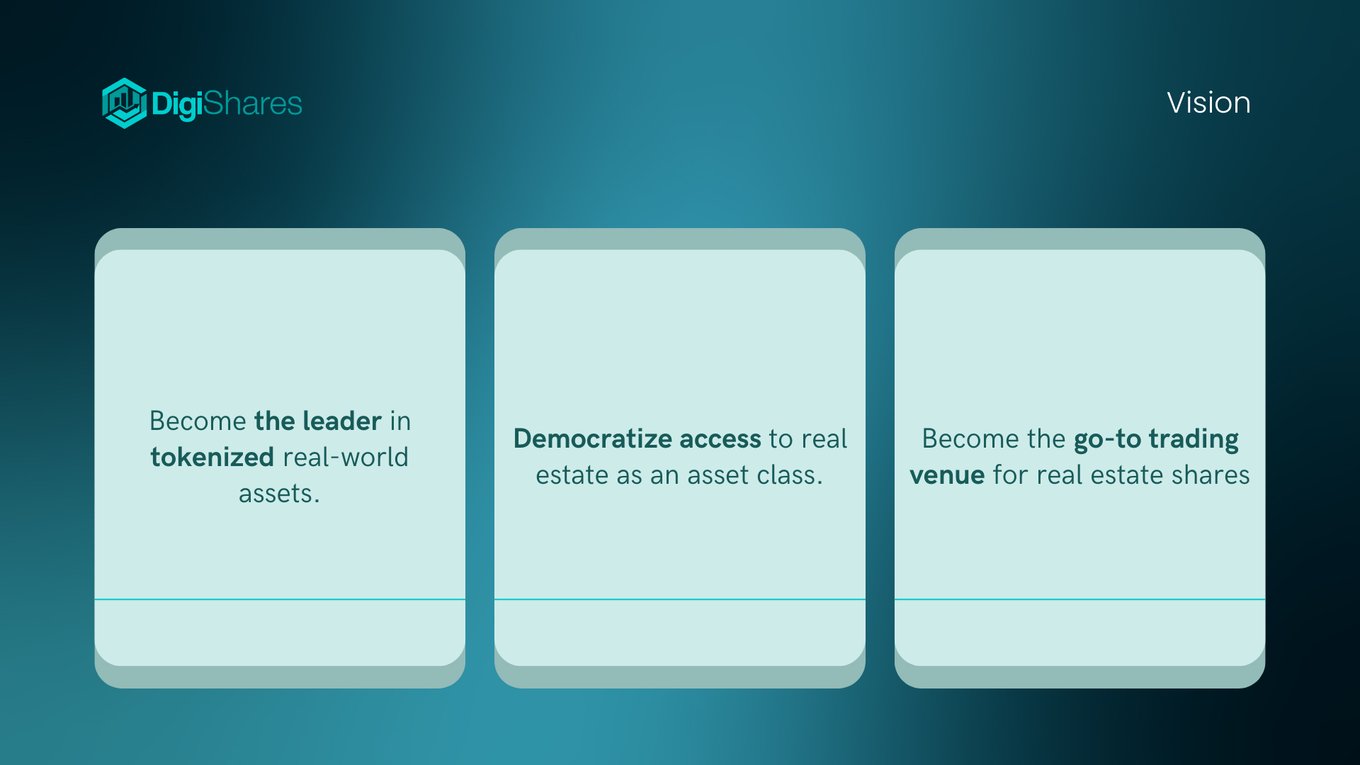

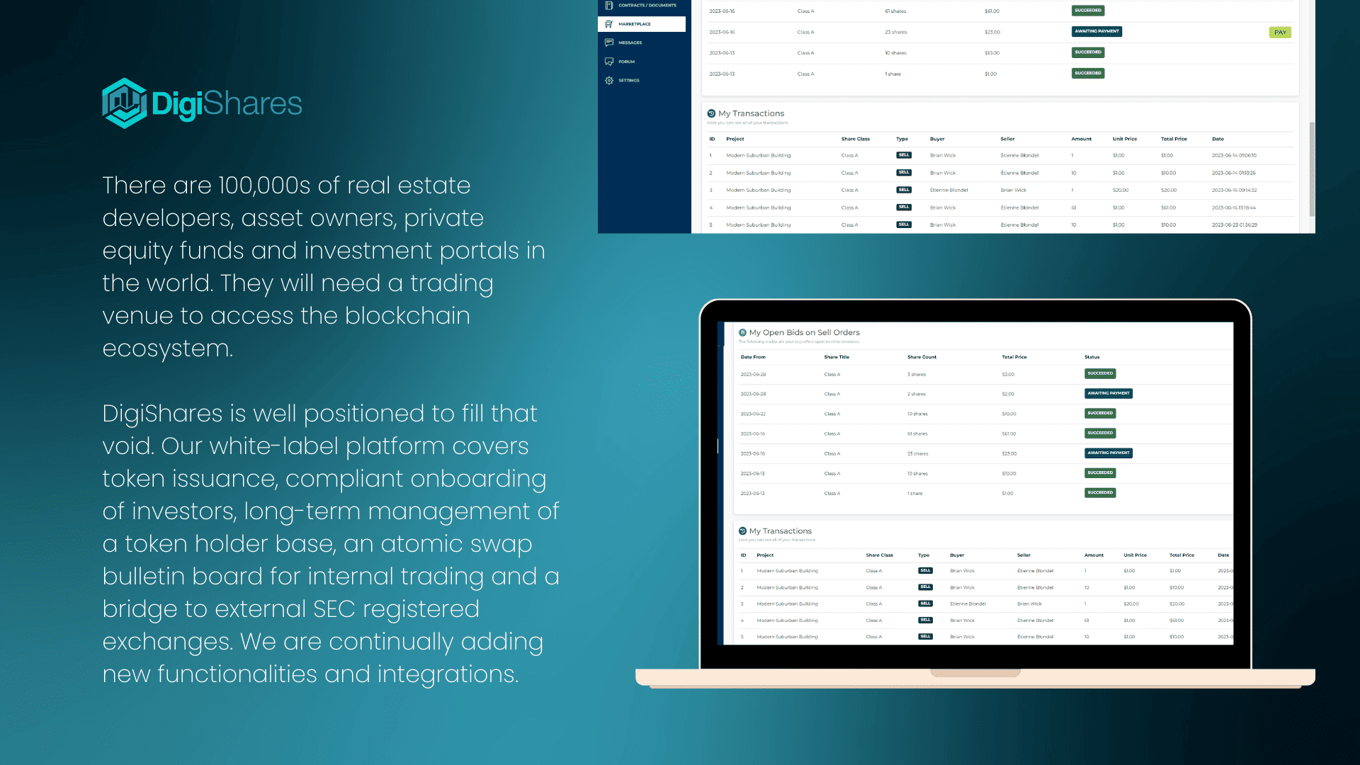

Just as Shopify is the go-to platform for businesses wanting to sell products on the internet, DigiShares aims to become the go-to platform for businesses wanting to sell shares on the internet.

With RealEstate.Exchange, we also aim to build the go-to exchange for real estate shares.

Product

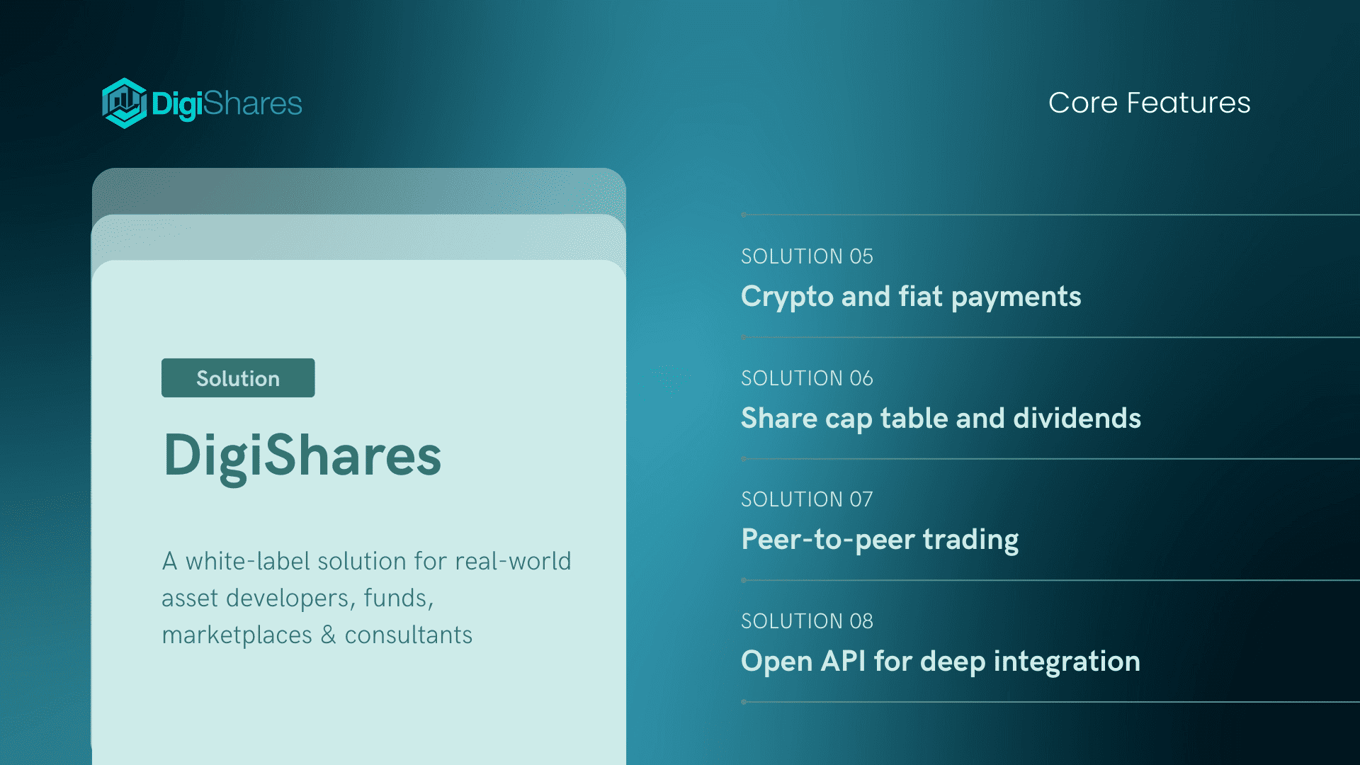

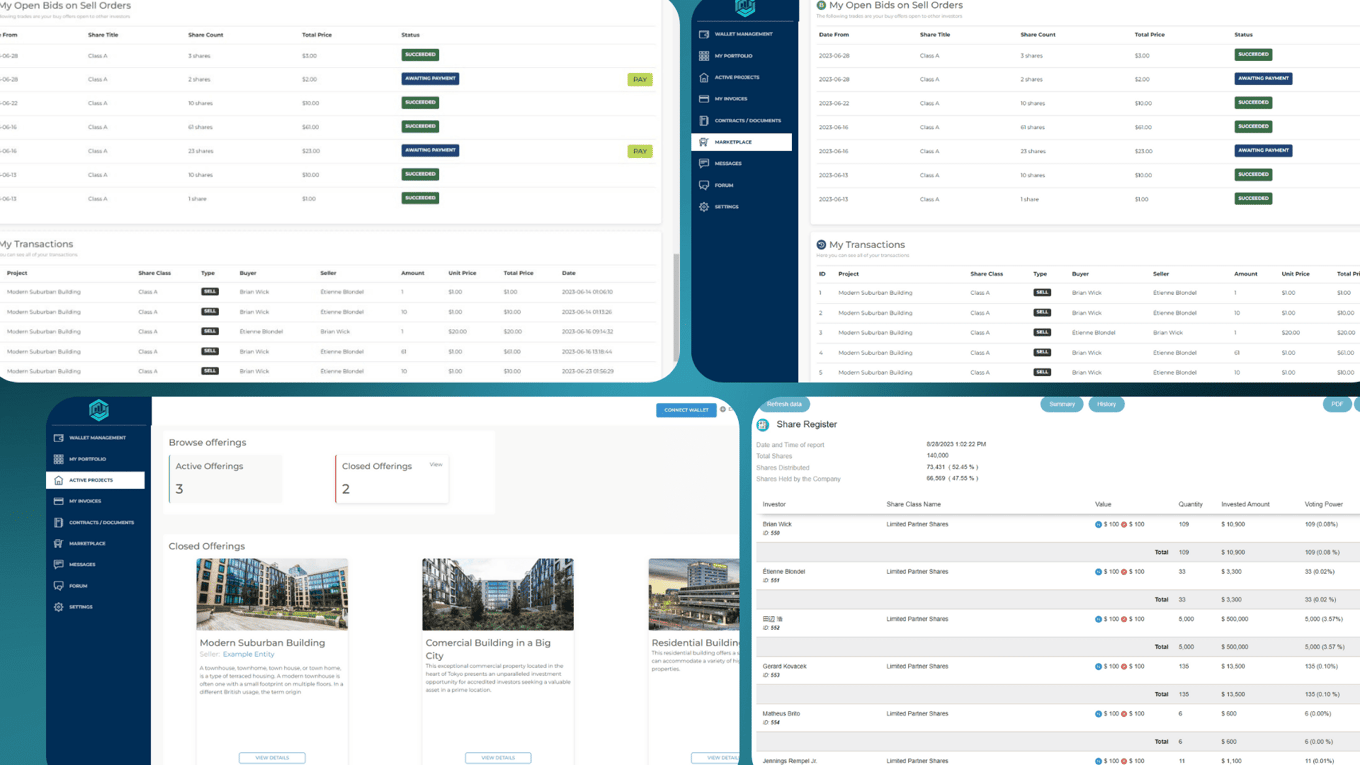

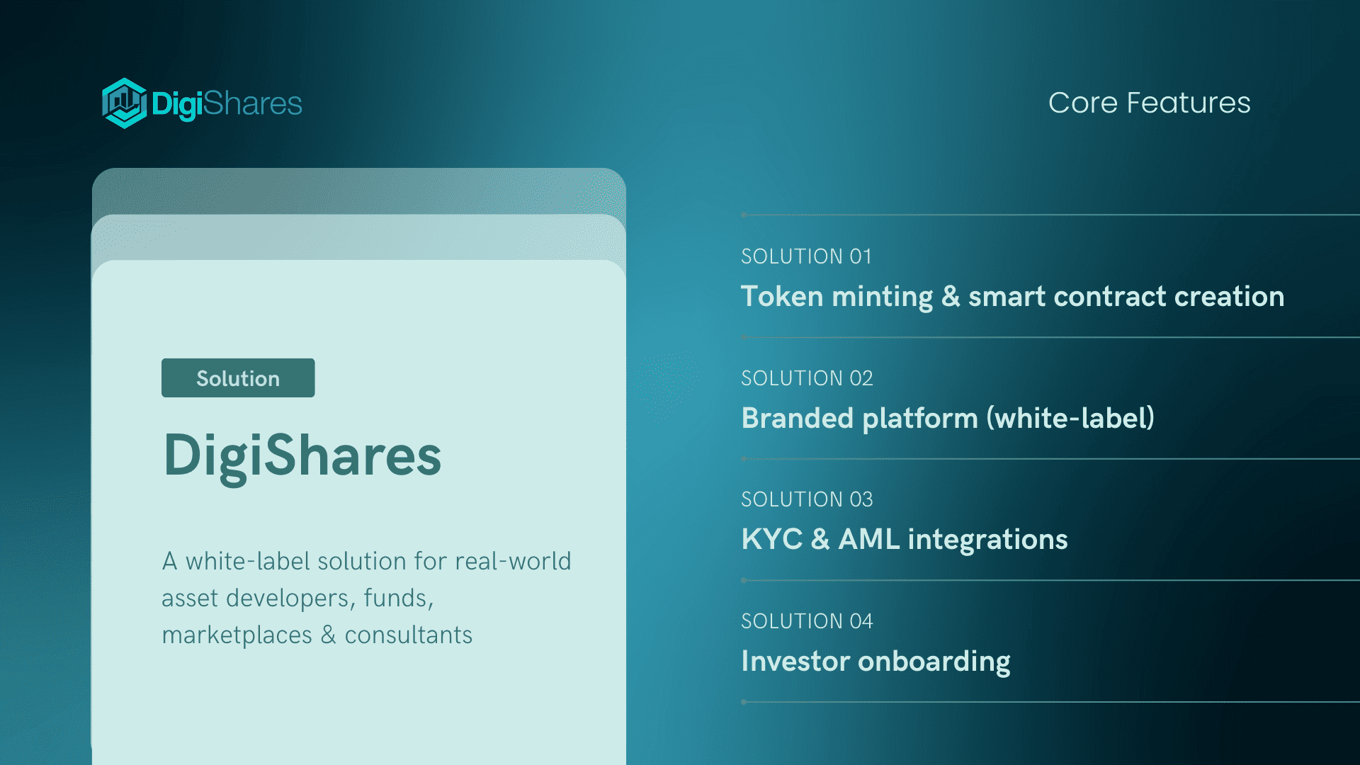

A white-label solution for real-world asset developers, funds, marketplaces & consultants

—

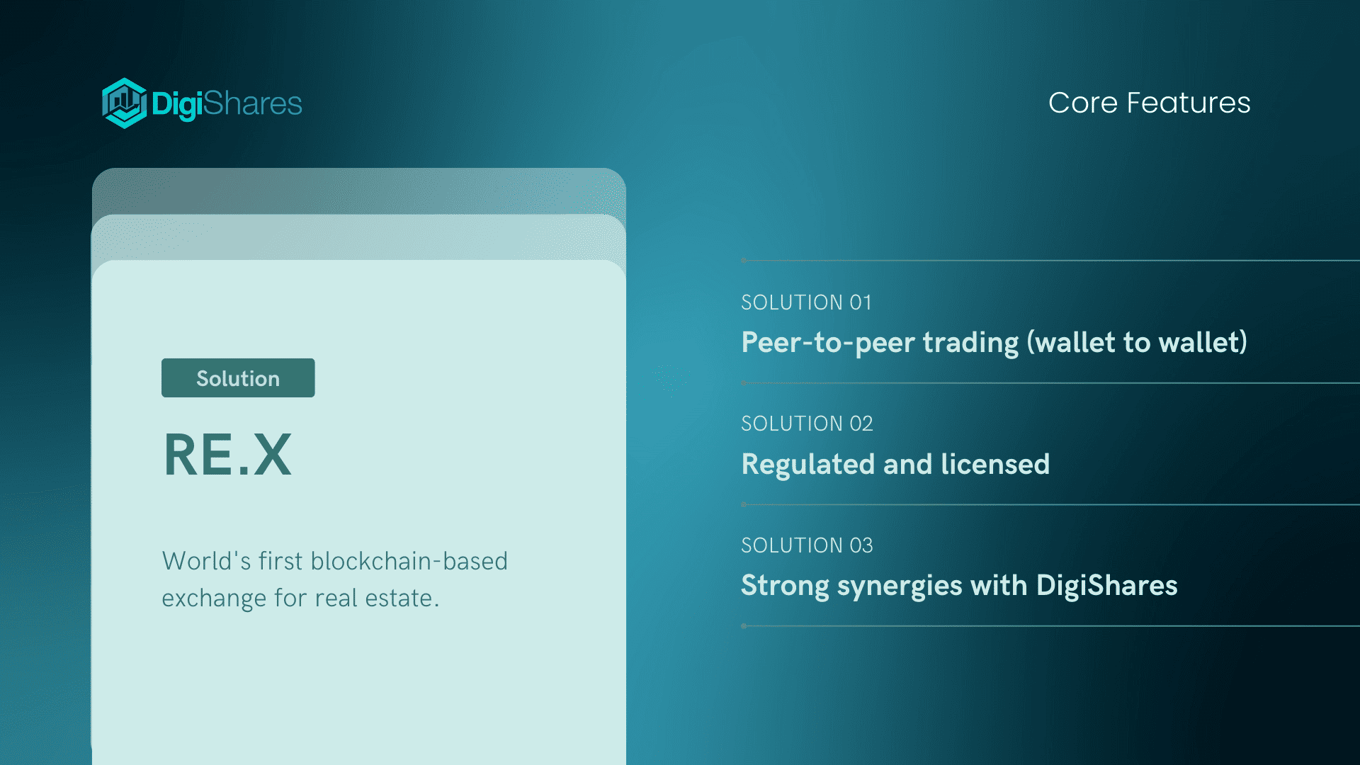

RealEstate.Exchange

—

Licenses | Phases of the Exchange |

|

|

Asset Pipeline | Synergies with DigiShares |

|

|

—

DeFi Solution

—

Decentralized Exchange (DEX) | DeFi Lending |

|

|

—

Benefits

—

Real-World Asset Developers | Individual Investors |

|

|

Traction

DigiShares is a global market leader

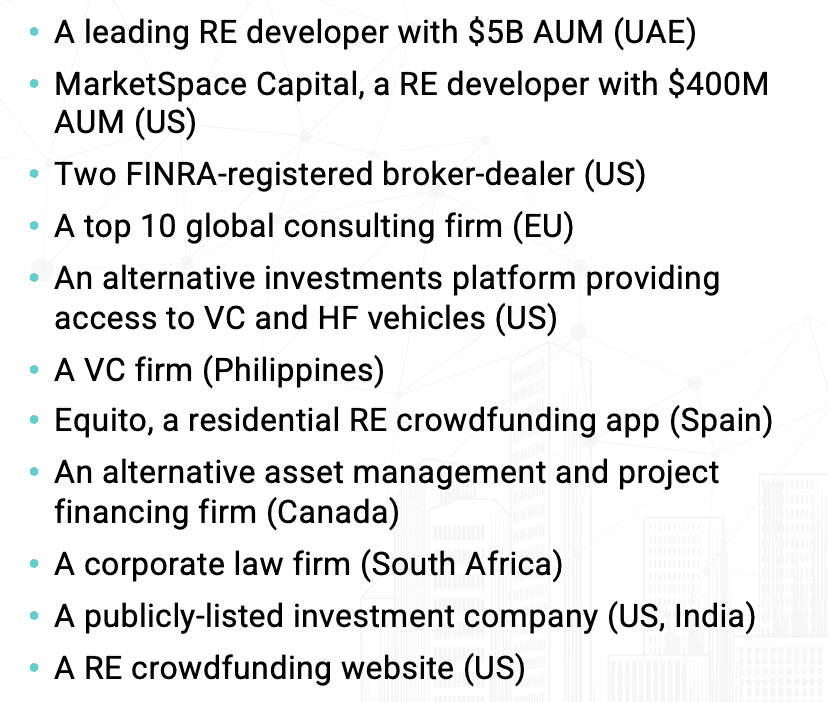

- Existing clients: 150+ with 40 in the US

- Pipeline: 5-10 new clients monthly

- Licenses: In process to become the first FINRA-registered Funding Portal for Security Token Offerings. Registered as a Transfer Agent in the US.

- Exchange: First to launch a global retail-oriented blockchain-based real estate exchange. DigiShares has partnered with Texture Capital, a FINRA-registered Broker-Dealer & Alternative Trading System to launch RE.X in the US compliantly. DigiShares will apply for a securities dealer license in the EU to run RE.X outside the US.

—

Selected clients:

—

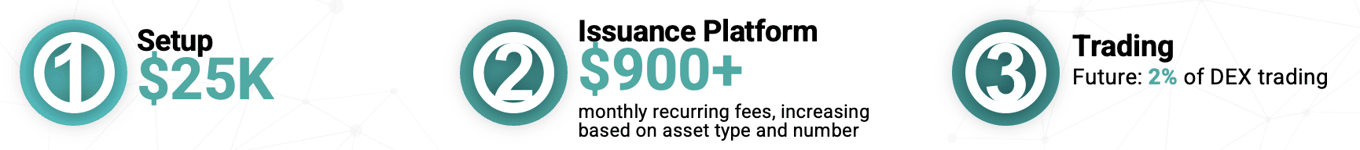

Business model

Three main revenue sources

Vision and strategy

Through an integrated marketing strategy...

Digital Tactics | Offline Tactics |

|---|---|

Online

| Sales & Account Management

|

Paid Search & SEO

| Events and Conferences

|

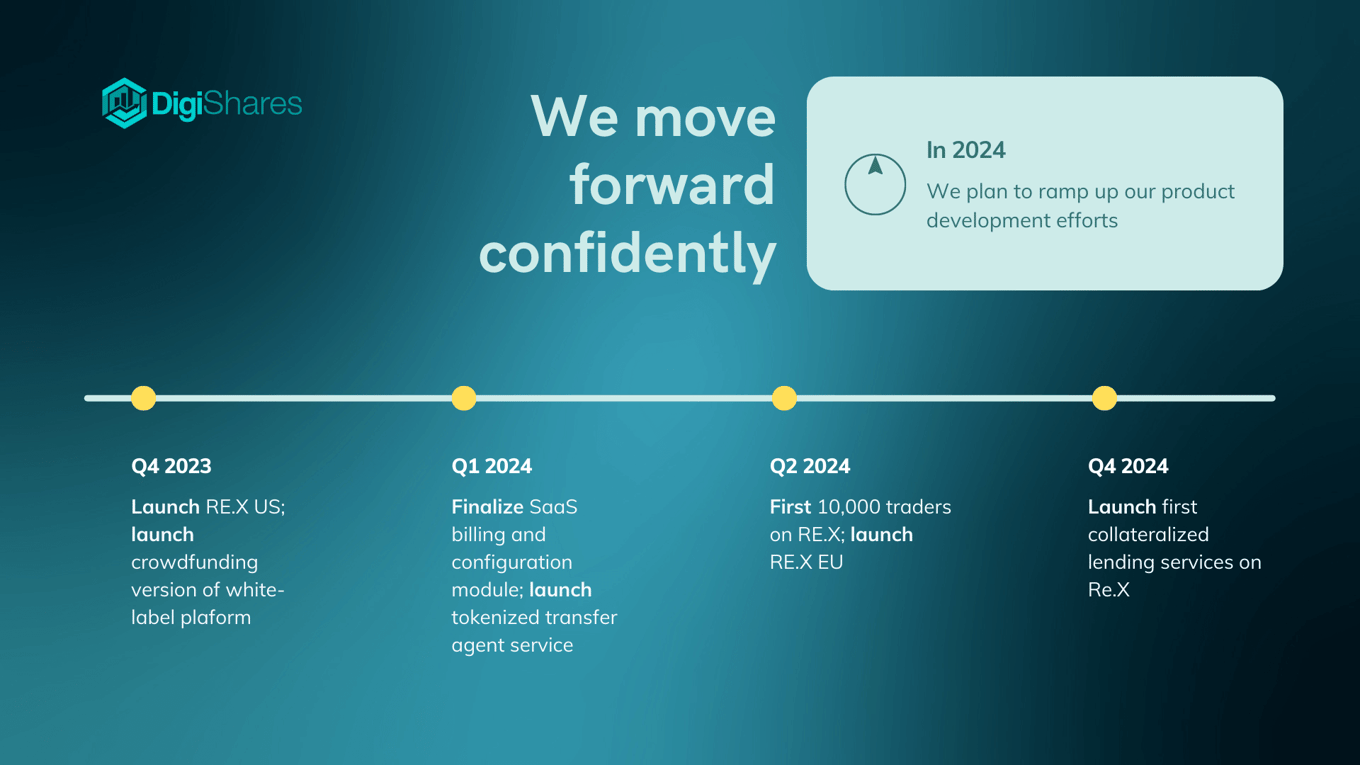

...and a timeline for product development ramp-up

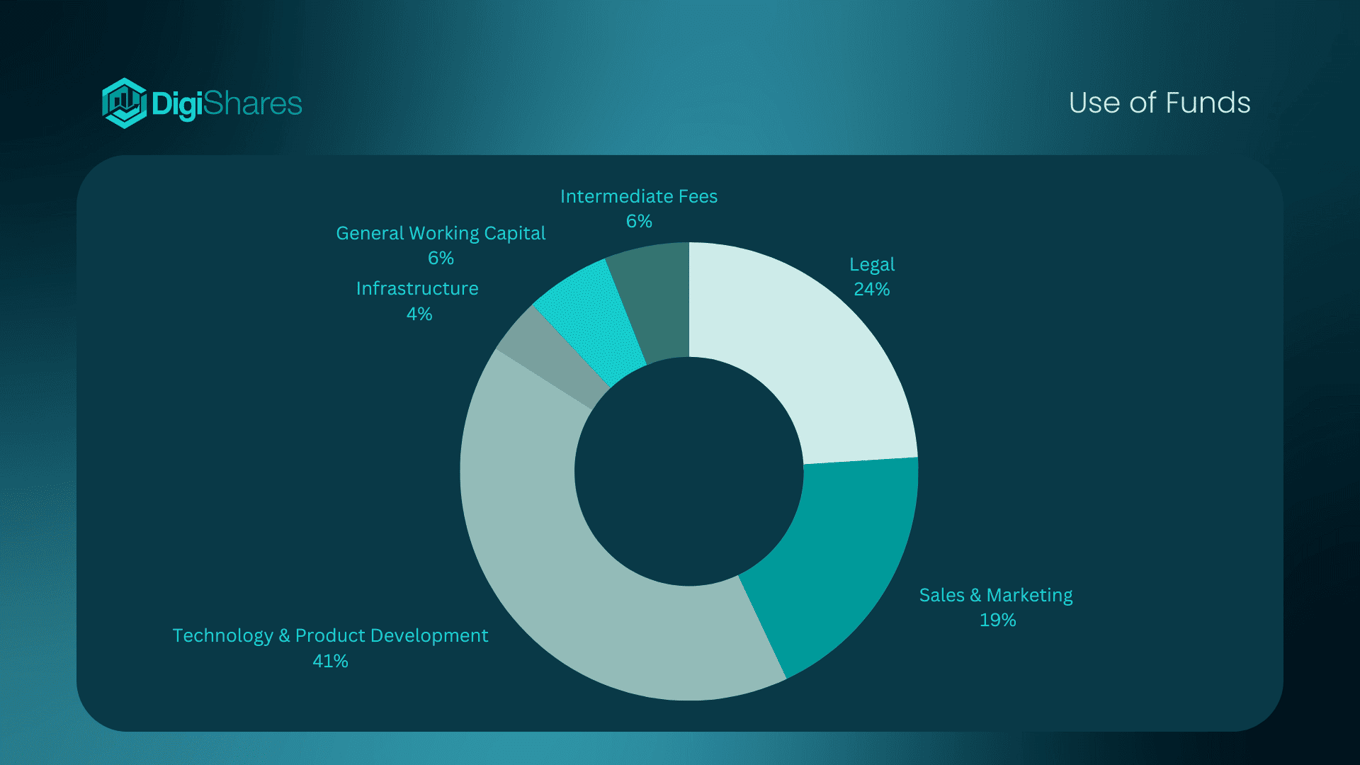

Funding

$2M raised to date

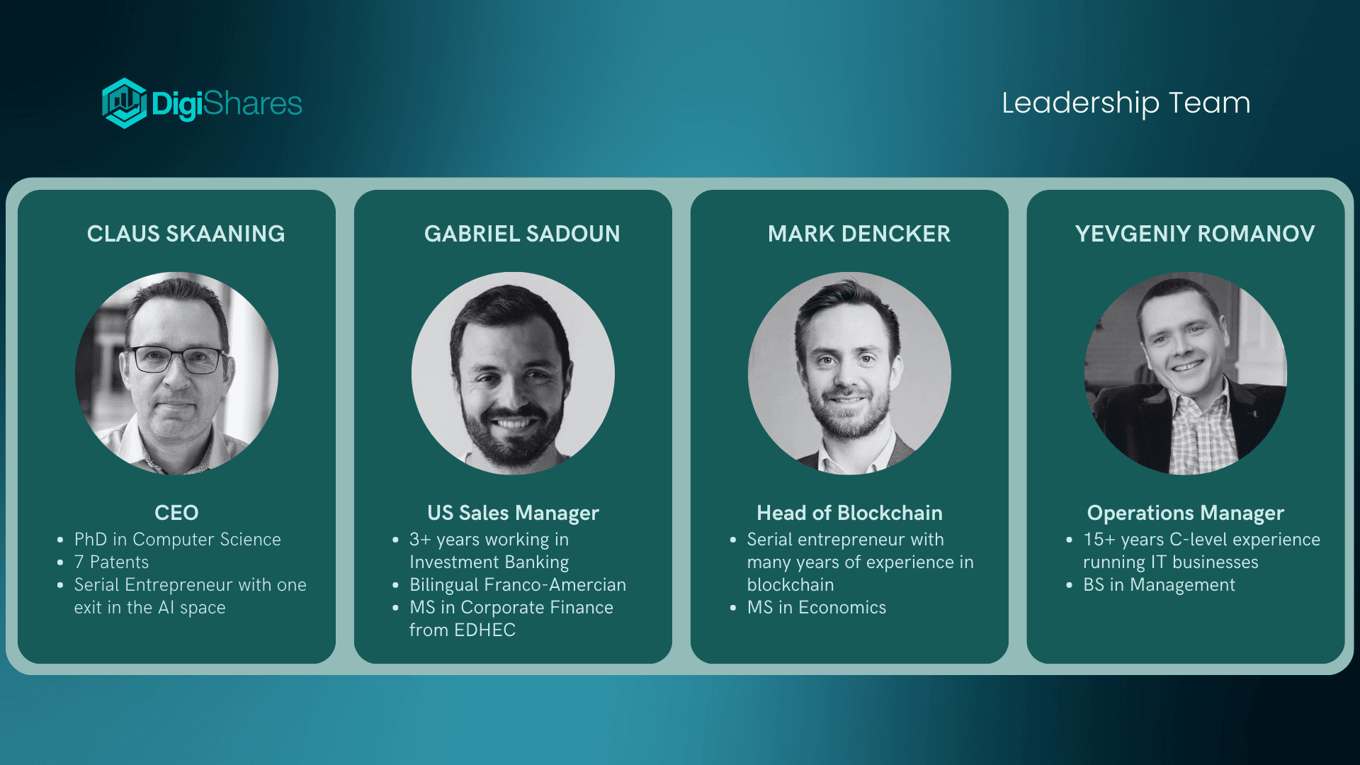

Leadership

A team of diversified & highly experienced professionals

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...