There may be other available opportunities that are similar to this investment but have different attributes, characteristics, cost factors, and fees. Disclosures & Disclaimers

Knightscope, Inc. trades on NASDAQ under the ticker symbol KSCP

Investments in this campaign are for Knightscope's current bond offering, and not the publicly listed shares.

Problem

The security industry is ripe for disruption by automation

Our country has invested heavily in providing appropriate technologies for our 2+ million military troops but has no comparable process for our Nation’s first responders and security professionals on our own soil. We are working to correct that injustice.

Solution

Knightscope provides leading security robotics

Our Autonomous Security Robots (ASRs) are a unique combination of artificial intelligence, robotics, and self-driving technology providing human law enforcement with extra eyes, ears, and a voice on the ground.

We’re growing quickly, and your investment in this bond offering will helps us continue to grow while offering 10% annual cash interest on your investment for up to 5 years.

Product

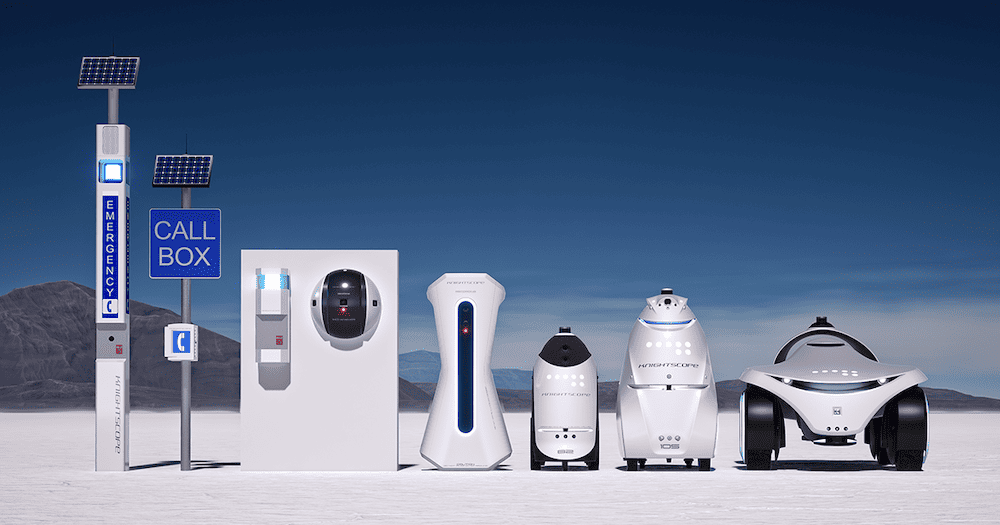

Our solution combines software, hardware, and monitoring

Our products serve all domestic public safety organizations with an amalgamated set of hardware, software and monitoring solutions

- Positively impacting restricted budgets with affordable products and subscription services

- Augmenting expensive guard details with advanced technologies that deter, detect, observe and report 24/7/365

- Expanding emergency communication end-points to provide a lifeline to those in need

- Creating an open feedback loop with end users to continually advance and future-proof technological development

Customers

Organizations are successfully fighting crime with Knightscope

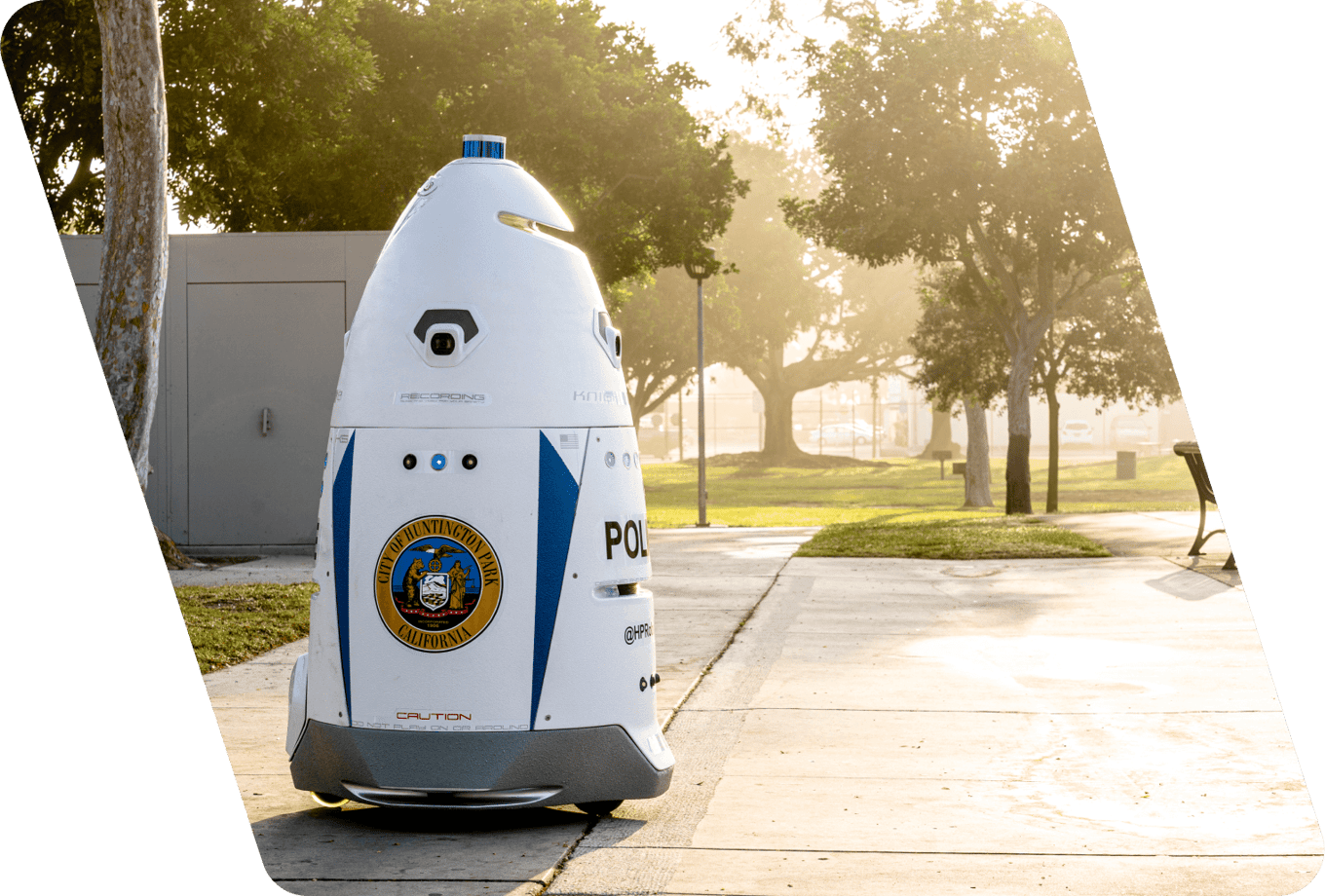

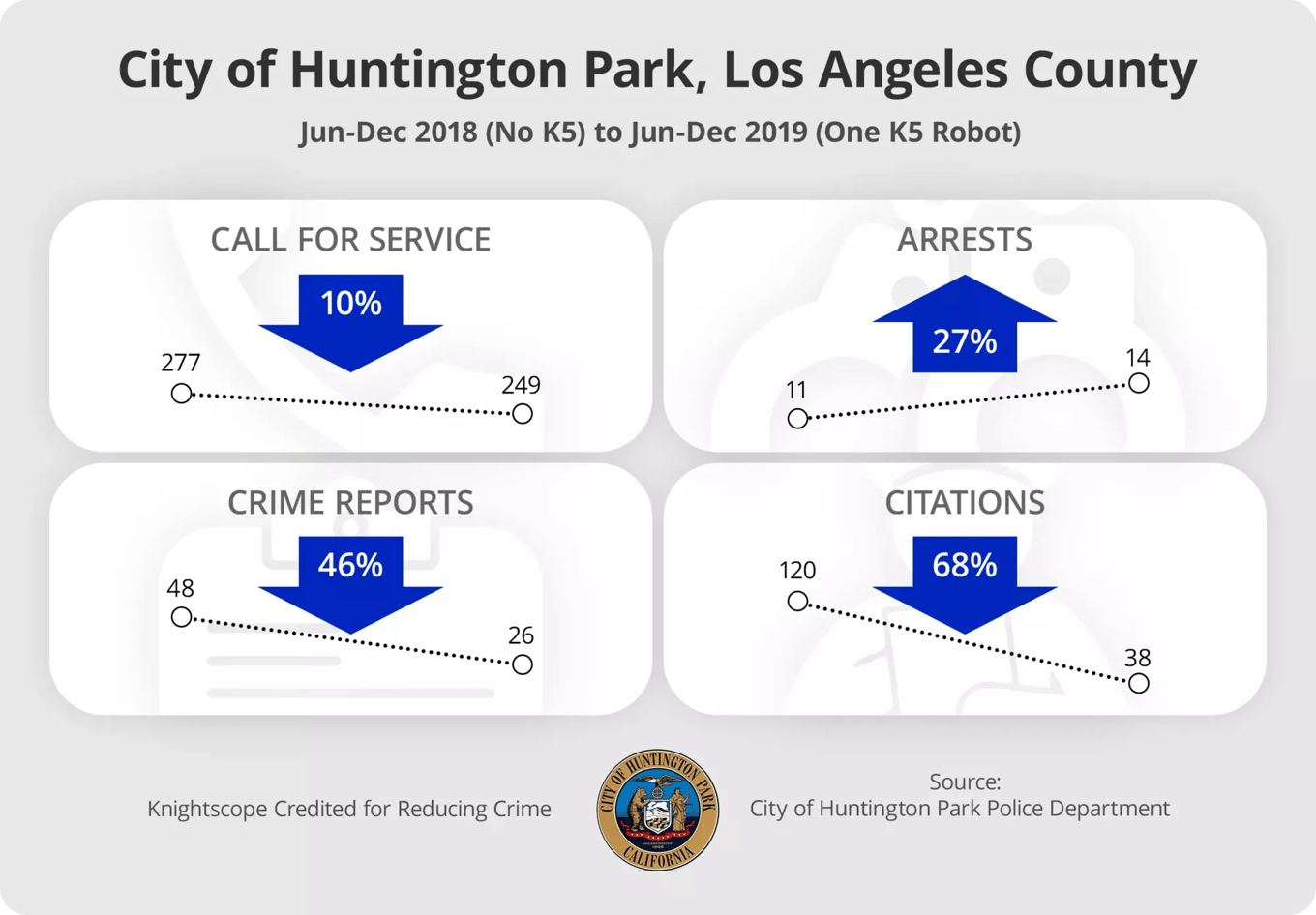

Case Study: Police Credit Knightscope for Reducing Crime

*Stats are for entire city of Huntington Park and not just area patrolled by robot

Chief Lozano describes Knightscope in his own words at the July 6, 2021, City Council meeting where Huntington Park unanimously voted to extend their contract by two years.

Case Study: Knightscope Deters Crime & Vandalism

As reported by the Las Vegas Review-Journal, Officer Aden Ocampo-Gomez of the Las Vegas Metropolitan Police Department said Liberty Village routinely ranked in the top three for 911 calls for apartment complexes in the northeast part of the valley, but has fallen out of the top 10.Complex manager Carmen Batiz indicated that the robot’s success could be duplicated in other Las Vegas complexes owned by California-based Westland Apartments. “It has deterred a lot of crime and vandalism,” said Batiz.

Business model

Our Machine-as-a-Service (MaaS) model generated $9.8M in net revenue for the first 9 months of 2023

Our model combines annual, automatically renewing subscriptions with all-inclusive service

- Deployment - needs assessment, virtual demo, site assessment, site survey, shipping, logistics, setup, configuration and training

- Technology - Autonomous Security Robot (ASR), Knightscope Security Operations Center (KSOC) user interface, charging systems, data transfer and data storage

- Service - all maintenance, service, parts, repairs plus 24/7 U.S. based technical support

- Knightscope+ - optional 24/7 remote security monitoring by former military and law enforcement professionals

- Upgrades - unlimited software, firmware and at times hardware upgrades improve the technology over time based on real world operating experience

Market

Our market is booming

The Security Robots Market was worth $32 billion in 2021 and is projected to reach $119 billion by 2030*. We have the unique potential to work with major law enforcement and security organizations across America and deploy our robots at airports, casinos, homeowners associations, hotels, hospitals, corporate campuses, and schools everywhere.

Vision and strategy

We want to put 1 million machines-in-network to assist the millions of law enforcement professionals and security guards in the USA

Analogous to building a defense contractor - but focused on the U.S. DHS, U.S. DOJ and the 19,000+ law enforcement agencies and 8,000+ private security firms

In the short term

- Verticals – focus on commercial real estate, hospitals, hotels, residential, manufacturing, logistics, casinos, corporate campuses, and transportation

- Marketing - continue our Robot Roadshow as a highly unique selling tool to place our advanced technology at the doorstep of prospective clients

- FedRAMP – having secured our ATO (“Authority to Operate”) with the U.S. Federal Government, leverage our listing on the FedRAMP Marketplace as an approved provider for federal agencies to grow our business

In the long term

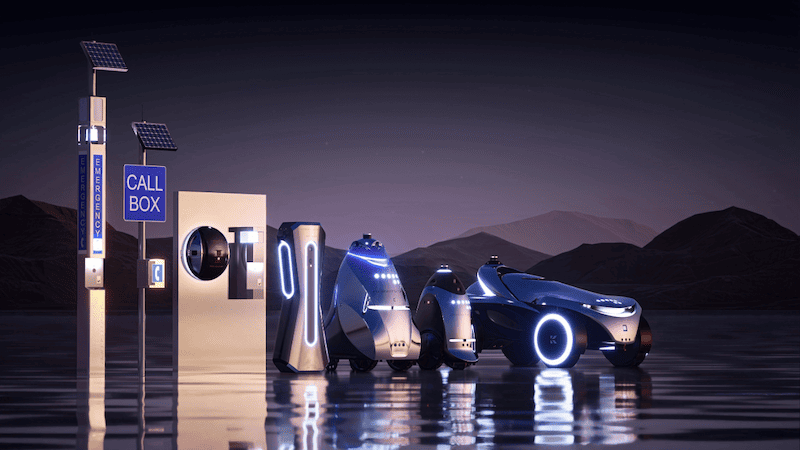

- Technology – building a wide-ranging portfolio of form factors that can see, feel, hear and smell and operate across environments both outdoors and indoors at low and high speeds – and do 100x more than a human could ever do

- Everywhere – criminals and terrorists can be anywhere and therefore in order to meet our mission Knightscope needs to be everywhere

Impact

Our mission is to make the United States of America the safest country in the world

We believe every American has a fundamental and basic right to live in a safe country, in safe communities, and that right should not be held exclusively by a tiny portion of the population – it should be enjoyed nationwide.

Founders

Our management team is experienced and driven

William Santana Li, Chairman and Chief Executive Officer

- Seasoned entrepreneur, intrapreneur and former corporate executive at Ford Motor Company

- Founder and Chief Operating Officer of GreenLeaf, which became the world's 2nd largest automotive recycler (now NASDAQ: LKQ)

Stacy Dean Stephens, EVP and Chief Client Officer

- Former Dallas-area law enforcement officer and seasoned entrepreneur

- Government Technology magazine’s Top 25 Doers, Dreamers & Drivers for commitment to advancing law enforcement technology

Mercedes Soria, EVP and Chief Intelligence Officer

- Winner of Leadership ABIE Award for Women in Technology and Silicon Valley Business Journal’s Woman of Influence Award

- Former Deloitte software engineering leader with 15+ years of experience in enterprise, artificial intelligence and machine learning

Aaron J Lehnhardt, EVP and Chief Design Officer

- 20+ years in two- and three-dimensional product and industrial design

- Former Ford Motor Company senior designer, digital design expert and Alias 3D instructor at College for Creative Studies

Apoorv S Dwivedi, EVP and Chief Financial Officer

- Extensive finance, corporate and startup experiences

- Former GE Finance, Cox Automotive, Sears and Nxu

Jason M Gonzalez, SVP Client Development

- Seasoned security professional with 20+ years of experience

- Former Whelen Security, G4S, Honeywell, and Tyco Integrated Security

Ronald J Gallegos, SVP Client Experience

- Seasoned security professional with 20+ years of experience

- Former AlliedBarton, G4S, Securitas and Geofeedia

Summary

Earn money and help us fight crime across the country

The purchase of a Public Safety Infrastructure bond supports our mission to make the USA the safest country in the world, while offering the opportunity to earn 10% per year on your initial investment for 5 years.

Disclaimers

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured. You may lose money.

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by BankProv until such time as a closing occurs. Securities offered through OpenDeal Broker LLC, a registered broker dealer, member of FINRA (www.finra.org), member of SIPC (www.sipc.org). We will pay OpenDeal Broker LLC, a registered broker-dealer, a cash commission equal to 6% of the amount raised through the Republic Platform, plus certain offering costs. Please review OpenDeal Broker LLC’s Form CRS. OpenDeal Broker LLC may require additional documents or information from you to complete your purchase, you will be contacted by a registered representative in this event.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...