Short version: Ponder Founder Manshu Agarwal understands the power of referrals. Not only did he find a job after someone...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Ponder isn't accepting new investments

Explore new investment opportunities:

View companies raising now

Ponder

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal Highlights

- Unique approach for making referrals across multiple verticals has the potential to revolutionize the $80 billion+ referrals industry!

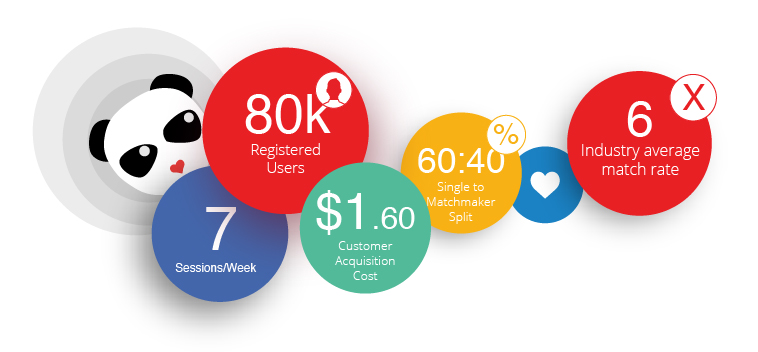

- Relationship Referrals - 80k registered users for dating referrals app, with match rates 6 x higher than popular dating apps

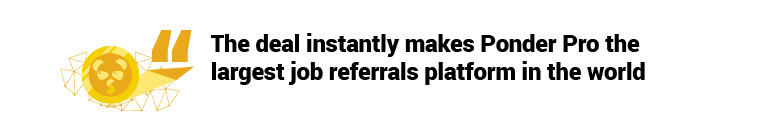

- Job Referrals - database sharing partnership with Recruiter.com, the world’s leading website for the recruitment industry with tens of millions of dollars of placement fees on its platform

- Investors include Joe Abrams, MySpace co-founder, Michael Egan, former CEO of JDate/Christian Mingle, and Wilson Sonsini, the leading Silicon Valley law firm

- Founder Manshu Agarwal is a Cambridge engineer and Columbia MBA, who helped raise $100 million as a business developer at a biotechnology company, worked as a Wall St investment banker, and was a strategy consultant for Fortune 500 companies.

- Partnership with Times of India, the largest media group in India, who are providing advertising credits for growth in Asia

- Accepted into the Helix hashgraph accelerator, run by Mind Fund, an early stage VC based out of Hong Kong

The Problem

Referrals Should Be Easier

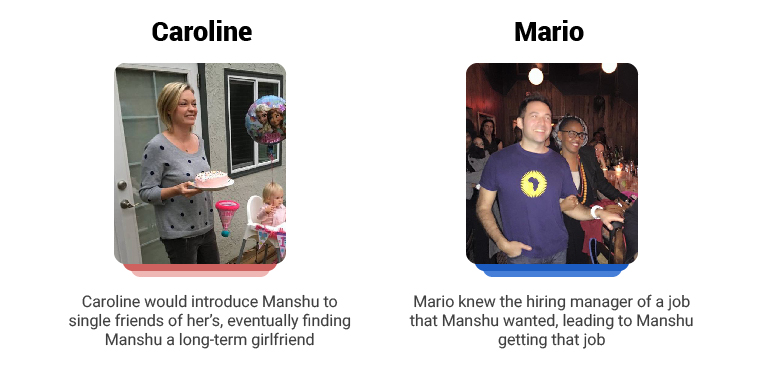

Manshu started Ponder because of 2 friends...

Why Now?

What is Ponder?

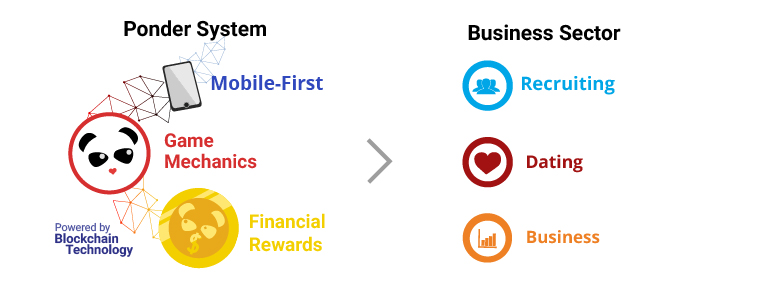

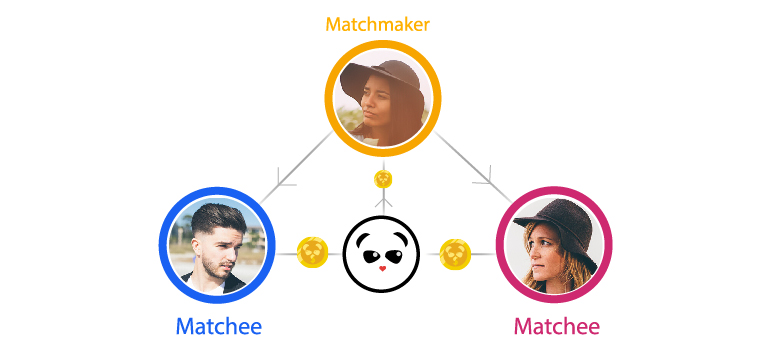

Ponder is a gamified platform for referrals. It is made for busy people and companies that want to cut through the noise to make quality connections.

Unlike traditional matching applications, Ponder gets trusted friends and contacts to play matchmaker, using game mechanics and financial rewards as motivators.

Ponder makes referrals fun and rewarding

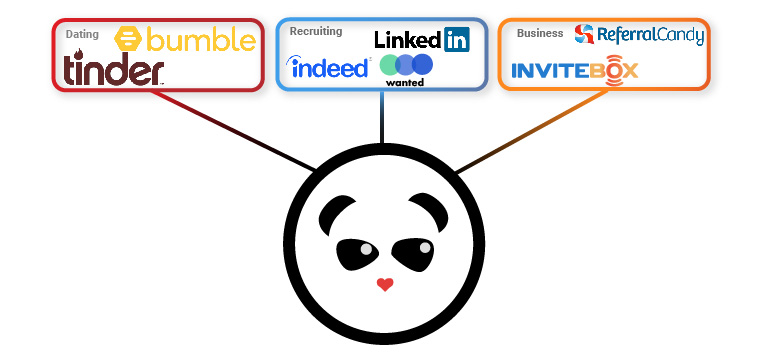

We focus on 3 industry sectors and will later build a platform for companies to develop other sectors eg. Investments, Roommates.

The Product

How it Works

Our first product is for romantic referrals

You matchmake by dragging and dropping photos over each other.

As you make more suggestions you level up, attaining increased abilities

By making it a fun 'puzzle-type' game we get more people to play matchmaker

If the couple ‘like’ each other, the matchmaker earns $10. The two singles pay $10 each, leaving Ponder with $10 net from each successful match.

If the couple eventually marries, the matchmaker earns $1000.

What's Next?

Our next product is for job referrals

For each new hire, companies pay Ponder $3000 - far lower than what they would pay

a recruiter

With the final app for business referrals, Ponder becomes a social network for friends to help each other find trusted services - from baby sitters to music teachers.

Imagine the possibilities!

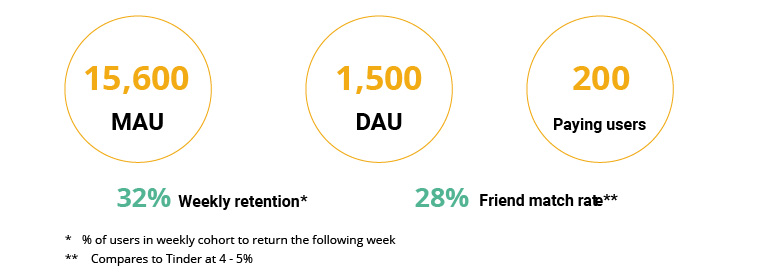

Traction

80k users and growing

Metrics Attained

Recruitment Partnership

We've secured a deal with Recruiter.com

- Sharing entire jobs database with the world’s leading website for the recruitment industry with tens of millions of dollars of placement fees on its platform

- $3000 for each job we fill

- Access to 10m job seekers

- Access to 15m social media followers

Business Model

The matchees that are successfully matched pay Ponder, a portion of which is given to the successful matchmaker.

$80+ Billion

Addressable Market

We're tackling major problems in large markets

Competition

Most matching applications use algorithms alone for connecting strangers.

And referral-based applications simply forward referral links.

Nobody is making referrals FUN

AS SEEN ON

INVESTORS

Ponder has received $1.6m in seed funding to date from 40+ investors

Notable investors include:

ROADMAP

On track to launch Ponder 2.0 in Feb

While V1 was a success, V2 is going to be better, with game levels added in and the brand new Bounty feature! We are aiming to hit 0.5m active accounts by July 2019, and $0.5m of monthly revenues by Aug 2019.

FOUNDERS & TEAM

Executive Team

Manshu is a Cambridge engineer, Columbia MBA and has 20 years of top-tier startup and corporate leadership experience. He is passionate about making long-lasting change in the world through technology. He was previously Business Development Director at Synthetic Genomics, a DFJ-funded startup. He helped them successfully launch two companies - a software platform for bioengineering and a water cleaning technology. Prior to that, he was a Wall St banker, raising money and doing mergers & acquisitions for small/mid-cap technology firms. Earlier in his career, he was a management consultant with the global consulting firm LEK, and at Coca-Cola.

Chris is a top-tier CTO who has done it all. He loves to scale startups from nothing to millions of users. He was previously CTO of Storybox, a social marketing platform funded by Eric Schmidt’s VC fund. He built the platform and helped scale it to 4m hits per day in a short period of time. Prior to Storybox, Chris was an Architect at the DMV.org restructuring their high-traffic websites to increase speed and security. Before that he was a Senior Engineer at Qualcomm.

Dan has 15 years of product marketing experience. He grew the photo-sharing app Butter to over 1.5 million users. He is a mentor at top LA accelerator, Mucker Lab.

Patrick has 16 years of design experience in the media & tech industries. He has designed websites and mobile apps for Forbes, Hilton, AP News, and Law.com, and the Golf Channel.

Key Advisers

Joe has vast experience in leading and growing early-stage tech companies. He is the co-founder of MySpace which he sold to Newscorp for $580m. Prior to that, he founded The Software Toolworks, which he sold to Pearson for $462m. Joe is a Board Observer with Ponder.

Over 20 years of experience in dating and internet brands. Former CEO of Spark Networks (NYSE: LOV), the owner of Christian Mingle and JDate. Former GM at Internet Brands and Senior Director at Yahoo

Over 10 years of product and gaming experience. VP of Product Marketing at Zynga, formerly Sr Product Director at Kabam. Has helped develop and grow several of the most popular mobile games in the world.

INVEST IN US

Join us in turbo-charging referrals!

Deal terms

$12,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

0%

If a trigger event for Ponder occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

Ponder must achieve its minimum goal of $50K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Ponder t-shirt

- Ponder Panda costume head

Why others invested

See all reviews (0) See all (0)This is a good idea. People are good at matching their friends with potential loved ones and creative partners.

With change in technology, the world is getting more electronic based and referrals becoming more valued on a trusted platform. I see PONDER as a multi billion Business in the next 5yrs. Revenues will start flowing as it gets bigger in Asian Markets.

This new App for referrals could be the next big thing.

About Ponder

Ponder Team

Everyone helping build Ponder, not limited to employees

Press

FAQ

How do I earn a return?

We are using Republic's Crowd SAFE security. Learn how this translates into a return on investment here.

Do you have your Meet the Drapers appearance transcript?

Manshu Agarwal: Hi. My name is Manshu Agarwal I'm the CEO and Founder of Ponder. By playing matchmaker, you recognize the power of a referral. It adds so much to people's lives but they're very hard to do. We try to bring in married people to help others and we're just getting started. I'm doing this because my father's a doctor. My brother's a doctor. My other brother is a financial analyst. They've all been working in jobs. I feel that I've got something to contribute as an entrepreneur. I'm super excited about being here. This is a great opportunity to be able to present Ponder on a much larger stage.

Tim Draper: Welcome to Meet the Drapers. Give us your pitch.

Manshu Agarwal: Wonderful. I'm Manshu Agarwal. I'm the CEO and founder of Ponder, gamified referrals on the blockchain. The reason I started was because a few years ago, I was single and had this friend of mine, Caroline. She's a married girl and she'd always try to set me up with friends of hers. These are a great way to meet quality dates. A year after that, I was looking for a job. I had a friend of mine, Mario, who new the hiring manager of the job I eventually got. It made me recognize the power of referrals. It's the best way to make a connection between people. I'm sure all of you as VC's recognizes how important that quality introduction is.

Tim Draper: Wait. Who referred you?

Manshu Agarwal: That's true. I thought, how could I make referrals at scale? I realize that you have to do one thing. You have to make it gamified, so it's fun for the referrer. And secondly, you'd all [inaudible 00:26:43] to some kind of reward, not too much, but a little bit of reward. I created this product where we focused on dating referrals. The way it works is ...

Speaker 19: It utilizes game mechanics and financial rewards to make everyone a matchmaker. You'll see someone like Sarah here and underneath there are a set of prospects that you can set her up with. If you see anyone could be a good match, you just drag and drop. The two people are notified. If they like each other, you win 10 bucks. If they get married, you win a thousand bucks. You have this balance that goes up and down based upon the matches you make for others, versus the matches made for you. You can only cash out once you've made 10 matches for others.

Tim Draper: How much did they pay to get matched up?

Manshu Agarwal: They each pay $10, so we take $20 from the two singles. We give $10 to the successful matchmaker. We keep $10 ourselves.

Tim Draper: And you figure the odds are worse than one in a hundred that they're getting married.

Manshu Agarwal: Exactly. I think we're pretty safe for that.

Tim Draper: Otherwise this business model is not going to work.

Manshu Agarwal: No. That might be a little difficult. Good question.

Polly: You get your money [crosstalk 00:27:41].

Manshu Agarwal: We only focus on the positive. No money lost if they're divorced.

Polly: Does Sarah know, when we say that that guy would be good for her, we know that guy?

Manshu Agarwal: You can do. You can just matchmaker for friends alone or you can actually match make for complete strangers. We found out people actually enjoy matching for even complete strangers, although their match rates are not quite as high as if you have a mutual friend in common. But people just enjoy the fact that somebody has thought who could be a better match for them. It's far better than the computer algorithm sending you a whole bunch of unknowns.

Tim Draper: You're like a big mechanical turk for dating.

Manshu Agarwal: Very much along those lines.

Tim Draper: That is hilarious. Oh my god. This is fun.

Manshu Agarwal: We have 80,000 users, 10,000 monthly active users of a match rate which is six times the industry average.

Bill Draper: What do you mean by the industry?

Manshu Agarwal: The online dating industry.

Vish Mishra: Online dating.

Speaker 19: The common system doesn't live very well. Less than one in four online daters actually find a relationship and they spend seven more times more time online than going on dates. If there was any other product that have those kind of success metrics, you'd give it back. You'd say, "Sorry, this is not working."

Polly: Wow.

Manshu Agarwal: We're already making money, one dollar per active user per month and nearly half our users are married. They're playing matchmaker for other people. Don't give up your day job, but this is a very nice little bit of extra cash at the end of the month. We've now replicated the model, given that product market fit for the job referrals industry which is far more lucrative because everybody knows that a referred candidate is the best candidate to get, but they have a hard time finding ways to motivate their employee base to make referrals because it's not fun. It feels like work. We're making it feel like a game. We want people to wake up every morning and say, "I want to make some referrals now."

Tim Draper: Who pays you there? Is that the corporate or you get-

Manshu Agarwal: That's where the company pays.

Tim Draper: You may want to pay the matchmaker more than that.

Manshu Agarwal: Oh, sorry, so $10 for the first where they both like each other digitally. And then if they end up getting a job, then the matchmaker wins $1500. I'm sorry. We get more from the company. We get $3,000 from the company.

Polly: The $1500 goes to the [crosstalk 00:29:35]

Manshu Agarwal: $1500 goes to the matchmaker.

Tim Draper: You're splitting it all up [crosstalk 00:29:38].

Manshu Agarwal: Exactly. We've got a lot of margin to play it with because currently they're paying 20 to $30,000. As long as it's far less than that, it becomes a no-brainer for a company. We've done a deal with recruiter.com which will share their entire database of jobs over 20 million job seekers to neatly become the largest job referrals platform in the world.

Bill Draper: What did you do before you started this?

Manshu Agarwal: I was actually working for one of your portfolio companies then, Synthetic Genomics.

Tim Draper: Oh, wow. That's a big switch for you.

Manshu Agarwal: It was because I felt the pain points myself. I actually found the job through a referral, so yes, it was definitely big a switch, but I understood what was required in order to overcome those problems.

Bill Draper: If this fails, what would be the reason?

Manshu Agarwal: I think the reason would be we haven't engaged the referrers sufficiently such that the lifetime over which they stick around is great enough to be able to overcome the cost of acquiring them.

Bill Draper: How do you look to resolve that problem?

Manshu Agarwal: Sure. One thing is through deals with like the recruiter.com. Immediately, we get a low cost of customer acquisition. And then secondly, we have to iterate constantly on the user experience to make it fun, to make it enjoyable, to make it a challenge. We want to feel like a puzzle, like a word with friends type of experience.

Polly: Like they want to keep coming back to say, I did that so well for those people, I want to try these people.

Manshu Agarwal: Exactly. The money trading aspect is there but it's not the core. The core is that feeling of goodwill you get when you do something good for people.

Polly: Yeah.

Manshu Agarwal: Ultimately, what we want to become is a new type of social network where instead of being passive consumer of content on most social networks, here, you're actively helping others and you're being helped yourself.

Vish Mishra: The other thing I'm trying to grapple with, okay, two businesses and not much in common. Just because you're a software platform, because the whole dynamic, characteristics. People are looking for a job, career, versus people who want to have a social life or a date. The more emotional or universal, more career and economics and all, so you had to pick one business that you personally feel passionate about.

Manshu Agarwal: We quickly realized that we weren't a dating app, we weren't job referrals app. What we were is a way to make people come in and make connections between entities, between parties. The same user experience can be replicated in many different industries. Yes, we can't go to too many because we'd be stretching ourself thin and I totally agree with you there, but we can do the ones that we think strategically make the most sense.

Manshu Agarwal: We think recruiting, dating and the third one, being for all the other industries where matchmaking can be really helpful such as investor-investee, roommate matchmaking, even baby sitting matchmaking, all of those will create an SDK, so that other companies, other developers can take our package and utilize that for that specific sector.

Vish Mishra: You want to be a platform company now.

Manshu Agarwal: We'll be a platform company, absolutely.

Vish Mishra: I see. That's interesting.

Tim Draper: Good guy, good gracious. Thank you for very much for coming to Meet the Drapers.

Manshu Agarwal: Thank you. It's been a pleasure.

Manshu Agarwal: I think I presented my company as good as light as I could. I've been to a lot of VC meetings, so I was expecting this to be very much along the lines of a traditional VC meeting. It was a lot friendlier. There was also a good number of opinion from different size where there was a lot of disagreement. It allowed me to put in some points that I wouldn't have done if it was just straight questions. I think Tim really got what we were trying to do. I think he can see the potential for how disruptive this could be. From just an addition to the world, we think this will have a tremendous impact.

Tim Draper: Now, let's see what the judges thought. But remember, you can be a judge yourself. You can invest in Ponder. Polly, what'd you think of Ponder?

Polly: I got kind of excited at the prospect of matching up different people with different people because it wasn't about the money. It was more about the competition of being the person that's so smart about people that I know that I can match them up or if I look at a profile of someone, even that I didn't know, the idea that, "Oh, I bet that would be good for my sister."

Tim Draper: Vish, how about you? What do you think?

Vish Mishra: His fundamental thinking that he just wants to make connections which is pretty good because yeah, connections you can make using tools. And obviously it's a platform. My feeling is, unless he focuses and maybe the jobs or the dating, they're all still crowded [inaudible 00:33:52].

Polly: I like the babysitting one.

Vish Mishra: I think also he just needs to go a little bit deeper. His [message 00:33:56] has to be different.

Bill Draper: I would be willing to back this if done right. It looked like he was just a man who would do it right. I liked him a lot.

Polly: Do too. He said he had a higher success rate than the online dating things. I think it's a smaller amount of data, but still ...

Tim Draper: Yeah. Okay. We're going to go to the crystal ball.

Polly: Beanie, beanie. You're pondering.

Tim Draper: I'm pondering a referral to another sphere. Now, we vote. And know that these are the votes of the judges and you can vote at home. Go to meetthedrapers.com and you can also invest. Here we go. Thumbs up, thumbs down, thumbs all around. Wow. Oh, that is really interesting.

Polly: That's the middle one.

Tim Draper: That was really interesting.

Polly: He's at a medium one, not a complete one.

Tim Draper: And I was mostly interested than I was at thumbs up.

Discussion

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC